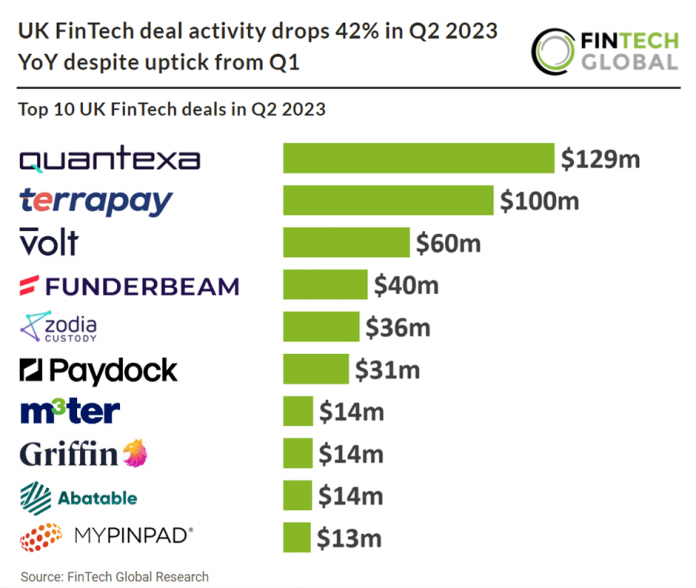

Key UK FinTech investment stats in Q2 2023

• UK FinTech deal activity reached 127 deals in Q2 2023, a 42% decrease from Q2 2022

• UK FinTech companies raised a combined $639m in Q2 2023, an 82% drop YoY

• Blockchain & Crypto was the most active UK FinTech subsector with a 19% share of total deals

The UK experienced mixed results in Q2 2023 with deal activity dropping significantly YoY but increasing 11% from Q1 2023. In Q2 2023, the number of deals in the UK FinTech sector reached 127, reflecting a decline of 42% compared to Q2 2022. During Q2 2023, UK FinTech companies collectively secured $639 million in funding, indicating a significant year-over-year decrease of 82%.

Quantexa, which provide data analytics for anti-money laundering, had the largest FinTech deal in Q2 2023, riaisng $129m in their latest Series E funding round, led by GIC. In what has been a difficult period for many tech companies, Quantexa continues to post impressive growth, having grown their ARR over 100% since closing their Series D round. In the same time period, Quantexa has seen robust growth in all regions, including a breakout performance in North America, with an increase in ARR of over 180%. This new capital will ensure that Quantexa continues to grow its global presence and invest in its world-class engineering talent. Quantexa also plans to use the funding to boost technology innovation efforts and strengthen its Decision Intelligence Platform capabilities in low-code data fusion, graph analytics, machine learning (ML), natural language processing (NLP) and artificial intelligence (AI). Additionally, Quantexa will increase focus on accelerating joint go-to-market efforts with its flagship partners which include Google, Moody’s, Accenture, KPMG, Deloitte, and EY.

Blockchain & Crypto was the most active FinTech subsector in Q2 2023 with 25 deals, a 19% share of total deals in the country. RegTech was the second most active with 18 deals, a 14% share and WealthTech was third with 16 deals, a 12% share of deals.

In response to the consultation by the Bank of England and the Treasury regarding the introduction of a central bank digital currency, UK Finance, a major finance trade body in the UK, has recommended imposing a limit on customer holdings of the “digital pound” to £3,000-£5,000. The organization expressed concerns about the potential risks of widespread bank runs that could occur if higher limits were allowed. UK Finance, which represents banks and financial firms, outlined its position regarding the launch of the digital pound by the end of the decade. They opposed the initial suggestions put forth by the government and the Bank of England, which proposed a temporary limit of £10,000-£20,000 in order to safeguard retail banks against significant deposit outflows. According to UK Finance, setting a lower limit on customer holdings would mitigate the potential impact of mass withdrawals and help maintain stability within the banking system.