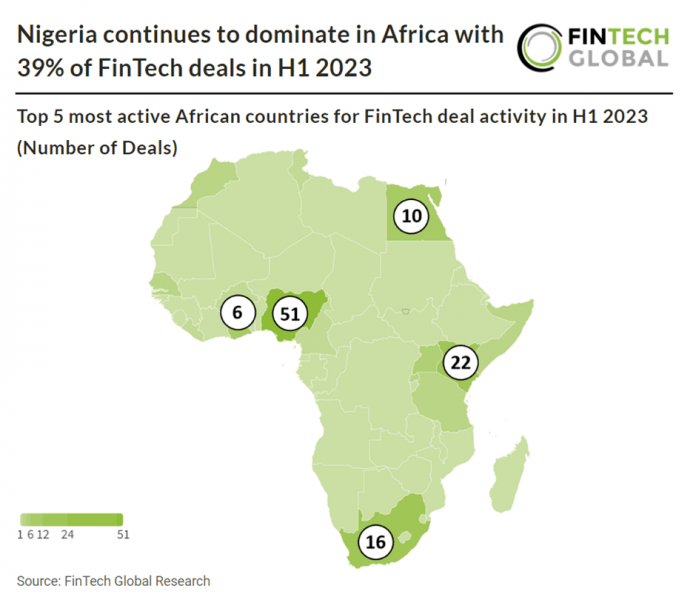

Key African FinTech investment stats in H1 2023:

• African FinTech deal activity reached 133 deals in H1 2023, a 38% drop YoY

• African FinTech companies raised a combined $555m in H1 2023, a 43% drop from H1 2022

• Nigeria was the most active FinTech country with 51 transactions, a 39% share of all deals

African FinTech has seen a significant drop in both deal activity and investment during H1 2023 although it is doing better than global trends. Global FinTech deal activity dropped 46% in H1 2023 YoY. In the first half of 2023, African FinTech saw a total of 133 deals, reflecting a 38% decrease compared to the same period the previous year. African FinTech enterprises collectively secured $555m in funding during the first half of 2023, marking a substantial 43% decline compared to the corresponding period in 2022.

MNT-Halan, an Egyptian digital lender, was the largest African FinTech deal in Q1 2023 after their latest $260m private equity round, led by Chimera Investment. The round propelled them to unicorn status with a post-money valuation above $1bn. Chimera Investment has invested more than $200 million in equity in exchange for over 20% of the company. MNT-Halan plans to expand internationally after its growth in Egypt and progress on the swap agreement between Halan and Netherlands-based microlending platform MNT Investments. The offerings aim to “reflect the high quality, diversity, and granularity of the combined securitized loan books, consisting of 246,000 contracts and a robust cash pay-back ability.”

Nigeria was the most active FinTech country with 51 deals, a 39% share of all funding rounds. The second most active country was Kenya with 22 deals, a 16.6% share of deals and third was South Africa with 16 transactions, a 12.1% share of all investments.

PayTech remains the most active African FinTech subsector with 34 deals, a 26% share of total deals. African total transaction value in the payments technology market is projected to reach $146bn in 2023. African total transaction value is expected to show an annual growth rate (CAGR 2023-2027) of 16% resulting in a projected total amount of $265bn by 2027.