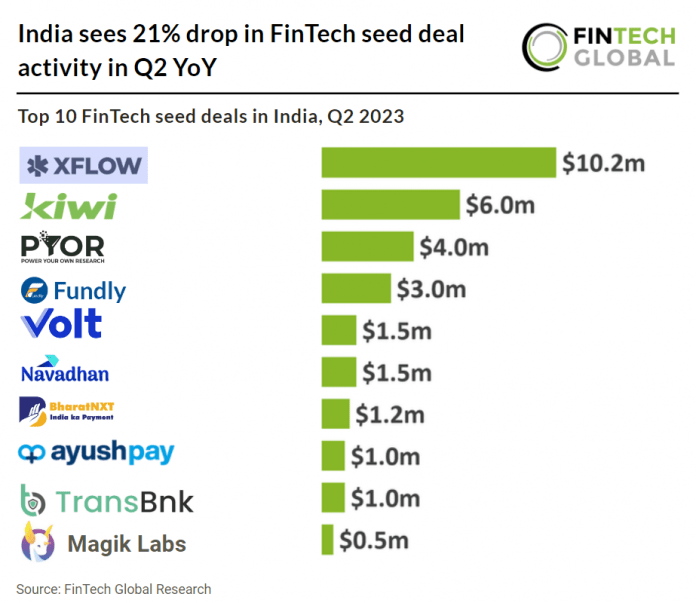

Key Indian FinTech seed deal investment stats in Q2 2023:

• Indian FinTech seed deal activity reached 41 transactions in Q2, a 21% drop compared to the same period in 2022

• The average FinTech seed deal size was $2.04m in Q2 2023, a 36% decline YoY

• Lending Technology was the most active Indian FinTech seed deal subsector with nine deals

India’s FinTech sector has seen a mixed Q2 with deal activity dropping but less than the general market. In Q2 2023, the number of seed deals in the Indian FinTech sector reached 41, showing a decline of 21% compared to the same period in 2022. India’s seed deal activity in general dropped 26% over the same period showing that FinTech is performing better than India’s aggregate market for private markets. Indian FinTech seed companies raised a combined $33.3m in Q2 2023. In Q2 2023, the average size of FinTech seed deals amounted to $2.04m, marking a significant YoY decrease of 36%.

XFLOW, which provide infrastructure for international business payments, had the largest Indian FinTech seed deal in Q2 2023, raising $10.2m in their seed round extension, led by Square Peg Capital. “With this new round of funding, we aim to increase the number of currencies we support, expand coverage of local payment methods in various countries and support all kinds of businesses in India,” said XFlow Co-Founder and Chief Executive Officer Anand Balaji. According to him, the firm offers a regulatorily compliant way to bring in money from anywhere in the world with no transaction limits. “XFlow also offers seamless API infrastructure for platforms to integrate cross border payments within their experiences, “This is arguably the only product that makes it this easy to integrate global payments,” he said. He said since the launch of the firm’s first product in November 2022, the firm has been able to support several customers – small and large.

Lending Technology was the most active Indian FinTech seed deal subsector with nine deals, a 22% share of deals. Blockchain & Crypto and WealthTech were the joint second most active FinTech subsectors for seed deals with six transactions each.

In the 2023-2024 financial budget, the Indian Government allocated INR 1,500 crores for fintech and banks. Earlier, they had announced an incentive of INR 2,600 crore to promote Unified Payments Interface transactions (UPI) for fintech startups and banks. Additionally, measures were introduced to encourage investments in tech, FinTech, and startups in India, along with tax-related relaxations such as extending timelines for funds relocation to IFSC GIFT City until March 31, 2025. Furthermore, the IFSCA introduced an incentive scheme to facilitate market access for domestic and foreign FinTechs to IFSCs in India and overseas markets.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global