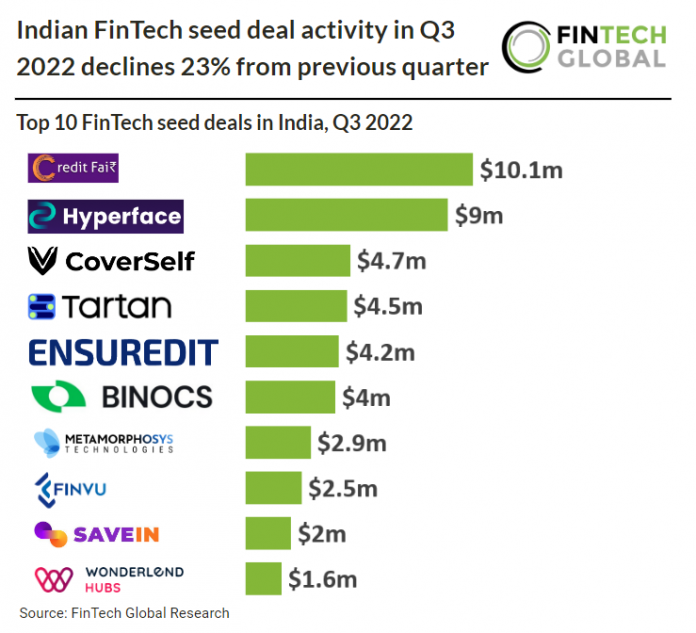

• In total there were 21 Indian FinTech seed deals in Q3 2022, a 23% decrease from the previous quarter. The drop in seed deal activity during Q3 could be due to the Reserve Bank of India informing dozens of FinTech start-ups in June 2022 that it is barring the practice of loading non-bank prepaid payment instruments (PPIs). This is a primary way that Indian start-ups facilitate lending, now Non-Banking Financial Companies (NFBCs) can’t give credit lines to merchants and their money should only be routed to regulated bank accounts of customers, bypassing the current payment gateways to merchants. FinTech start-ups are speculating that banks have lobbied the RBI to reach this decision. Only two PayTech seed deals were announced by India during Q3 2022 compared to five in Q2 2022.

• Credit Fair, a consumer-lending platform, was the largest Indian FinTech seed deal announced in Q3 2022 raising $10.1m led by LC Nueva Investment Partners. Credit Fair said it will utilise the funds to augment technology and deliver a superior customer experience at point-of-sale. The FinTech startup will also leverage the capital infusion to launch its wealth-tech platform, Credit Fair Capital, which will enable retail investors to access secured fixed income alternatives that were previously available only to high-net-worth investors.

Indian FinTech seed deal activity in Q3 2022 declines 23% from previous quarter

Investors

The following investor(s) were tagged in this article.