Key FinTech investment stats in the Middle East:

• 169 FinTech deal were announced in the region in 2022, a 1.8% drop from 2021

• FinTech investment in the Middle East reached $1.37bn in 2022, a 3.6% drop from 2021

• The UAE was the most active FinTech country in the Middle East during 2022 with a 43% share of total deals

The Middle East saw a slight drop in both FinTech investment and deal activity during 2022. FinTech investment in the region decreased to $1.37bn in 2022, a 3.6% drop from the previous year. Middle Eastern FinTech companies raised 169 deals in 2022, a 1.8% drop from 2021 levels. Both these figures are a good sign for Middle Eastern FinTech as they are well above the global FinTech decline. France for example saw a 14% decline in deal activity during 2022 from the previous year.

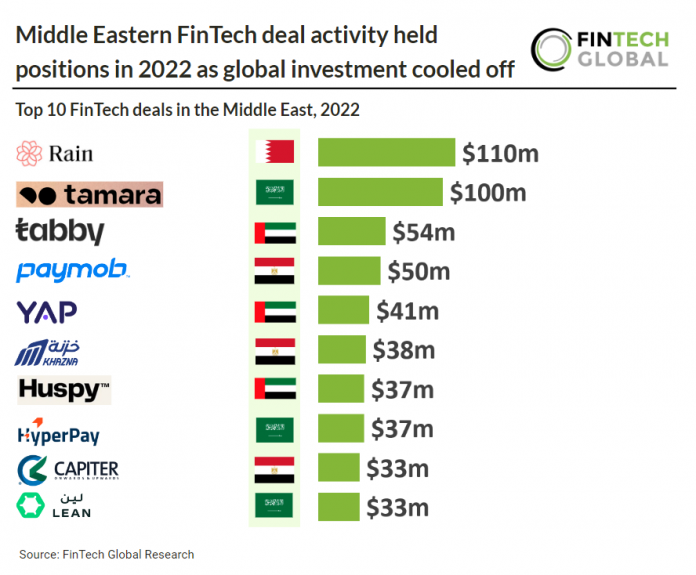

Rain, a crypto exchange, was the largest Middle Eastern FinTech deal in 2022 raising $110m in their latest Series B funding round, led by Kleiner Perkins and Paradigm. Rain will utilize this investment to further expand licensing in other countries and regions, enhancing its technology with an advanced trading platform and continuing to grow the team as cryptocurrency adoption continues to increase globally. The start-up claims to have 185,000 users and so far has processed over USD 1.9 billion worth of transactions as of February 2022. It currently employs a team of 400 people and plans to double the size in 2022.

The UAE was the most active FinTech country in the Middle East during 2022 with 73 deals, a 43% share of total transactions in the region. Egypt was the second most active FinTech country in 2022 with 37 deals announced and Saudi Arabia was third with 33 deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global