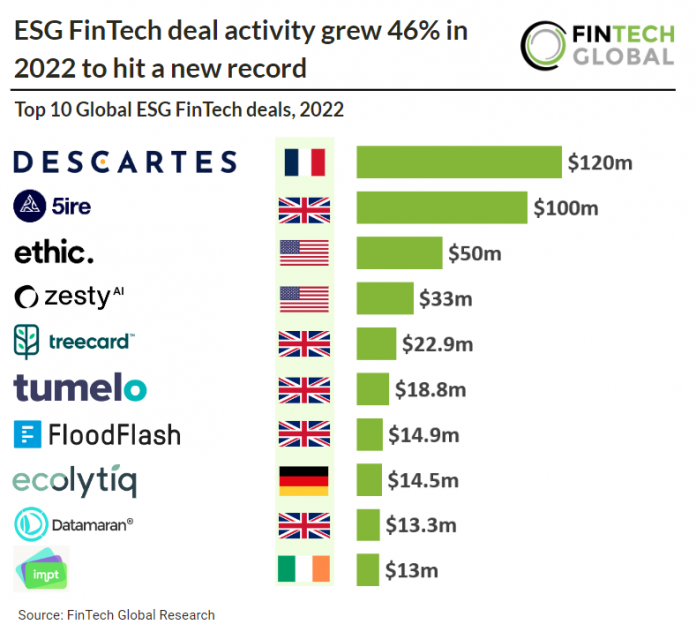

Key ESG FinTech investment stats in 2022:

• Global ESG deal activity set a new record in 2022 with 114 deals in total, a 46% increase from 2021 levels

• Global ESG funding however saw a 25% drop last year

• The United States was the most active ESG country with a 28% share of total ESG deals

The ESG FinTech sector saw its fifth consecutive year of growth with deal activity reaching a record breaking 114 deals in 2022. However, capital invested in the sector saw a 25% decline, reaching $878m in total for 2022. According to Pwc, Asset managers globally are expected to increase their ESG-related assets under management (AuM) to $33.9tn by 2026, from $18.4tn in 2021. With a projected compound annual growth rate (CAGR) of 12.9%, ESG assets are on pace to constitute 21.5% of total global AuM in less than 5 years.

Descartes Underwriting, an insurance provider that builds resilience against climate risk, was the largest ESG FinTech deal in 2022 raising $120m in their latest Series B funding round. The funding, led by Eurazeo and Highland Europe will be used to support Descartes’ ambition to become a category leader in corporate insurance worldwide. The company will use the new financing to scale up its approach to corporate and public entity risk exposures, growing its technology platform, expanding into new lines of business and targeting larger deals, while continuing its global expansion to better serve its brokers and clients.

The United States was the most active ESG country in 2022. US ESG companies raised a total of 32 deals, a 28% share of total deals last year. The UK was the second most active ESG country with 17 deals, a 15% share of total deals. Germany, Singapore and France were the joint third most active with seven deals each.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global