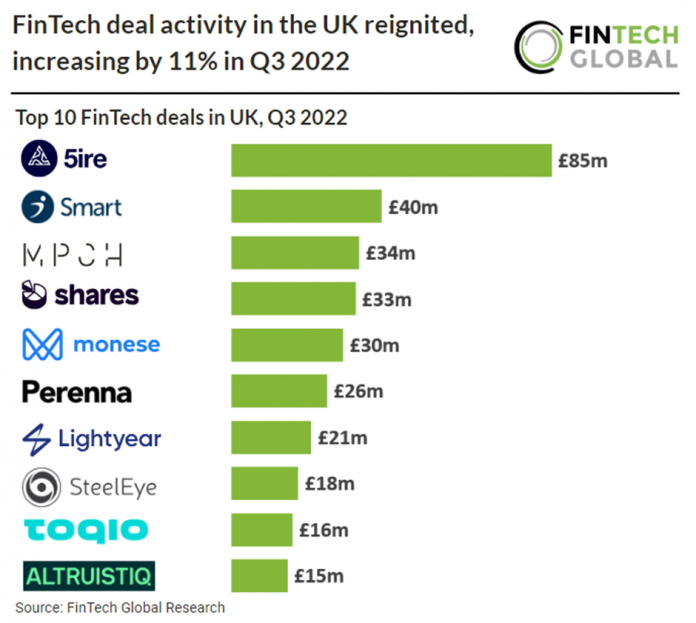

• FinTech deal activity reached 134 deals in Q3 2022, an 11% increase from the previous quarter. On the other hand average deal sizes have dramatically dropped to $11m in Q3 2022, a 49% drop from Q2 2022. UK FinTech companies raised a total of £1.59bn in Q3 2022 which brings total investment during the first three months of the year to £8.6bn.

• 5ire, a scalable decentralised and sustainable open-source blockchain with smart contract & ESG ranking services, was the highest valued FinTech deal in Q3 following its latest Series A funding round. The round was led by SRAM & MRAM and saw a total £85m raised, bringing the company’s valuation to $1.5bn. The funds raised will be used for business expansion and extending 5ire’s footprint across three continents including Asia, North America and Europe, with India as the hub of operations and core area of focus.

• A Speech by Nikhil Rathi, Financial Conduct Authority (FCA) Chief Executive delivered at the UK Finance annual dinner on 16th Nov 2022 made it clear that the FCA wants the UK to remain as the largest destination for FinTech investment in Europe. This statement comes after the rollout of new Consumer Duty regulation. Nikhil said “I know some argue that the Consumer Duty may prompt risk aversion in firms and even withdrawal of products for difficult to reach groups. We will be monitoring closely to make sure this does not happen.” The Duty puts the onus on firms to act to deliver good outcomes for consumers: To act in good faith, avoid causing foreseeable harm and support customers to pursue their financial objectives.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global