• PropTech companies are the driving force behind FinTech investment in Mexico. It is reported that 50% of homeowners in Mexico currently have “irregular” property status. The Mexican Real Estate sector is also growing, 2021 saw 9.5% growth compared with 2020 and is expected to grow by an additional 10% during 2022. Certain hurdles also need to be overcome by developers and construction companies in Mexico. Overall, Mexico’s Real Estate sector has some challenges but due to positive growth and regulatory hurdles, PropTech companies are in a prime position to solve these issues and benefit Mexicans in the process.

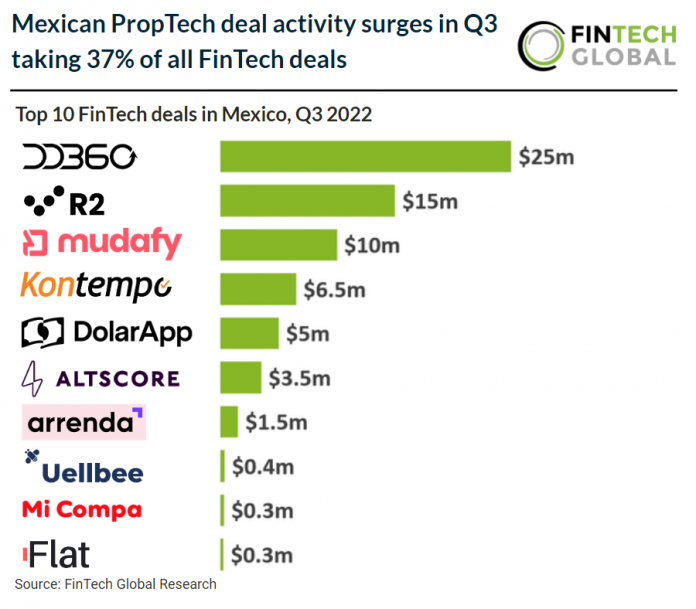

• Mexican deal activity reached 19 deals in total for Q3 2022, more than double Q2 2022. The PropTech sector was the most active Mexican FinTech subsector in Q3 2022 with seven deals, a 37% share of total deals.

• DD360, an intelligent ecosystem for Real Estate developments, was the largest Mexican FinTech deal in Q3 2022 raising $25m in their latest venture round led by Creation Investments Capital Management, LLC. DD360 will use the additional funding to support loan growth acceleration and product roll-out through the expansion of its technology platform offerings and software development team. “We are thrilled to invest in a business that aligns with our thesis of high growth and profitability, while addressing numerous impact themes such as access to housing and job creation,” said Amadeo Ibarra, director and Mexico country head for Creation Investments. “We look forward to partnering with DD360’s management team to support its next phase of growth.”

Mexican PropTech deal activity surges in Q3 taking 37% of all FinTech deals

Investors

The following investor(s) were tagged in this article.