Key European FinTech seed deal investment stats in Q2 2023

• European FinTech seed deal activity increased 6% in Q2 2023 from the previous quarter

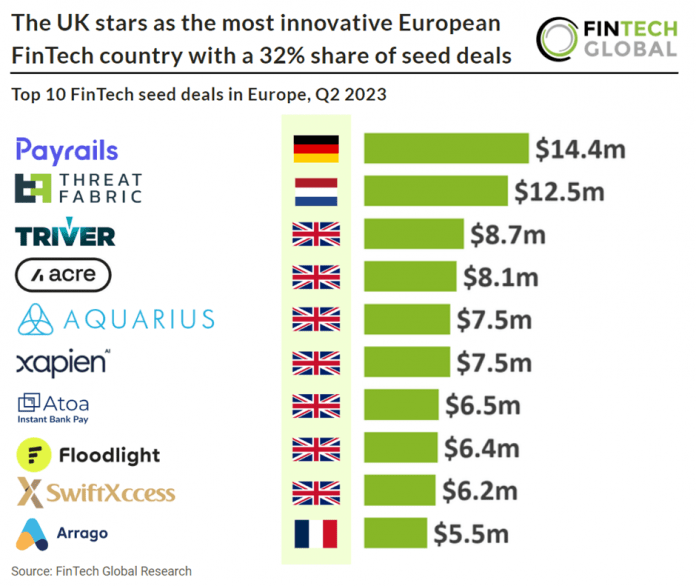

• The UK was the most active European FinTech seed deal country with a 32% share of deals

• RegTech was the most active FinTech subsector in Europe with a 23% share of deals

European FinTech seed deal activity continues to see a major decline compared to the previous year dropping 66% in Q2 2023 YoY. Although this seems negative, in Q2 2023 there were 184 FinTech seed deals announced, a 6% rise in European FinTech seed deal activity compared to the preceding quarter.

The UK was the most active FinTech seed country in Europe with 59 deals, a 32% share of all FinTech seed deals in Europe. Germany and France were joint second with 22 deals each, a 12% share of deals. Spain were the third most active with 16 deals.

Payrails, a payment infrastructure provider, had the largest FinTech seed deal in Q2 2023, raising $14.4m to extend their seed deal funding round, led by EQT Ventures. In total Payrails has raised $20.8m in their seed round. Payrails will use the funding it received to advance its product development and implement its go-to-market strategy. By leveraging local payment methods and routing transactions to multiple processors in over 200 countries, early customers have already improved their payment processes, resulting in cost savings and higher authorization rates. Payrails has developed an end-to-end payment processing operating system to improve the highly fragmented payments process space for platforms, marketplaces and large enterprises. The founding team recognized the gap in the market and is addressing the global digital payments market, which is expected to grow to 3.3 trillion by 2031. USD. With Payrails, companies can process international payment transactions across multiple processors without having to build internal structures.

RegTech was the most active FinTech subsector for seed deals in Europe during Q2 2023 with 42 deals, a 23% share of total deals. Blockchain & Crypto was the second most active with 3, an 18% share.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global