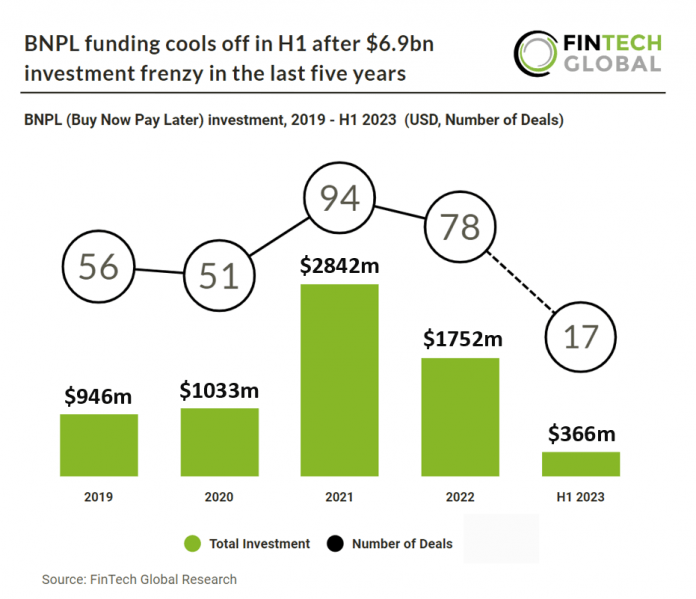

Funding for Buy Now Pay Later (BNPL) has dropped significantly in 2023 and the sector is on track to report its lowest deal activity and investment in the past five years. BNPL deal activity is on track to reach 34 deals in 2023, a 56% drop from 2022. BNPL funding has also dropped significantly. Based on the first half of 2023 BNPL investment is expected to reach $732m a 59% drop YoY. BNPL companies have collectively raised $6.94bn over the past five years.

Due to the enticing proposition of short-term loans with minimal or zero interest rates, BNPL providers have experienced a significant surge in popularity in recent years. According to a recent report by ResearchAndMarkets.com, the BNPL market reached a substantial value of $141.8 billion in 2021 and is projected to maintain a remarkable Compound Annual Growth Rate (CAGR) of 33% until 2026. Similarly, Juniper Research predicts a staggering increase in BNPL users, estimating that the user base will surpass 900 million by 2027, soaring from 360 million in 2022. High interest rates and high inflation will cause the BNPL market to go through a tricky period. The accessibility of BNPL over other forms of credit, such as credit cards, will likely increase usership. This is due to the appeal of interest-free rate periods offered by BNPL, especially in a high-interest rate environment. However, it also poses challenges for BNPL providers seeking funds to lend from the debt market, putting pressure on their ability to raise capital.

Klarna, a Swedish BNPL provider, is the most well-funded BNPL later company globally, as of H1 2023. Klarna currently has a 7.04% market share in the payments processing industry. Klarna has raised $4.5bn in investment over 31 funding rounds with their latest $800m venture round taking place in June 2022. This latest venture round dropped Klarna’s valuation by 85% to $6.7bn. Of the $6.9bn investment in BNPL companies in the past five years, Klarna accounts for $3.86bn, a 56% share.

The UK government has released draft legislation aimed at subjecting the rapidly growing ‘buy now pay later’ (BNPL) industry to Financial Conduct Authority (FCA) regulation, with the goal of enhancing consumer protection. The proposed legislation would grant the FCA authority to oversee firms offering interest-free instalment credit to consumers, addressing concerns about potential harm in the unsecured credit market. Currently, most BNPL firms and products are unregulated, leaving borrowers without the same level of consumer protections found in regulated lending products. The new regulatory framework would require BNPL lenders to obtain authorization from the FCA and adhere to various consumer credit rules, including the forthcoming Consumer Duty and financial promotions regime. The move signifies a broader shift towards consumer credit reforms, according to experts in financial regulation.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global