Key European PayTech investment stats H1 2023:

• European PayTech deal activity reached 93 transactions in the first half of 2023, down 52% YoY

• European PayTech companies raised a combined $469m in H1 2023, a 92% reduction compared to the same period last year

• The UK was the most active PayTech country in Europe with 34 funding rounds

European PayTech has seen a major drop in both deal activity and funding during the first six months of 2023. In the first half of 2023, there were 93 deals in the European PayTech sector, marking a YoY decline of 52%. During H1 2023, European PayTech companies secured a combined total of $469m in funding, reflecting a substantial 92% decrease compared to the funding raised in the same period of 2022. This funding drop can be attributed to the global market drop but also from major players being absent from raising funds in 2023 such as Checkout.com, a digital payment provider for businesses, which raised $1bn in 2022. Checkout.com have raised funding every year since 2019.

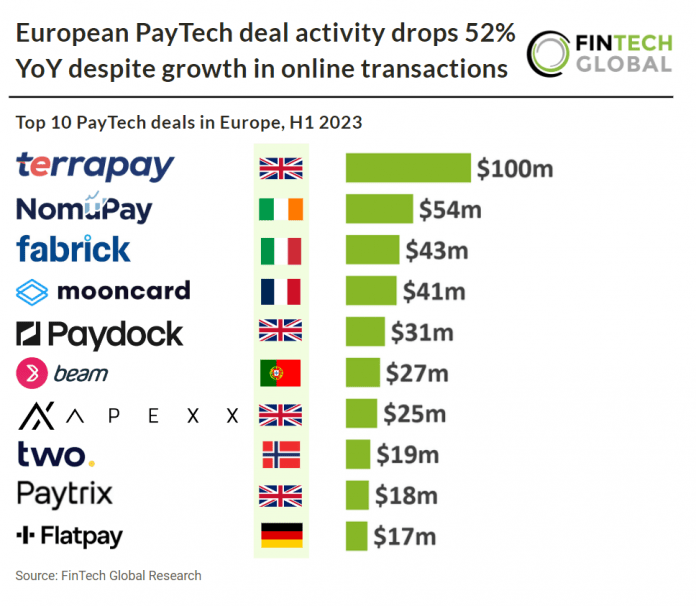

Terrapay, a mobile-first payments service, had the largest PayTech deal in H1 2023, raising $100m in their latest Series B funding round, led by the International Finance Corporation. The funding will help “further TerraPay’s global expansion plans, especially across the LATAM and MENA regions, strengthen its existing pay-out network to 150 countries by 2024, support and accelerate its growth, and invest in the marketing and adoption of alternate payment methods for mobile wallets, like Request-to-Pay – an interoperable mobile wallet solution, at a larger scale.” Furthermore, TerraPay also aims “to expand its regulatory and compliance infrastructure, including key license applications across the world.” Currently, TerraPay’s agile payments infrastructure and solutions platform “offers business/merchant pay-outs, acquiring and issuing services, among others.” The company has “built a far-reaching network of partners and customers, present in more than 108 receiving countries and 205 sending countries with 62 settlement currencies.”

The UK was the most active country for PayTech deal activity in Europe with 34 transactions completed in the country, a 36% share of total deals on the continent. Germany was the second most active with eight deals, a 7.4% share and France was third with seven deals.

The European digital payments market is projected to reach $1,795bn in 2023 and grow at a CAGR from 2023-2027 of 13.6% resulting in a projected total amount of $2,994bn by 2027. Europe is the second slowest continent for online payment growth, globally, only ahead of Asia by 4.3 percentage points. Africa is the fastest growing at 16%.