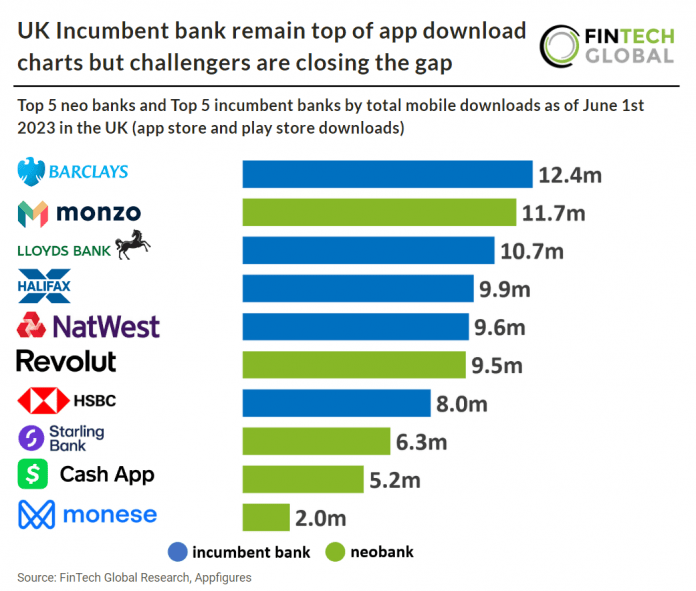

Key mobile banking download stats as of June 1st 2023:

• Revolut was the most downloaded mobile banking app in 2022 with 3.31m downloads

• Combined app downloads from incumbent banks totalled at 50.6m as of June 1st 2023

• Neobanks listed have seen an average CAGR of 51% from 2017 – 2022 for app downloads

The gap between neobanks and incumbent banks shrinks as agile and tech-driven approaches, seem to bring more value than traditional banking models. Combined downloads for incumbent banks apps totalled at 50.6m as of June 1st 2023, 46% higher than neobanks which totalled at 34.7m. Neobanks listed have seen an average CAGR of 51% from 2017 – 2022 for app downloads compared to just 5.3% CAGR from incumbents over the same period.

Barclays, a traditional bank based in London, was the most downloaded mobile banking app in the UK as of June 1st 2023 with 12.4m downloads. Barclays is a popular choice as the app is the ability to add accounts from other banks. Taking advantage of open banking, you can link your accounts to the Barclays app to see your balance and other information at a glance. This is particularly useful for those who have various bank accounts for separate purposes.

Revolut, a London based neobank, was the most downloaded banking app in the UK during 2022 with 3.31m downloads, 11.6% higher than the second most downloaded banking app, Monzo which had 2.97m downloads. Revolut has also not limited itself to the UK, as the bank is available currently in 36 countries with plans to expand globally soon, namely in Brazil, Ecuador, India, Mexico, Oman, and New Zealand, where a waiting list is already ongoing.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global