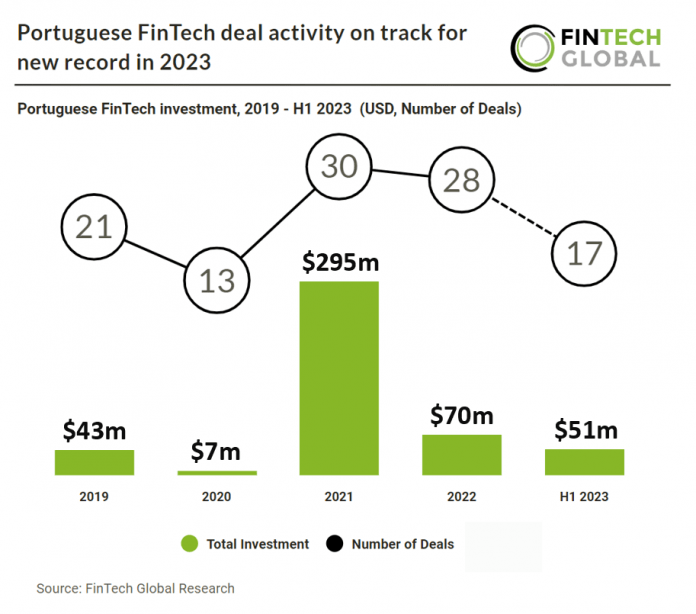

Key Portuguese FinTech investment stats in H1 2023:

• Portuguese FinTech deal activity reached 17 transactions in H1 2023, an 88% increase from H1 2022

• Portuguese FinTech companies have raised a combined $51m in H1 2023, a 64% increase YoY

• Portuguese FinTech companies have raised a combined $465m since 2019

Portugal’s FinTech sector has seen consistent growth over the past five years and is on track to have their most active year in 2023. From 2019 to the first half of 2023, FinTech companies in Portugal collectively secured $465m in funding. In the first half of 2023, Portuguese FinTech firms raised a total of $51m, marking a remarkable 64% YoY growth. Portuguese FinTech deal activity reached 17 deals in H1 2023, an 88% increase from H1 2022. Based on H1 2023 activity, Portuguese FinTech deal activity is projected to reach 34 deals, a 21% increase from 2022.

Coverflex, a compensation management platform, had the largest Portuguese FinTech deal in H1 2023 after raising $16.5m in their latest Series A funding round, led by SCOR Ventures. This funding round, Coverflex claims, will allow it to continue growing its team to more than 150 by the end of 2023, mainly in its product, sales and engineering teams. In addition, the funding will support its launch in Italy and consolidate its position in the employee benefits management space in Portugal. Coverflex CEO Miguel Amaro said, “In the current macro environment, this Series A round validates our ambitious vision, product-market fit in Portugal and a market opportunity in Europe, especially in Italy – Edenred’s most profitable market in the world despite having a strong pushback from both merchants and users recently. “This round confirms that our focus on adapting human resources processes to the current demand for a more personalised compensation experience is more than relevant today”.

Starting from July 15, 2023, Notice no. 1/2023 of the Bank of Portugal will be in effect. This notice supplements the Anti-Money Laundering (AML) Legal Framework and outlines the procedures and requirements for complying with AML and anti-terrorist financing duties for entities dealing with virtual assets. Although there are no specific regulations targeting virtual currencies, there is a growing focus on regulating activities related to digital assets, particularly in terms of AML measures. The Bank of Portugal, following supranational authority guidelines, has clarified that virtual currencies are not considered legal tender in Portugal. Therefore, businesses are not obligated to accept them as a form of payment in transactions. However, virtual currencies can be used as an alternative means of payment if both parties involved in a transaction agree, aligning with the European Court of Justice’s view that Bitcoin is a contractual means of payment.