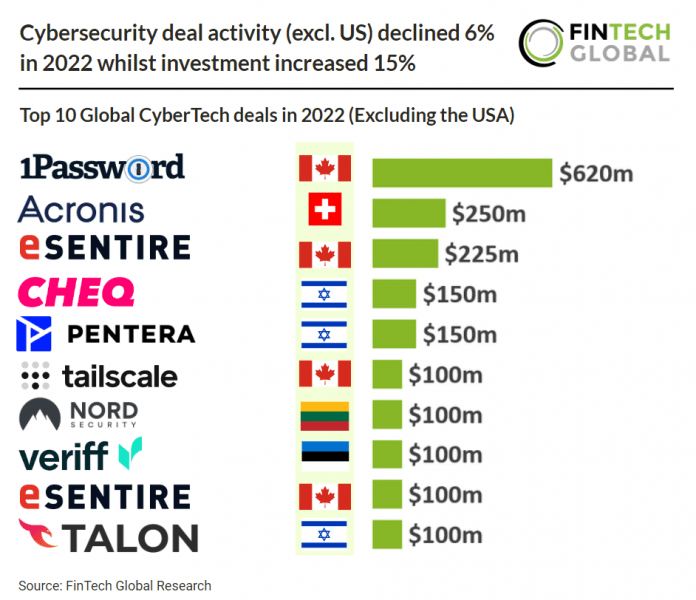

• Overall, there were 291 CyberTech deals announced outside the US in 2022, a 4% decline from 2021

• CyberTech companies headquartered outside the US raised a combined $3.9bn in 2022, 15% higher than 2021 levels

• Israel was the most active CyberTech country in 2022, outside the US, with 64 deals

CyberTech deal activity declined slightly in 2022 by 4% with companies based outside the United States completing 291 deals in total. Despite the drop in deal activity, investment saw a substantial 15% increase to $3.9bn defying global trends. Notably European (not including Israel) CyberTech deal activity saw a 25% drop from 2021 levels indicating a lack in innovation compared to other regions.

1password, a password management solution, was the largest CyberTech deal in 2022, raising $620m in their latest Series C funding round, led by ICONIQ Growth. After their latest funding 1password is valued at $6.8bn. Since its latest funding round in July 2021, 1password has increased its paying business customer base from 90,000 to more than 100,000 — adding big-name corporate subscribers including Datadog, Intercom and Snowflake — and has grown its internal headcount from 475 to 570 employees. This, the company says, has been driven by three things: the continuation of remote and hybrid working, the rapid adoption of cloud apps and the acceleration of work-related burnout.

Israel was the second most active CyberTech country in 2022, behind only the US, with 64 deals, a 22% share of total deals. France was the second most active CyberTech country with a 12.7% share and China was third with an 8.2% share. Revenue in Israel’s Cybersecurity market is projected to reach $900m in 2023 and is expected to show an annual growth rate (CAGR 2023-2027) of 10.8%, resulting in a market volume of $1.35bn by 2027.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global