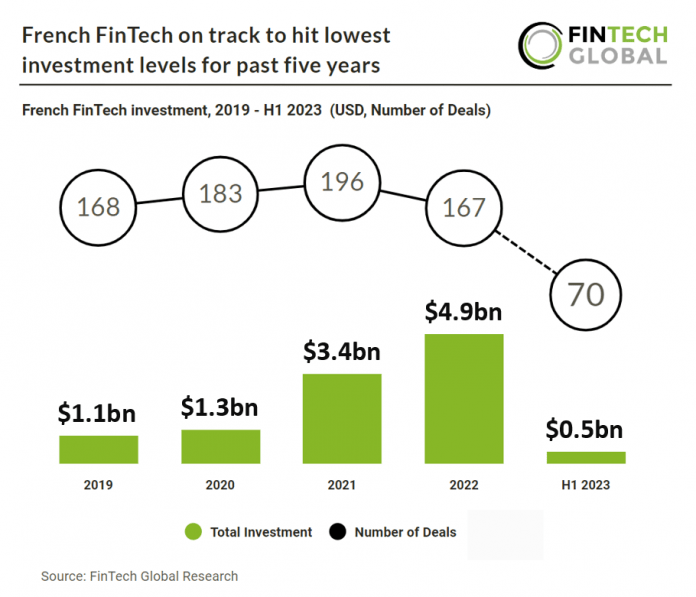

French FinTech investment stats in H1 2023:

• French FinTech companies raised a combined $521m in H1 2023, an 84% drop YoY

• French FinTech companies are on track to raise a total of $1,042m, the lowest investment in the past five years and a 79% drop from 2022

• French FinTech deal activity reached 70 deals in the first six months of 2023, a 30% drop from H1 last year

French FinTech has seen a huge amount of growth over the past five years although 2023 seems to be a turning point with both deal activity and investment dropping to pre 2019 levels. French FinTech investment grew at a CAGR of 52.2% from 2018 -2022. France has solidified its position as one of the most active FinTech countries in Europe. During 2022 they were the third most active country and in H1 2023 they have fallen to fourth, overtaken by Switzerland. In the first half of 2023, FinTech firms in France secured a total funding of $521 million, experiencing a significant 84% decrease compared to the previous year.

Ledger, which provides security and infrastructure solutions to critical digital assets, was the largest French FinTech deal in H1 2023 raising $108m to extend their Series C funding round. The extension round maintained the company’s valuation at €1.3 Billion. The company intends to use the funds to further its global ambitions and accelerate its drive to support blockchain innovation. Led by Pascal Gauthier, Chairman and CEO, Ledger is a global platform for digital assets and Web3. With more than 6M devices sold to consumers in 200 countries and 10+ languages, 100+ financial institutions and brands as customers, 20 % of the world’s crypto assets are secured, plus services supporting trading, buying, spending, earning, and NFTs.

France has introduced a tailored tax framework for digital assets, encompassing a tax system that treats exchanges between “qualifying” digital assets as tax-neutral for individuals. However, converting a “qualifying” digital asset into fiat currency now incurs a fixed 30% tax rate (or a progressive income tax scale effective from January 1, 2023). Capital gains arising from digital assets not covered by this specific tax regime are subject to taxation as either commercial or non-commercial income, following the progressive personal income tax scale, potentially reaching 49%, in addition to relevant social security contributions. Individuals are required to report their foreign digital asset accounts annually. The 2022 Finance Bill amended this tax framework, stipulating that starting from January 1, 2023, capital gains on digital assets will be categorized as non-commercial income if they occur under conditions similar to professional trading and as commercial income if they are made on a professional basis. The French tax authorities are anticipated to provide guidelines to distinguish between private wealth management and professional-like gains from digital assets.