PayTech services have continued to be an integral part of Sweden drive for a cashless society. Sweden digital payments total transaction value is projected to reach $38.15bn in 2022 and is expected to grow at a CAGR of 16.3% from 2022 2027. WealthTech apps such as Swedbank, a Swedish retail bank, listed above have also been a key driver to reduce dependency on cash. In 2019, 84% of Swedes used online banking via the internet.

Sweden have also been experimenting with e-krona, a digital form of Swedish currency, which has now entered the third phase testing. During Phase 2, technical tests have included investigating whether and how an e-krona might function off-line, whether the performance of the tested solution is adequate, and how banks and other payment service providers could be integrated into an e-krona network. The latter has been tested between Riksbanken (Sweden central bank), Handelsbanken and Tietoevry. At yet no decision has been taken whether e-krona will be released.

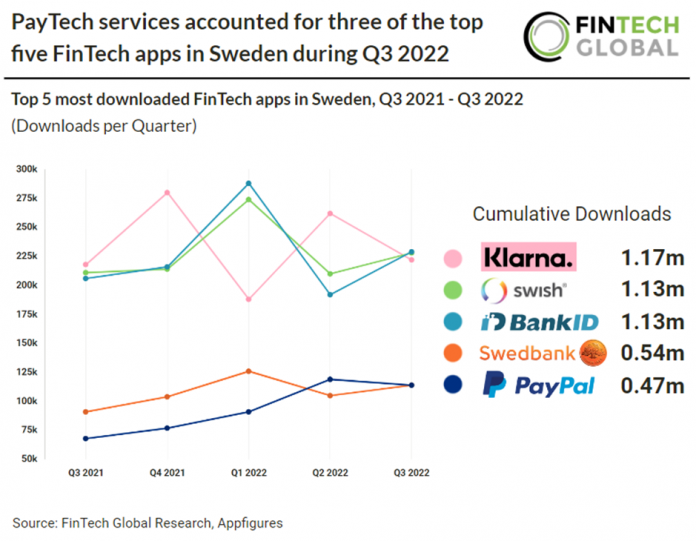

Klarna, a buy now pay later provider, was the most downloaded FinTech app in Sweden from Q3 2021 Q3 2022 with 1.17m downloads over the period. Klarna has been downloaded over 3m times in Sweden which means that roughly a third of Swedes have downloaded the app (Swedish population 10.42m).

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.??2022 FinTech Global