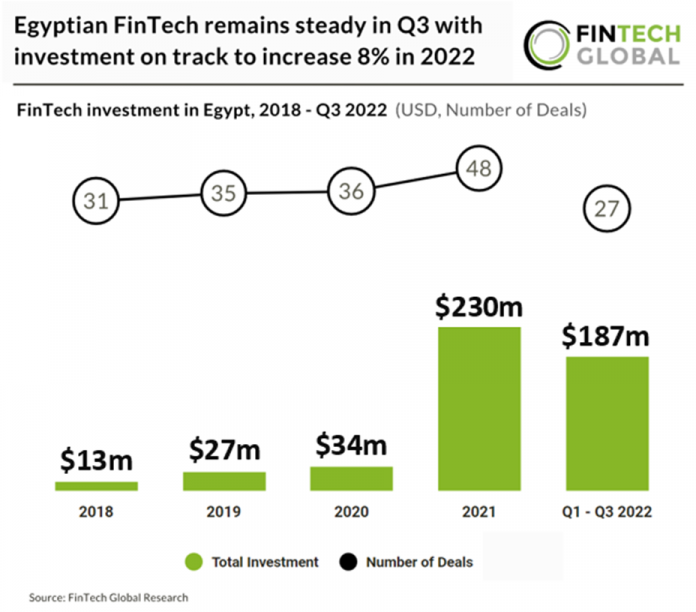

- FinTech investment in Egyptian companies is expected to reach $249m in 2022, an 8% increase from the previous year. Deal activity in the country has slightly slumped this year and is on track to drop by 25% based on the first three months of 2022, however, this is in line with global trends.

- Paymob, which enables payments for emerging markets, was the largest Egyptian FinTech deal in 2022 raising $50m in its latest Series B funding round led by Clay Point Investors, Kora and PayPal Ventures. The fresh funding will be used to help the company expand its product range, maintain its leadership position on the Egyptian market, and expand to new territories across the Middle East and North Africa region. Recently, the Egyptian FinTech company partnered with Mastercard to introduce Tap-to-Pay in the country which aims to replace traditional POS.

- Egypt has made it clear via policy in recent years that they want more financial inclusion for their population. The Central bank of Egypt (CBE) set up a regulatory sandbox for FinTechs in 2019 to test products under the supervision of the CBE and this has been extended in 2022 to non-banking companies via Egypt’s Financial Regulatory Authority (FRA). This has been approved by Law No. 5 of 2022 although this sandbox is not currently functioning.

- Cairo was the FinTech hub for companies in Egypt accounting for 85% of new funding rounds in 2022, Gaza was the second most active city with a 15% share of deals. It is no surprise that FinTechs choose Cairo as their headquarters in Egypt as it is the most populated city in the country as well as the MEA region with over 20m people. The city is also the financial centre for the country, home to many of the incumbent banks.

Egyptian FinTech remains steady in Q3 with investment on track to increase 8% in 2022

Investors

The following investor(s) were tagged in this article.