Tag: Neobanks

Mercury personal revolutionises consumer banking for tech savvy entrepreneurs

Mercury, a leading FinTech company used by over 100,000 startups for business banking, has now ventured into consumer banking with its new offering, Mercury Personal.

Combined French banking app downloads increase 31% in 2023 YoY

Combined French banking app downloads reached a total of 73m downloads by the end of 2023, that’s 24% higher than Germany’s total banking app...

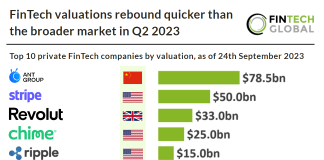

FinTech valuations rebound quicker than the broader market in Q2 2023

According to PitchBook, the stock prices of public FinTech companies have shown a quicker recovery than the broader market. In the second quarter, these...

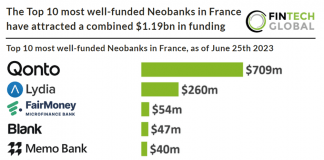

The Top 10 most well-funded Neobanks in France have attracted a...

French neobanks may face challenges in staying competitive due to their close association with incumbent banks like Boursorama Banque and Société Générale. While these...

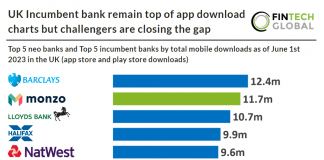

UK Incumbent bank remain top of app download charts but challengers...

Key mobile banking download stats as of June 1st 2023:

• Revolut was the most downloaded mobile banking app in 2022 with 3.31m downloads

• Combined...

Why sanctions screening is crucial for FinTechs

Following the invasion of Ukraine, financial institutions have seen a tidal wave of sanctions. Implementing strong sanctions screening tools enables FinTechs and neobanks to bolster their market reputation.

FinTech Farm herds $7.4m in seed funding raise

London-based firm FinTech Farm has secured $7.4m from a seed funding round co-led by Flyer One Ventures and Solid.

Zeta secures unicorn label following $250m Series C

Indian neobank startup Zeta has received unicorn status after a $250m Series C funding round took it to a $1.45bn valuation.

Neobank Nemo reportedly nabs funding from Mumbai Angels to empower Indian...

Early-stage investors’ platform Mumbai Angels Network has reportedly invested an undisclosed amount in cloud-based neobank Nemo.

Bunq, Volt partner to bolster open payment technology

Dutch challenger bank Bunq has partnered with London-based payments company Volt to provide a faster way for Bunq customers to transfer money from other accounts.