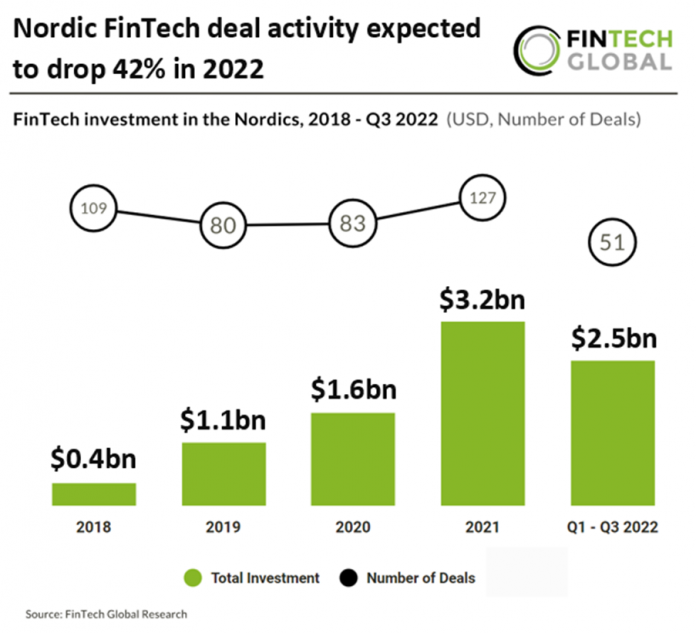

- Nordic FinTech deal activity disappoints in Q3 2022 with only 27 deals announced, a 36% drop from Q2 levels. Deal activity for the year is on track to reach 68 deals in total for 2022 based on the first three quarters of the year, a 42% drop from 2021 levels. Investment is remaining strong due to large deals from companies such as Klarna, a buy now pay later service. In Q3 Klarna’s $800m venture accounted for 63% of funding in the quarter.

- Reltime, which offers Web3 embedded finance solutions, was the second largest Nordic FinTech deal in Q3 2022 raising $50m in their latest Venture funding round led by GEM Digital. GEM Digital’s commitment provides the Norwegian company with the opportunity to scale up following years of game-changing Research and Development (R&D), while bolstering its activities in 150 countries and taking the company to the next level. Reltime will soon commence the off-net integration of its physical, biometric and virtual cards, e-money, BIN and IBAN (SWIFT, SEPA and Faster Payment System (FPS), UK).

- As of January 2022, amendments have been made to existing legislation in Sweden that relates to the EU’s sustainable finance package. The EU Regulation on sustainability-related disclosures in the financial services sector (“SFDR”) and the EU Taxonomy are both part of the new EU sustainable finance package. The SFDR entered into force on 10 March 2021 and lays down sustainability disclosure obligations for manufacturers of financial products and financial advisers, as well as disclosure obligations at entity and financial products levels. Additionally, the EU Taxonomy Regulation entered into force on 1 January 2022 and sets out a classification system that identifies environmentally sustainable investments. No other FinTech-related regulation has been introduced in the Nordics during 2022.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global