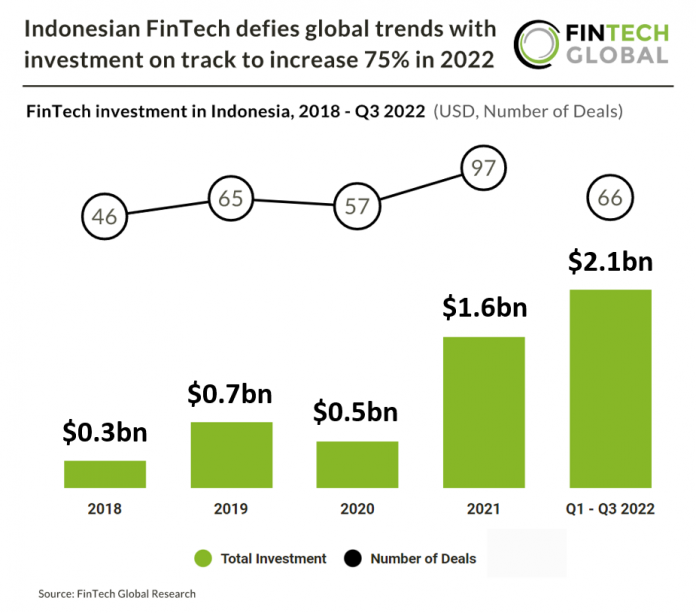

• Indonesian FinTech investment is expected to reach $2.8bn in 2022 based on investment in the first three quarters of 2022, a 75% increase from 2021 levels. This is defying global FinTech investment trends with countries such as the UK, where funding is expected to decline 32% in 2022.

• Deal activity is set to fall slightly in 2022 by 9%, reaching 88 deals in total based on Q1-Q3 investment activity. Average deal size is projected to grow at a CAGR of 37.37% from 2018 – 2022 with average deal size in 2022 reaching $31.8m. Deal activity in Q3 2022 has reduced 25% from Q2 2022 levels and even more significantly from Q1 2022 where it has more than halved.

• Dana, a digital wallet, was the largest Indonesian FinTech deal in Q3 2022 raising $250m in their latest Venture Round led by Sinar Mas Group. The latest funding gives Dana unicorn status at a $1.13bn valuation and the company will use the funding to invest in new technology and debut new financial services. The company has acquired more than 115m users and processes over 10m transactions per day. Dana has forecasted that its total payment volume and gross transaction value at the end of 2022 will double from the same period in 2021.

• Indonesia has had an increasing number of FinTech companies involved in P2P lending. As of January 2022, there were at least 103 P2P-lending businesses registered with the OJK (Financial Services Authority). To deal with the growing FinTech industry, the Indonesian government has built a special department in the OJK that supports innovation in the digital finance or FinTech sector, namely the Digital Financial Innovation Group.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global