Key Latin American FinTech investment stats in 2023:

• Latin American FinTech deal activity reached 335 transactions in 2023, a 37% reduction YoY

• Latin American FinTech companies raised a combined $1.3bn, a 60% drop from 2022

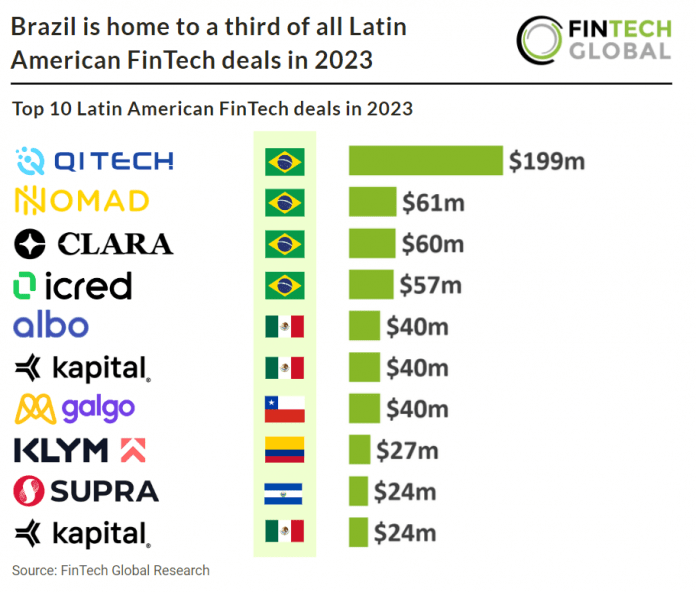

• Brazil was the most active Latin American FinTech country in 2023 with 111 deals, a 33% share of all funding rounds

In 2023, the Latin American FinTech sector experienced a significant decline in deal activity, with only 335 deals recorded, marking a substantial 37% reduction compared to the previous year. Latin American FinTech companies faced a substantial decrease in funding, raising a total of $1.3bn, which represented a striking 60% drop from their 2022 fundraising efforts.

QI Tech, which provides tech solutions for the credit market, had the largest Latin American FinTech deal in 2023 after raising $199m in their latest Series B funding round, led by General Atlantic. QI Tech intends to utilize the fresh infusion of capital to not only strengthen its already prominent product position but also to delve into strategic merger and acquisition possibilities for future growth and development. QI Tech provides an extensive range of APIs that enable businesses to effortlessly offer financial products to their clientele. Their all-in-one solution encompasses an array of digital tools, including registration tools, data validation, credit scoring, digital account opening, wire transfers, Pix services, bank slips, and credit underwriting, catering to diverse sectors of the economy. In addition to these services, QI Tech holds a coveted brokerage license (DTVM), allowing them to effectively structure, manage, and secure investment funds in credit rights (FIDC). Remarkably, the fintech boasts an impressive top-tier Fitch rating of A+ (bra), underscoring its financial strength and reliability in the industry.

Brazil was the most active Latin American FinTech country in 2023 with 111 deals, a 33% share of all funding rounds. This was followed by Mexico with 64 deals, a 19.4% share of all transactions. Colombia was the third most active FinTech country with 43 deals.

The Latin American region has been an early adopter of Open Finance. In 2023, the market grew significantly, with several players entering the market. Brazil has been a pioneer, with the Central Bank introducing Open Banking regulations in 2021, leading to rapid growth and expansion into areas like Open Insurance in 2023. Mexico made significant progress since 2020, but its Open Finance is still in early stages. Colombia, after introducing Open Banking regulations in 2021, is witnessing substantial growth as major players develop their platforms. Chile is preparing for Open Banking regulations in 2024, with numerous FinTech’s and institutions gearing up. Peru is analysing Open Banking regulations, expecting progress by the end of 2023. The Dominican Republic and Guatemala are exploring Open Finance, with the former progressing in regulatory definitions, while the latter sees increasing demand. Argentina is working on regulations and initiatives for open banking. Uruguay is enthusiastic about potential Open Banking initiatives but has yet to start the regulatory process. Ecuador, though lacking official regulations, is experiencing market-driven adoption of Open Banking principles.