A massive $7.2bn in FinTech investment was reported by FinTech Global this week, with FinTech giant Stripe dominating over the rest with a huge $6.5bn raise.

Of the top ten deals recorded this week, the overwhelming majority of the total funding was raised – with $7.1bn coming from these investments.

For the second week in a row the US was the home of the most funding deals recorded with 13 in total coming from the North American country. Meanwhile, the UK and India represented two each, while Australia, Saudi Arabia and Nigeria all came in with one investment.

The sector that saw the most investment this week was PayTech, with up to six deals recorded by companies focusing on payments technology. Other big-hitting industries this week were FinTech on five and cryptocurrency and CyberTech on three.

Other areas that saw investment this week included in WealthTech and InsurTech.

While funding in the FinTech industry has had a strong week, the market has come off a 2022 that mostly saw funding totals mixed across the board.

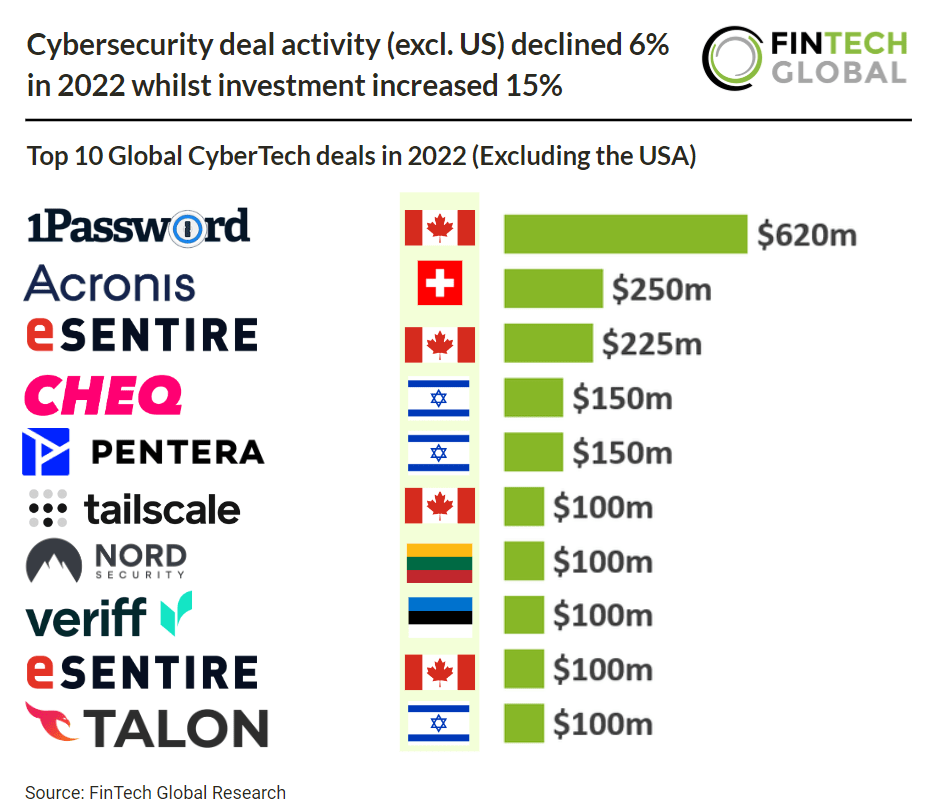

Recent research from FinTech Global found that deal activity in CyberTechs declined 6% in 2022 while investment climbed 15%.

Notably, European – not including Israel – CyberTech deal activity saw a 25% drop from 2021 levels indicating a lack in innovation compared to other regions.

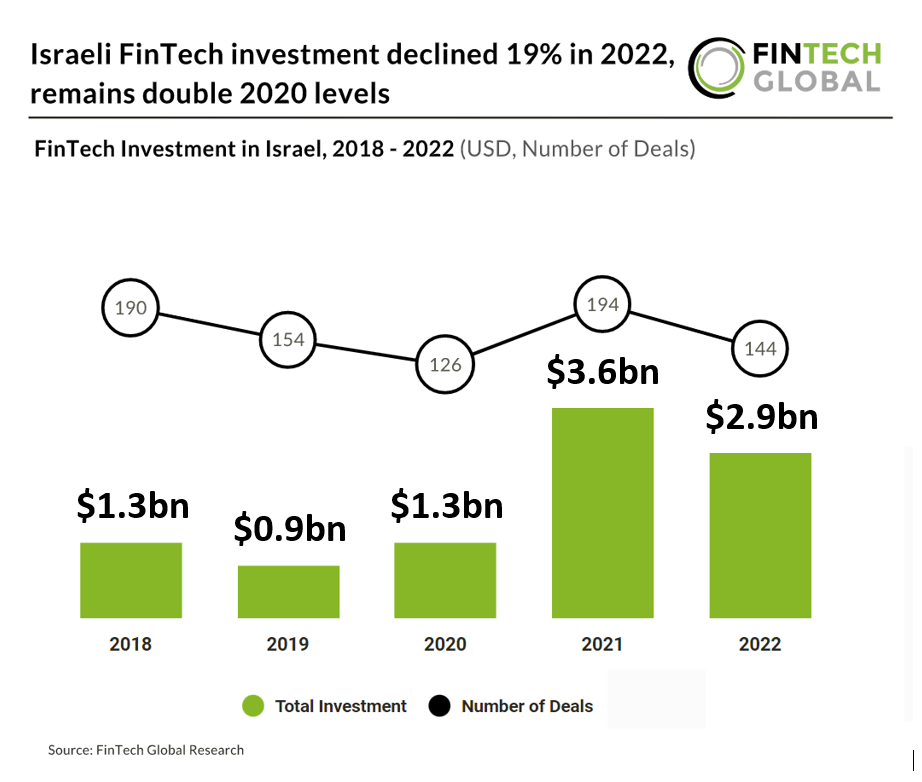

In Israel itself, the country’s FinTech market saw a 19% decline in investment in 2022. Last year, Israeli FinTech funding reached $2.9bn, which was a decline compared to Israel’s record-breaking year for FinTech deals in 2021.

FinTech deal activity saw a 26% drop in 2022 from the previous year although activity is still 14% above 2020 levels. Overall, there were 144 deals raised by Israeli FinTech companies in 2022.

Here are this week’s deals.

FinTech giant Stripe raises $6.5bn

FinTech giant Stripe has seen its valuation slashed again, following the close of a colossal funding round of $6.5bn.

This investment puts Stripe’s valuation at $50bn, which is nearly half of its peak valuation of $95bn in 2021.

The FinTech giant has seen its valuation on a steady decline since 2021. It initially dropped from $95bn to $74bn in July 2022. Six months later it dropped by a further 11%, going down to $63bn.

This capital injection will be used to provide liquidity to current and former employees and address employee withholding tax obligations related to equity awards, resulting in the retirement of Stripe shares that will offset the issuance of new shares to Series I investors. It added that it does not need this capital to run its business.

India’s PhonePe nets further $200m

Indian FinTech giant PhonePe has raised $200m in a primary capital investment from Walmart. PhonePe’s pre-money valuation was $12bn.

With the capital, the FinTech company is looking to build and scale new businesses, including insurance, wealth management, lending, stockbroking, ONDC-based shopping and account aggregators.

The capital will also enable PhonePe to bolster the growth wave for UPI payments in India, including UPI lite and Credit on UPI.

PhonePe offers a variety of financial services. Through the platform, users can pay bills, send money, buy gold, invest and shop at online stores, as well as order food, book flights and purchase groceries.

Parker nets $157m investment

Parker, a New York-based firm that has launched the first charge card for ecommerce, has recently scored $157m in total funding.

The raise included $31.1m in Series A funding led by Valar Ventures, $5.9m in previously unannounced seed funding, $70m in debt as well as an uncommitted option to upsize by $50m.

Parker claims it offers a unique approach to underwriting, with limits based on the performance of the business.

By combining this with customisable, rolling payments terms, Parker gives e-commerce businesses a financing model built for their own unique needs.

Saudi Arabia’s Tamara raises up to $150m

Tamara, a shopping and payments platform in Saudi Arabia and the GCC region, has secured $150m in a receivables warehouse facility from Goldman Sachs.

This capital will help Tamara finance the demand for its BNPL product, as well as grow across new verticals.

This investment brings Tamara’s total funding through equity and debt to $366m. In 2021, the company raised $110m, which it claimed was the largest Series A in the MENA region.

Its flagship solution is the BNPL service. This allows consumers the ability to pay for products within 30 days or across three separate payments in a two-month period. Its platform can be used to make payments online or in physical stores, which is done through its app and scanning a QR code.

InsurTech Fairmatic bags $46m

Fairmatic, an AI-powered commercial auto insurance company, has raised $46m in funding for its fleet insurance products that reward safe driving.

Fairmatic said it is creating a new commercial auto insurance category with its AI-driven underwriting approach that unlocks continuous savings opportunities for fleets.

By providing an easy way to monitor driving events and offering actionable improvement tips, Fairmatic aims to give fleets more proactive control over their risk management approach.

This underwriting approach, according to Fairmatic, unlocks a better understanding of risk, ensuring fleets are only evaluated based on factors within their control. Fleets are incentivised for safer driving and not penalised for unavoidable incidents. This diverges from traditional insurance models that rely on historical data, which has led to losses and overpriced premiums, especially upon renewal.

WealthTech Masttro nets $43m in FTV Capital-led raise

Masttro, a WealthTech firm that manages the wealth of ultra-high-net-worth families, has raised $43m in a growth equity investment.

Founded in 2010, Masttro was established to provide a ‘100%’ view of total net worth, offering a software suite that uses data and AI to implement a frame for wealth data extraction, processing and analysis.

Masttro provides direct digital access and real-time visibility into client portfolios through its best-in-class user experience, with an emphasis on multicurrency, tracking and reporting on alternatives.

The investment will speed up the company’s growth through market expansion and will drive R&D for its innovative software platform including wealth data aggregation, synthsis and visualisation, leveraging AI.

Ibanera lands $18.5m in capital investment

Digital banking and payments firm Ibanera has raised $18.5m in a funding round to enable itself to keep support its BitLine business line.

Emerchantpay Limited recently reached an agreement for an $18.5m capital investment in Ibanera at discounted valuation of $195 million.

In the fourth quarter of 2022, Ibanera launched its new digital banking and payments platform powering its payment APIs for scalable banking with ACH, wire, P2C, and RTP for account funding, payment distributions and collections.

Ibanera’s payments architecture represents next-gen Distributed Ledger Technology based banking that removes the complications of supporting Web3 businesses, including Ibanera’s own Bitline.

Crypto firm Proven snares $15.8m

Proven, a developer of zero-knowledge proofs that enables exchanges, stablecoins, asset managers and custodians to prove their solvency, has raised $15.8m in a seed round.

Proven enables stablecoins, asset managers and custodians to safely and efficiently prove their solvency to customers, lenders, and regulators on a daily schedule. The company allows these groups to show their assets and liabilities without needing to publicly disclose their balance sheets, or any other sensitive information to the public.

While most proof of reserve schemes show only a firm’s assets, Proven helps firms show both assets and liabilities without needing to reveal additional details about the firm or its customers. Proven’s “Proof of Solvency” can be run daily, thereby increasing transparency and creating trust among customers, lenders, and regulators.

The company claims its seed funding will enable it to further expand its development team and scale its zero-knowledge-based technological infrastructure.

DeFi firm Violet nets $15m

Violet, a provider of privacy-protective compliance and identity infrastructure for DeFi, has bagged $15m in a funding round and launched a compliant decentralised exchange.

Violet claims it is focused on helping DeFi fulfil its potential to become the default financial system of the 21st century. To facilitate this transition, the Violet team has designed and built privacy-protective compliance infrastructure that is directly embedded on the blockchain.

Mauve requires its users to undergo rigorous compliance checks. These checks ensure compliance-conscious users, who are currently restricted to centralized and custodial exchanges, feel confident migrating to DeFi. Fully transparent and governed by audited smart contracts, users can trade with instant settlement, without relying on intermediaries.

Violet claims Mauve brings the benefits of DeFi and TradFi together to empower crypto investors globally. The solution utilizes DeFi architecture to enable self-custody that ensures funds remain the property of their true owner, not a separate custodian. From a TradFi standpoint, the platform offers its users TradFi-level compliance guarantees to drastically reduce counterparty risk.

Payroll for flexible workers Wingspan nabs $15m

Wingspan, which claims to be the first payroll system purpose-built for flexible workers, has secured $14m in its Series A round.

Wingspan has earmarked the capital to expand its team, as well as bolster the investment into its platform.

Anthony Mironov and Greg Franczyk founded Wingspan in 2019 to remove the barriers of self-employed workers. Its platform accelerates payments and allows companies to work with contractors at scale.

It is an all-in-one, scalable solution for companies to onboard, pay and support contractors effortlessly and claims to save companies an average of $240 per contractor and 10 hours in time per week.

Miami-based PayTech Payabli scores $8m

Miami-based PayTech startup Payabli has raised $8m in an extension funding round, adding to the $4m it raised for its seed round in May 2022.

With the capital, the company plans to bolster its growth, streamline and enhance the implementation process of its technology, and support its innovation efforts.

This investment comes after a strong period of growth for Payabli. During 2022, the company nearly tripled its revenues to reach seven figures.

Payabli’s API First Payments Infrastructure is a unified API that allows companies to easily implement a payment system. It supports payment acceptance, payment issuance and robust payment operations tools to manage the tactical operations of a payments company.

Web3 firm Cubist lands $7m in seed raise

Cubist, a security-focused Web3 dev tools provider, has scored $7m in a seed funding round headed by Polychain Capital.

Cubist claims it makes Web3 development efficient, seamless, and safe. Through its modular set of security-focused dev tools, Cubist brings software engineering best practices to the entire lifecycle of a dApp—from Continuous Integration (CI) testing to push-button deployment backed by secure credential management.

This secure-by-design tooling empowers developers to design applications without needing to navigate complex interfaces and infrastructure.

Cubist’s first offering is its newly released, open-source software development kit (SDK), the first SDK designed for multi- and cross-chain development and testing. Cubist’s SDK allows users to write cross-chain dApps as if they run on a single chain and change chains or bridge providers with a single line of configuration. The team is also building enterprise security offerings.

Security solution Monarx scores $6.1m

Monarx, a security solution for web hosting, has bagged $6.1m in a recent funding round headed by Signal Peak Ventures.

Founded in 2017, Utah-based Monarx protects web environments against attack. The firm’s cloud-delivered server protection provides continuous real-time malicious script detection and proactive prevention along with an integrated hunting and remediation engine.

Monarx’s solution hardens servers and applications reducing the attack surface, by providing actionable intelligence about web security posture based on real world best practices. Monarx claims it is leading the way in non-signature-based post-exploit prevention.

The CyberTech firm said it will use the newly raised capital to help it further fuel partner growth.

Zaggle secures $6m debt funding

Zaggle, a spend management software-as-a-service provider, has reportedly secured INR 500m ($6m) in debt funding from Vivriti Asset Management.

The FinTech company offers three core product lines: Zoyer, Save and Propel. The Zoyer solution is a business spend management and embedded finance platform that helps firms boost efficiencies, improve cash flow and maximise financial performance.

The accounts payable and payments automation platform enables organisations to turn accounts payable into a data-led function.

Its Save platform helps employees save tax through flexible employee benefit plans. Companies can digitise employee tax benefit programs with a single card that can replace food coupons, food cards, fuel cards, travel vouchers and gift cards.

Finally, its Propel solution is an all-in-one solution for employee rewards and channel partner incentives. Its service offers automated rewards to increase employee engagement.

Nigeria-based OnePipe collects $4.8m investment

Nigeria-based OnePipe, which empowers companies to integrate financial services within their value chains, has reportedly raised NGN 2.25bn ($4.8m).

The investment was led by pan-African alternative investment firm TLG Capital, according to a report from Further Africa.

Capital from the round will be used to help the company provide inventory finance to small shops in Nigeria. The FinTech company also hopes to expand its operations, as it aims to become a leading provider of financial services to micro-enterprises in Nigeria

The Nigerian FinTech company boasts three flagship solutions: PaywithTransfer, Pay4me and Benefits.

Its PaywithTransfer solution is an embedded payments service which includes virtual accounts, cards and more. The Pay4me solution offers various forms of credit for customers, including inventory finance, asset finance and short-term cash loans.

CRM and revenue operations platform Nexl raises $4m

Nexl, a no-data-entry CRM and revenue operations platform, has reportedly raised $4m in a recent funding round.

Nexl claims its platform is changing the way law firms connect in a deeper way than ever before possible to stay competitive and meet client expectations while working in a collaborative environment as one firm.

Unlike traditional CRM products, Nexl works by actively capturing important relationship data points across firms (without data-entry) and then passively mapping all relationships and interactions between firm members, prospects, and clients on an ongoing basis. The result is deep relationship intelligence into both existing and prospective client interactions, holistically across the firm without data entry.

The company said it has positioned itself to be a partner to professional service firms in the face of these rising pressures as the industry increasingly looks to technology like Nexl to drive go-to-market efficiencies and better client service and experience.

Nexl will use this recent funding round to accelerate the development of its core product, increase acquisition efforts in major markets, and attract industry talent to build out its fast-developing ecosystem for partners and clients alike.

Investor and startup connection builder Connectd bags $2.6m

Connectd, which helps connect investors and startups, has reportedly collected $2.6m in a fresh funding round.

Connectd supplies advisors with a platform to connect with UK startups as well as get support and guidance from experienced experts and mentors.

As for investors, Connectd provides them with deal flow and portfolio management tools that allow teams to manage, track and report on investments. It boasts real-time portfolio insights, personalised deal flow and metric tracking.

Finally, startups can use the platform to make connections with UK angel investors. They also have access to a reporting suite, portfolio management system and smart match technology.

Price discovery platform Tallarium lands $1.6m

Tallarium, a provider of unique trade analytics for price discovery in off-exchange energy markets, has raised $1.6m in an investment.

The investment was provided by XTX Ventures, which is the venture capital arm of leading algorithmic trading firm XTX Markets, as well as fellow VC Reciprocal.

Tallarium’s platform automatically gathers and structures pricing information from broker chat messenger and voice conversations to create the industry’s first, definitive price discovery platform for the entire market.

Its data analytics provides a step-change in off-exchange energy trading, making manual data-entry and analysis obsolete, increasing efficiencies and helping traders to maximise the potential of every trade.

Tallarium will use the investment to fund its ongoing expansion as the ‘single source of truth’ for pricing in the energy trading markets.

Unified data controls firm Securiti lands investment

California-based unified data controls company Securiti has secured an investment from Citi Ventures and Capital One Ventures.

The raise followed a $75m Series C funding raise by the company last October. This recent funding round did not see the funding amount disclosed.

Founded in 2019, Securiti’s DataControls Cloud creates a layer of unified data intelligence and controls across all major public clouds, data clouds, SaaS and private clouds. The solution enables enterprises to fulfil key obligations around data security, privacy, governance and compliance.

The company claims that large global organizations rely on Securiti to identify and secure sensitive data, address privacy rights, govern access to data, comply with global data regulations and more.

US CyberTech Secuvy snaps up new funding

Secuvy, a California-based contextual data privacy and security platform, has raised an undisclosed amount in financing.

The round was led by Dell Technologies Capital and WestWave Capital. Also participating in the round were Z5 Capital.

Secuvy offers a contextual intelligence platform for data privacy, security and governance. The firm’s data oriented approach automates data discovery, classification and assessments for Fortune 1000 firms.

The company also offers unique contextual-AI privacy workflows to automate ROPA, PIAs, DSARs and data transfers to reduce efforts for data governance.

The firm also provides data protection workflows to monitor, manage and protect sensitive data with scale and visibility. Secuvy also provides a user friendly interface to reduce time, cost and efforts and provide 365 degree view of unstructured and structured data for on-prem, cloud or hybrid environments.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global