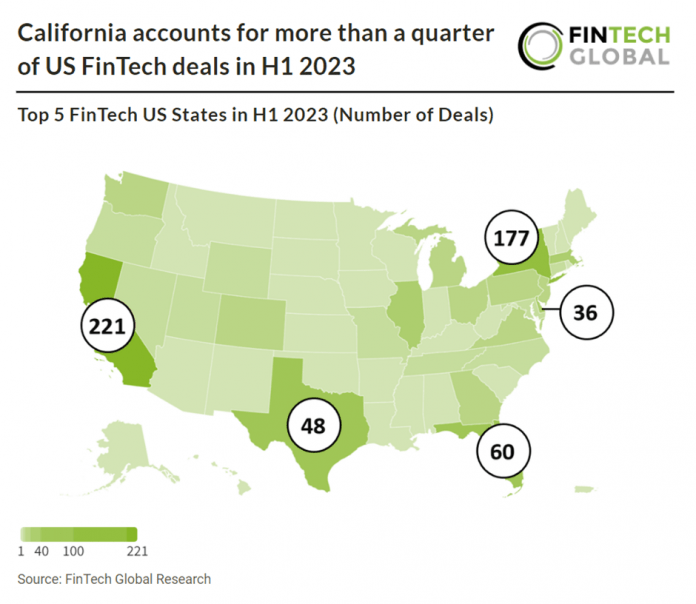

Key US FinTech investment stats in H1 2023:

• California was the most active US state for FinTech investmenbt with a 26.8% share of all deals in the country

• US FinTech deal activity reached 821 transactions in H1 2023, a 53% drop YoY

• US FinTech companies raised a combined $13.1bn in H1 2023, a 56% drop from H1 2022

The US remains the largest market for FinTech in H1 2023 with a 35% share of total deals globally. In the first half of 2023, there were 821 FinTech funding rounds in the United States, marking a significant 53% YoY decline in deal activity. In the first half of 2023, FinTech companies in the United States collectively secured $13.1 billion in funding, experiencing a substantial 56% decrease compared to the same period in 2022.

California was the most active US state for FinTech deal activity in H1 2023 with 221 deals, a 26.8% share of deals. This was followed by New York with 177 deals, a 21.5% share of deals and Florida was third with 60 deals, a 7.3% share. The fourth most active state was Texas with 48 deals, a 5.8% share of total deals and Delaware was fifth with 36 deals, a 4.4% share of total deals.

Stripe, an online payments provider, was the largest US FinTech deal in H1 2023, raising $6.5bn in their latest private equity funding round from existing investors as well as new investor, including GIC, Goldman Sachs Asset and Wealth Management and Temasek. Co-founder and president John Collison says the funding will give current and former employees the opportunity “to access the value they’ve helped create”. Stripe says 100 businesses now handle more than $1 billion on Stripe every year, with 75% using Stripe for more than just payments and more than 70% using the FinTech to manage operations across multiple countries.

The latest US FinTech regulation came in June 2023 with the introduction of The Improving Digital Identity Act of 2023. The act aims to establish a comprehensive framework for improving digital identity management by addressing key challenges: 1. Cybersecurity Concerns: The rising instances of identity theft, fraud, and cyber threats emphasize the need for stronger identity verification and protection methods. Traditional methods are vulnerable to phishing and breaches. 2. Simplifying Access to Online Services: With the shift of services online, managing multiple usernames and passwords becomes burdensome for individuals. 3. User Privacy Protection: In the digital era, safeguarding user privacy has become a crucial concern that needs to be adequately addressed. 4. Enabling Digital Transformation: To enhance efficiency and user experience, governments and businesses are adopting digital transformation. However, complex identity verification processes hinder progress in this area. 5. Building Trust: Establishing a robust digital identity system is essential for fostering trust among individuals, service providers, and government entities. Public adoption of these services relies on this foundation of trust.