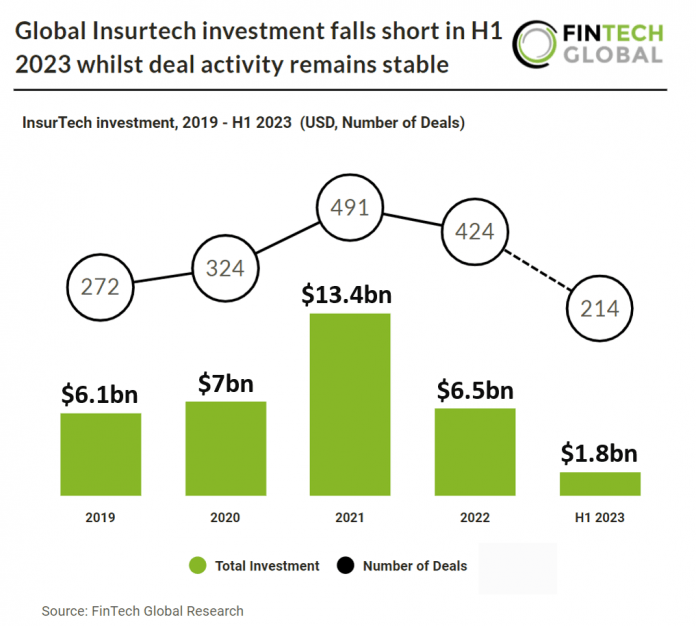

Key Global InsurTech investment stats in H1 2023:

• InsurTechs have raised a combined $34.8 billion, globally from 2019 – H1 2023

• Global InsurTech deal activity is on track to reach 428 deals in 2023, based on H1 2023 activity a 1% increase YoY

• The average InsurTech deal size was $8.4m in H1 2023, a 52% drop from H1 2022

The InsurTech sector, globally has seen a significant drop in investment during H1 2023 compared to the previous year but deal activity is on track to increase. Based on the InsurTech deal activity in the first half of 2023, it is projected that there will be a 1% year-on-year increase, bringing the total number of deals in 2023 to an estimated 428. From 2019 to the first half of 2023, InsurTech companies worldwide have collectively secured a total of $34.8 billion in funding. In the first half of 2023, the average deal size for InsurTechs stood at $8.4 million, marking a significant 52% decrease compared to the same period in 2022.

Bolttech, a Singapore based InsurTech with the mission of building the world’s leading technology-enabled ecosystem for protection and insurance, had the largest InsurTeh deal globally in H1 2023, raising $196m in their latest Series B extension funding round, led by Tokio Marine. The funds from the Series B will be utilised to further accelerate Bolttech’s organic growth. This includes investments in proprietary technology, enhancing digital capabilities for business partners and end consumers, and attracting talent across Bolttech’s 30+ markets. Additionally, the funds will be used to explore inorganic opportunities to expedite international growth. Rob Schimek, Bolttech’s group chief executive officer, said, “Having just celebrated our third anniversary since our launch in 2020, we are incredibly proud of what we have achieved so far on our mission to build the world’s leading, technology-enabled insurance ecosystem. We thank all our Series B investors for their support, and we are excited to welcome our new investors, reputable leaders in their respective spaces, and look forward to strong partnerships that will fuel Bolttech’s continued growth on our path to profitability in 2024.”

The latest InsurTech related regulation came from the EU. The Retained EU Law (Revocation and Reform) Act 2023 makes significant changes to the framework of REUL. The Treasury will repeal the firm-facing requirements in retained EU law (REUL), and we will replace those provisions, where appropriate, with our rules. There is a significant amount of REUL, and the repeal and replacement work will have an impact on our Handbook. This includes the Insurance Distribution Directive (IDD). With the next steps being an FCA Consultation Paper in September 2023. The IDD was designed to establish standards and transparency measures for insurance distributors, ensuring fair treatment and clear information for consumers when purchasing insurance. It covered aspects like business conduct standards and transparency requirements, such as providing comprehensive information to consumers. Efforts were underway to replace certain regulations related to the IDD, in collaboration with the Treasury, for regulatory consistency.