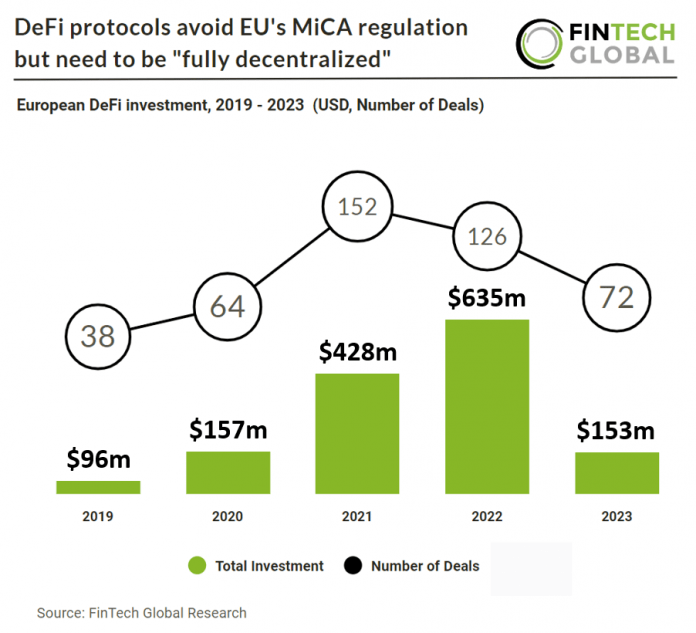

Key European DeFi investment stats in 2023:

· European DeFi deal activity reached 72 deals in 2023, a 43% drop from 2022

· European DeFi companies raised a combined $153m in 2023, a 76% reduction YoY

· From 2019 -2023 European DeFi companies raised a combined $1.4bn

In 2023, European DeFi deal activity experienced a significant decline, dropping to 72 deals. This marked a notable decrease of 43% compared to the previous year’s figures. Alongside this decline in deal activity, European DeFi companies collectively raised a total of $153m in funding throughout the year. This figure reflects a substantial 76% reduction YoY, indicating a challenging funding environment for DeFi ventures in the European market. European DeFi companies collectively raised a total of $1.4bn from 2019 to 2023 which highlights the opportunities VCs see in the technology.

LI.FI, which builds a multi-chain DeFi middleware, had the largest European DeFi deal in 2023 after raising $17.5m in their latest Series A funding round, led by CoinFund and Superscrypt. The capital raised in this funding round will expedite the advancement of LI.FI’s solutions across various blockchains, decentralized exchanges (DEXs), cross-chain bridges, and more. Additionally, they will strengthen sales, business development, and marketing efforts, facilitating smoother integration between traditional finance (TradFi) and DeFi. This will facilitate the onboarding of institutions into the financial landscapes of tomorrow. LI.FI quickly became a leader in cross-chain liquidity aggregation as they quickly rose to handle over 96% of all cross-chain swap activity on MetaMask in just six months, according to data supplied by Dune. LI.FI recently launched Jumper.Exchange, which is a multi-chain exchange interface that enables qualified users to swap virtually any asset for any other asset with just one click.

Decentralized finance (DeFi) protocols are considered exempt from the European Union’s Markets in Crypto-Assets Regulation (MiCA) if they are “fully decentralized,” meaning no individual or entity controls the platform. The European Commission, under MiCA, will conduct a comprehensive analysis of the advantages and drawbacks of DeFi over the next year. This assessment will inform the EU’s future actions regarding DeFi. Mark Foster, the EU policy lead at the Crypto Council for Innovation, explained that potential legislation may be proposed if risks are identified, with decisions expected to be made during the next Parliament. Currently, there is minimal direct impact on DeFi protocols in the EU, reflecting a deliberate political choice by EU policymakers to allow the market to mature and gain understanding before implementing regulations.