Key Latin American FinTech seed investment stats in H1 2023:

• Latin American FinTech seed deal activity reached 104 transactions in H1 2023, a 44% drop YoY

• Brazil remained the most active Latin American FinTech country with 39 funding rounds

• Latin American FinTech companies raised a combined $119m in H1 2023, a 47% decrease from H1 2022

Latin American FinTech seed investment have seen a significant drop in both funding and deal activity during the first half of 2023 whilst other regions such as Europe saw an uptick during the same period. In the first half of 2023, Latin American FinTech seed deal activity recorded 104 deals, marking a significant 44% decline compared to the previous year. During the first half of 2023, Latin American FinTech firms secured a total of $119m in seed funding, representing a substantial 47% reduction compared to the same period in 2022.

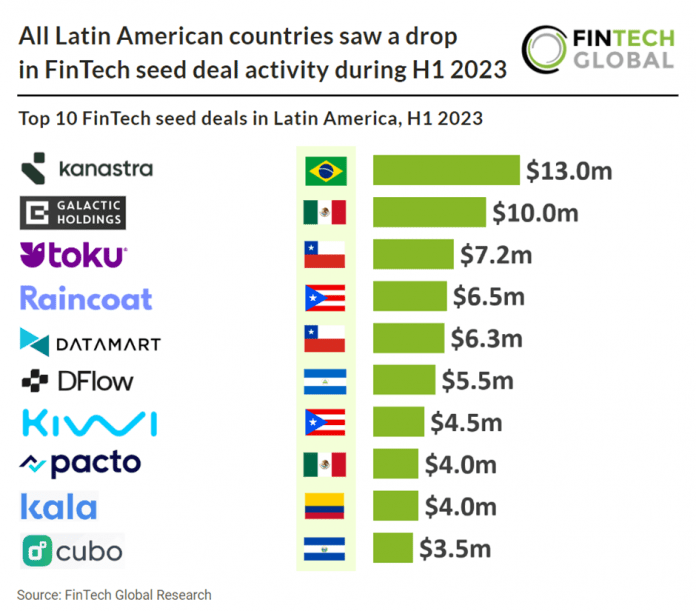

Kanastra, a technological back office for alternative investments, had the largest FinTech seed deal in Latin America during H1 2023, raising $13m in their latest seed deal funsing round, led by Quona Capital, Valor Capital Group. “This round will enable us to pursue our strategy of consolidating the necessary services for operating private credit funds and securitizations on a single tech platform, streamlining the journey for originators and institutional investors, making it a seamless, more efficient, and cost-effective experience”, said Gustavo Mapeli, co-founder of Kanastra. Founded in 2022, Kanastra simplifies debt facilities for both originators and investors by bringing to market an all-in-one, tech-driven solution. The platform streamlines and provides all services needed to set up, run and invest in debt facilities in a truly digital and automated way. The company takes care of everything from fund administration to debt issuance so originators and investors don’t have to spend time and energy with spreadsheets, complicated documents and legacy systems, enabling critical automation, data availability, modern integrations and a host of features to empower lending.

Brazil was the most active FinTech seed deal country in Latin America during H1 2023, with 39 deals, a 37.5% share of transactions. Mexico was the second most active FinTech seed deal country with 16 deals, a 15.3% share of deals and Colombia was third with 15 deals.

In May 2023 FinTech associations in Mexico, Colombia, Peru, and Chile have collaborated to propose joint standards for Open FinTech, potentially paving the way for unified regulatory bodies in Latin America. This initiative aims to enhance cross-border transactions and establish a common standard for exchanging financial information among FinTechs, banks, and other financial market participants. The goal is to reduce information asymmetries, foster competition, and lower costs for end-users. This collaborative effort is a significant milestone in Latin America, where regulatory advancements have been progressing independently in various countries. It holds the potential to accelerate financial inclusion and benefit the growing FinTech ecosystem in the region.