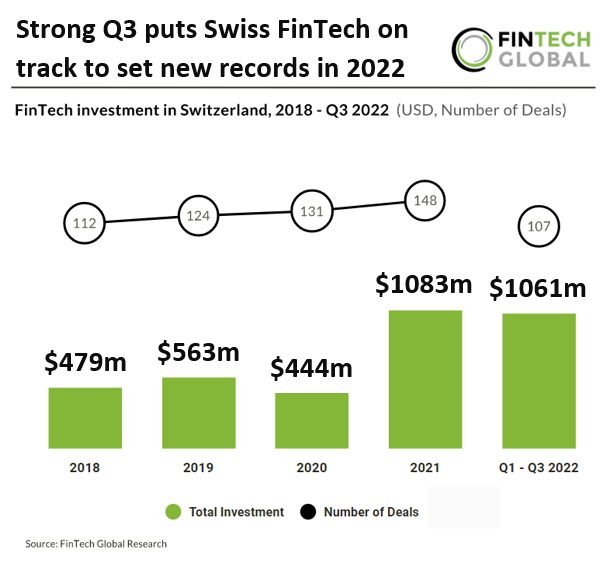

- Swiss companies raised $384m in Q3 2022 which pushes Swiss FinTech investment projections in 2022 to over $1.4bn based on investment activity in the first nine months, which would be a new record for the country. Overall, there were 32 Swiss FinTech deals announced in Q3 2022 which was double the previous quarter’s levels. Deal activity in Switzerland is expected to reach 137 deals in total for 2022, a 7% reduction from 2021’s transaction numbers.

- Zug closes the gap to be the FinTech hub in Switzerland. Zurich holds onto the crown in Q3 2022 with 16 FinTech deals, a 44% share of total deals this quarter. This was closely followed by Zug with 12 deals. Both Zurich and Zug have increased their share of deals from H1 2022 increasing 14pp and 16pp respectively.

- Acronis, an all-in-one cyber protection provider, was the largest FinTech deal in Switzerland during Q3 2022 raising $250m in their latest Private Equity funding round led by BlackRock. The funding will be used to expand its business, including through acquisitions and hiring and pushes Acronis’ valuation to a sizeable $3.5bn valuation, increasing from $2.5bn. Acronis accounted for 65% of Swiss FinTech investment in Q3.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global