Key Latin American FinTech investment stats in Q2 2023:

• Latin American FinTech companies raised a combined $254m in Q2 2023, a 68% drop YoY

• Latin American FinTech deal activity reached 76 deals in Q2 2023, a 53% drop from Q2 2022

• Brazil was the most active Latin American Fintech country with a 32% share of deals

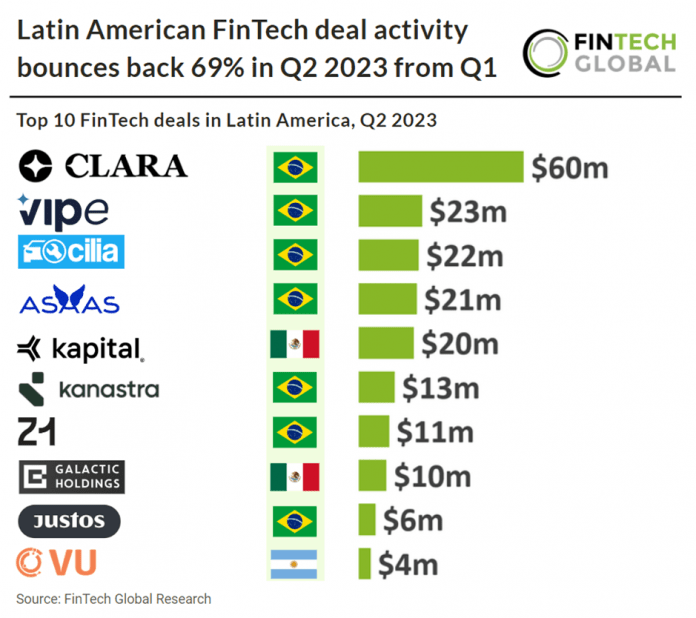

Latin American FinTech saw a strong Q2 with a 69% increase in deal activity from Q1 2023. In Q2 2023, a total of 76 deals FinTech deals were announced in Latin America dropping by 53% compared to the same period in 2022. In Q2 2023, Latin American FinTech companies experienced a significant decline in funding, with a YoY drop of 68%. They collectively raised $254 million during this period.

Clara, a credit card, payment solution, and expense tracking platform, had the largest FinTech deal in Latin America during Q2 2023, raising $60m in their latest series B funding round from 15 investors, led by GGV Capital. The company expects to use the additional capital to invest in its products and team, Giacoman said, while funds from recent debt lines were budgeted to increase liquidity for customers. Capital injections in the region are expected to slow in 2023, in part due to interest rate hikes aimed at taming high inflation as well as uncertainty after Silicon Valley Bank, which primarily serviced startups, crashed in March. Clara, which said it has reported credit card transactions equivalent to $1 billion at an annualized rate, didn’t disclose its valuation after the new round.

Brazil was the most active FinTech country in Q2 2023 with 24 deals, a 32% share of total deals in the region. Mexico was the second most active country with 14 deals, an 18% share. Chile and Colombia were joint third with 11 deals each.

In 2023, the Brazilian National Data Protection Authority (ANPD) continued to make progress in the implementation and enforcement of data protection regulations. In early 2021, the ANPD started publishing guidelines on topics such as data breach notification, followed by guidelines on the collection of cookie data in May 2022. Important developments included the declaration of the right to data protection as a constitutional fundamental right and the change in the ANPD’s legal nature, reinforcing its independence from the Brazilian Presidency. To strengthen the enforceability of the Brazilian General Data Protection Law (LGPD), the ANPD introduced administrative penalties, including fines, interruption, and suspension of activities related to personal data processing. In February 2023, the ANPD published the Regulation on the Calculation and Application of Administrative Sanctions, which established standards and criteria for the imposition of penalties. With active administrative processes underway, it is anticipated that the first penalties will be imposed in the first semester of 2023, emphasizing the importance of data processing agents complying with the provisions and obligations outlined in the LGPD.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global