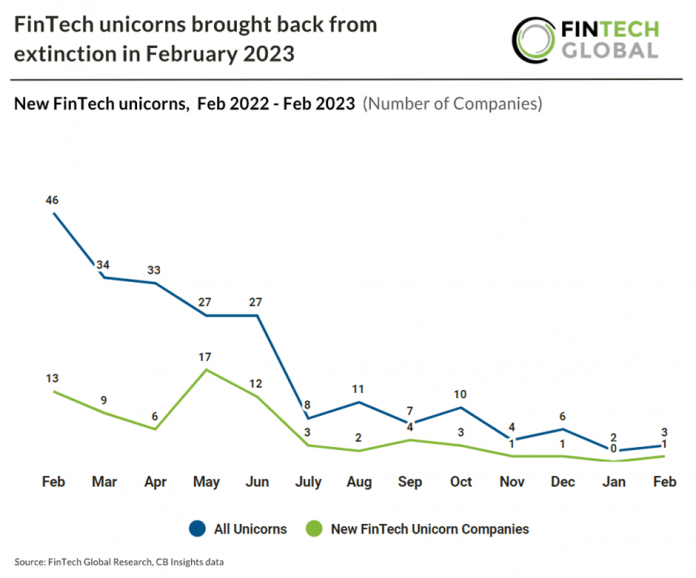

MNT-Halan, an Egyptian digital lender, revitalised the FinTech unicorn population in 2023 after their latest $400m private equity round, led by Chimera Investment. The round propelled them to unicorn status with a post-money valuation above $1 billion. Chimera Investment has invested more than $200 million in equity in exchange for over 20% of the company. MNT-Halan plans to expand internationally after its growth in Egypt and progress on the swap agreement between Halan and Netherlands-based microlending platform MNT Investments. The offerings aim to “reflect the high quality, diversity, and granularity of the combined securitized loan books, consisting of 246,000 contracts and a robust cash pay-back ability.”

Looking forward in 2023, Who are the FinTech Soonicorns to watch?

Moonfare, a private equity funding platform, most recent post-money valuation: €953M (2021)

Moonfare is seeking to democratize access to private equity funds as allocations to this asset class have been on the rise in recent years. The company offers individual investors and advisors the opportunity to invest in PE funds for as little as $125. Moonfare experienced significant growth last year, doubling its assets under management to over €2 billion and attracting over 40,000 users. In late 2021, the company secured a $125 million Series C funding round led by Insight Partners. Given the current instability in public markets, Moonfare anticipates a rise in investors looking to diversify their portfolios by investing in private equity, which could further boost the company’s success.

Quantexa, a data & analytics platform to uncover financial risk, Most recent post-money valuation: €678.7M (2021)

As the number of cyberattacks and scams continues to increase, preventing fraud has become a primary concern for many companies. Quantexa offers software that provides a comprehensive overview of internal and external data. This tool can help companies tackle challenges related to financial crime, customer intelligence, credit risk, and fraud. In July 2021, Quantexa raised $153 million in funding, led by Warburg Pincus. The company’s clientele includes banks, insurance companies, and government authorities.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global