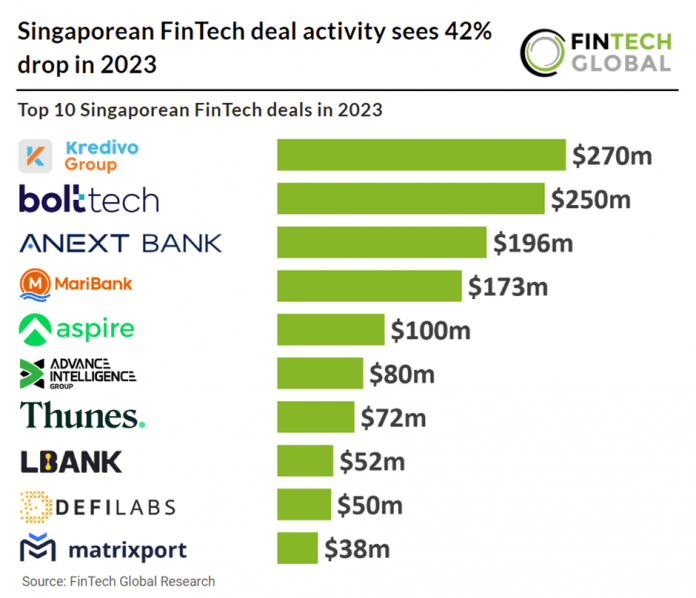

Key Singaporean FinTech investment stats in 2023:

• Singaporean FinTech deal activity totalled at 135 transactions in 2023, a 42% reduction from 2022

• Singaporean FinTech companies raised a combined $1.6bn in funding in 2023, a 33% drop from the previous year

• Singaporean FinTech deal activity has increased at a CAGR of 9.2% from 2019 – 2023

In 2023, Singaporean FinTech experienced a notable decline in deal activity, with a total of 135 deals recorded, marking a substantial 42% reduction compared to the previous year. The total funding raised by Singaporean FinTech companies in 2023 also decreased significantly, amounting to $1.6bn, reflecting a 33% drop from the preceding year. Singapore’s FinTech sector has displayed resilience and steady growth over the past five years, with a compound annual growth rate (CAGR) of 9.2% from 2019 to 2023. During this period, FinTech firms in the country collectively raised $9bn. To compare this was 24% less than France’s FinTech investment over the same period.

Kredivo Holdings, which provide a wide range of financial services including BNPL and loans, had the largest FinTech deal in Singapore during 2023 raising $270m in their latest Series D funding round, led by Mizuho Financial Group. The company says the new capital will be deployed to support its existing ecosystem of digital payments and credit service and to finance the upcoming launch of its neobank Kroo. Akshay Garg, CEO of Kredivo Holdings, says: “Despite challenging market conditions, investors continue to recognize the scale and strength of our business, and our innovation potential. The upcoming expansion into digital banking is deeply synergistic with the existing Kredivo product and also opens up a very promising channel for us to become the digital financial services platform of choice for tens of millions of consumers in Southeast Asia.”

The Monetary Authority of Singapore (MAS) has issued a Notice on December 18, 2023, instructing licensed payment service providers offering cross-border money transfer services (remittance companies) to temporarily halt the use of non-bank and non-card channels when sending money to individuals in China. This suspension will be in effect for three months, from January 1, 2024, to March 31, 2024. The decision comes in response to reports of funds sent by individuals (mostly Chinese nationals working in Singapore) through remittance companies being frozen in their recipients’ bank accounts in China. Although most remittances using these channels are successful, a small portion has faced freezing in China, prompting MAS to take this precautionary measure to protect consumers. Remittance companies have been instructed to assist affected customers, improve complaint handling processes, and review their arrangements with partners for the China remittance corridor. The suspension aims to safeguard consumers and will commence on January 1, 2024, following a 14-day notice period. MAS advises the public to use alternative channels like banks or card networks during this period to avoid any potential freezing of funds. The situation will be closely monitored, and the suspension may be extended or terminated as deemed necessary after March 31, 2024.