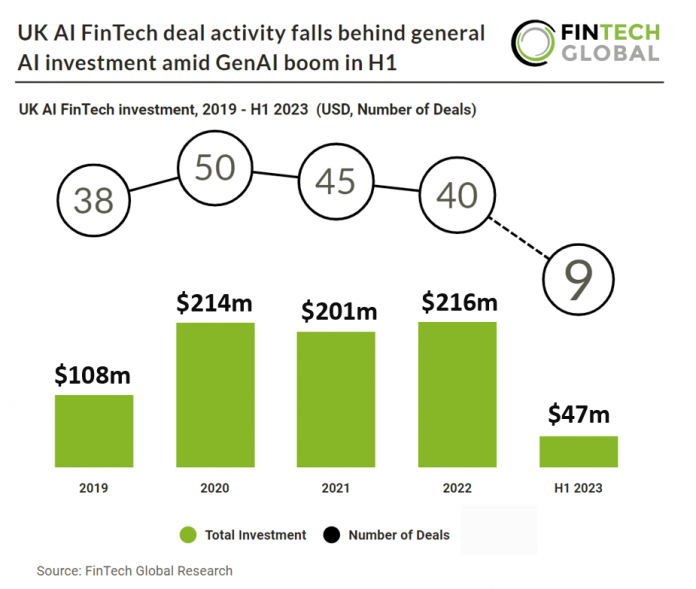

Key UK AI FinTech investment stats in H1 2023:

• UK AI FinTech deal activity reached nine deals in H1 2023, a 57% drop YoY

• UK AI FinTech companies raised a combined investment of $47m in the first six months of 2023, a 74% decline compared to same period last year

• Based on first half deal activity the UK’s AI FinTech number of funding rounds is on track to drop 39 percentage points more than the UK’s AI deal activity in general

The UK’s AI FinTech market reported negative results in H1 2023 and is on track to drop 39 percentage points more than the UK’s AI deal activity in general YoY. Global AI FinTech deal activity is on track to only drop 22% in 2023, significantly better than the UK. The UK AI market is worth more than £16.9bn, according to the US International Trade Administration, and is expected to grow to £803.7bn by 2035. In the first half of 2023, the number of AI FinTech deals in the UK saw a significant decrease of 57% compared to the previous year. During the first half of 2023, AI FinTech firms in the UK secured a combined total funding of $47m, marking a substantial decrease of 74% when compared to the funding raised in the same period of 2022.

Flock, a digital insurance company for connected and autonomous commercial vehicles, had the largest UK AI FinTech deal in H1 2023, raising $38m in their latest Series B funding round, led by Octopus Ventures. This funding round will allow Flock to expand into new segments of the commercial motor industry as well as new geographies, Ed explains. The company will also be doubling down on its data-driven approach to risk quantification and dynamic pricing, significantly increasing the size of its data science and engineering teams, and more than doubling the size of its UK team in the coming years. Flock has grown revenues by more than 30x since its Series A in 2021. Flock’s fleet insurance isn’t only proving commercially successful, its real-time telematics-based approach has the ability to create safer roads, by leveraging telematics data to help customers better understand risk and identify high-risk drivers and routes. Fleets who adopt safer driving are then rewarded with lower insurance premiums; with Flock, safer fleets pay less.

The UK Government has proposed a sector-based AI regulation approach in March 2023, contrasting the EU’s rules-based strategy. This approach relies on existing regulators implementing AI principles and introduces new ‘central functions’ for support. The ongoing Data Protection and Digital Information Bill, along with initiatives like the Foundation Model Taskforce and AI Safety Summit, will shape AI governance. Besides regulation, non-regulatory tools such as standards and assurance will enhance AI outcomes. Collaborative efforts with the UK AI Standards Hub are intended to develop these tools for responsible innovation. Although this initiative is seeking to promote innovation, the framework allows individual regulators to define AI adaptivity and autonomy, leading to potential divergence in interpretations by UK regulators like the FCA or Ofcom. This might cause uncertainty for AI businesses across sectors.