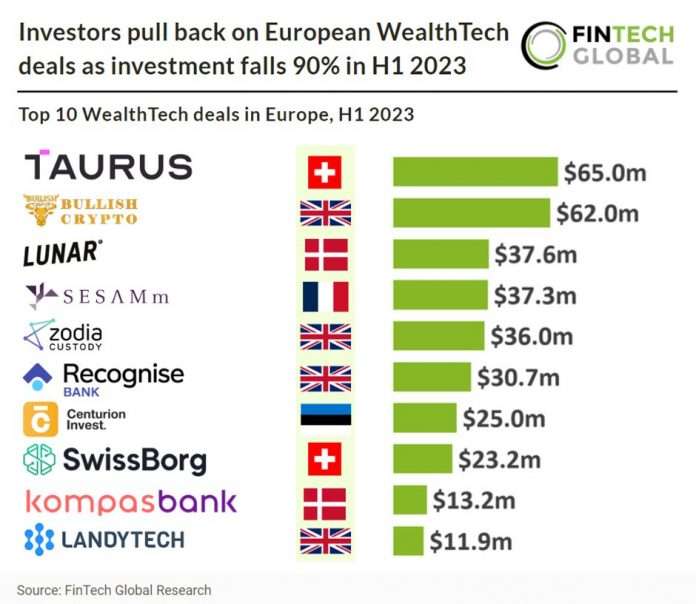

In the first half of 2023, European WealthTech firms raise a combined funding of $553m, marking a substantial 90% decrease compared to the same period in 2022. As mentioned significant transactions are still notably lacking, FNZ, a wealth management platform, for example raised $1.4bn in H1 2022 and the top 20 European WealthTech deals in H1 2022 raised a combined $5bn compared to $426m in 2023. In the first half of 2023, European WealthTech saw a total of 124 deals, reflecting a 39% decrease compared to the same period in the previous year.

Taurus, a digital assets trading and investment platform, was the largest European WealthTech deal in H1 2023, raising $65m in their latest Series B funding round led by Credit Suisse. The funds will be used to support Taurus’ growth strategy across three main priorities: hiring top engineering talent to further develop its platform; expanding its sales and customer success organization with new offices in Europe, UAE, North America, South America and Southeast Asia; and maintaining stringent security, risk and compliance requirements across product lines, processes and organizations. “We are proud to welcome such high-profile investors and benefit from their expertise to further develop one of the richest platforms in the industry, covering any type of digital assets” said Lamine Brahimi, co-founder and managing partner of Taurus.

The UK was the most active European WealthTech country in H1 2023 with 44 deals, a 35% share of total deals. Switzerland was the second most active with 14 deals, a 11.2% share of deals. Turkey and France were the joint third most active WealthTech countries in Europe with 11 deals each.

The UK’s Financial Conduct Authority (FCA) has released a consultation paper (CP23/17) on securitization regulations in line with HM Treasury’s 2021 review. The proposed changes, while mainly clarificatory, are expected to align with current UK Securitisation Regulations (UK SR). The CP should be considered alongside the near-final draft statutory instrument (Draft SI) published by HM Treasury, which includes rules for “firm-facing requirements” affecting FCA-authorized firms and certain unauthorised entities. The Prudential Regulation Authority (PRA) is also consulting on rules for PRA-authorized firms.

Notable points include:

• Amendments to the “institutional investor” definition related to alternative investment fund managers (AIFMs) will apply only to UK-authorized AIFMs, excluding non-UK AIFMs from the rules.

• Due diligence and information disclosure requirements for institutional investors will become more “principles-based,” removing distinctions based on originator or sponsor location.

• Clarifications regarding delegation of due diligence obligations, with responsibility shifting to the managing party when delegated, except when delegated to an occupational pension scheme (OPS).

• Small registered UK AIFMs will be subject to due diligence rules under the Draft SI, similar to other institutional investors.

• Sell-side parties should note core requirements related to risk retention and transparency reporting, with a second consultation planned in 2024 to potentially modify the reporting framework for securitizations.

The FCA’s consultation is open until October 30, 2023, with the implementation of new rules expected in Q2 2024.