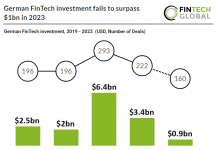

Key German FinTech investment stats in 2023:

• German FinTech investment totalled at $911m in 2023, a 74% drop YoY

• German FinTech deal activity totalled at 160 transactions in 2023, a 28% reduction from 2022

• The average German FinTech deal size was $5.7m in 2023, a 63% drop from 2022

German FinTech suffered drops across all investment statistics in 2023. Last year, the landscape of German FinTech investments experienced a significant transformation as it recorded a staggering 74% decline YoY, with German FinTech companies raising a combined $911m in funding. This downturn signified a considerable departure from the previous year’s figures, signalling shifts in investor sentiment and market dynamics. German FinTech deal activity in 2023 saw a notable reduction, with a total of 160 funding rounds completed. This represented a 28% decrease compared to the previous year. The average size of German FinTech deals in 2023 was $5.7 million. This marked a substantial 63% decrease from the figures recorded in 2022.

IntegrityNext, a firm with a mission to make supply chains more sustainable with better ESG compliance and oversight, had the largest German FinTech deal in 2023 after it secured €100m in their first Venture round. EQT Growth led the investment, and the recent capital infusion will propel the company into its next developmental phase. According to EU Startups, Munich-based. IntergrityNext has developed a sustainability software platform that is dedicated to making supply chains more transparent and compliant. Founded in 2016, IntegrityNext’s solution supports enterprises to assess risk and monitor a large portion of their supply chain for ESG metrics and compliance, enabling them to meet the demands of stakeholders, regulatory and societal demands. IntegrityNext plans to use the new funding to embark on the next phase of growth. The firm will also consolidate its position within the German market while also expanding its product to serve upcoming European regulations.

In October 2023, Germany published a draft for their new Financial Market Digitalisation Act (FinmadiG) which will significantly impact financial technology by aligning German law with EU regulations like MiCA and DORA. It introduces new definitions and regulations for crypto-assets and cryptographic instruments and amends existing financial regulation laws. Key changes include harmonization of crypto-asset laws across the EU, new national regulations for cryptographic instruments, and adjustments to the treatment of client crypto-assets and reserve assets. The Act also enhances the powers and sanctions of BaFin, the German financial services supervisory authority, and sets transitional regimes for service providers to adapt to the new regulations. This will likely lead to increased compliance requirements and operational changes for fintech companies operating in Germany.