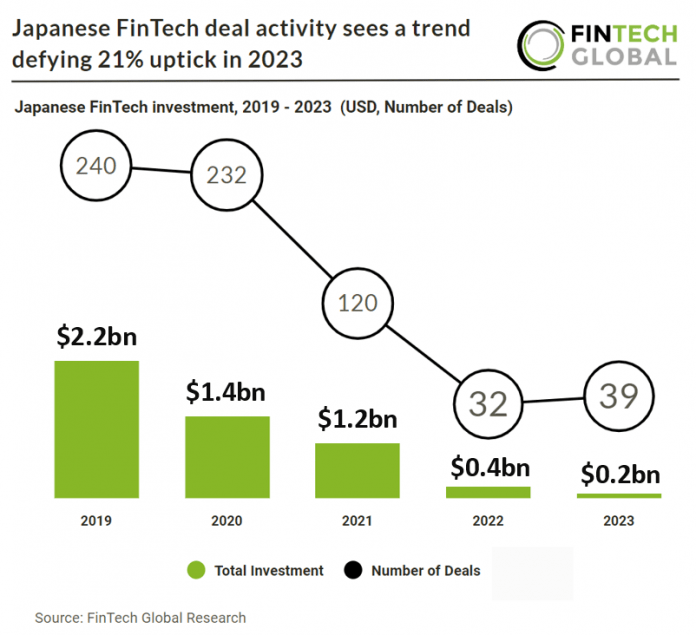

Japanese FinTech investment stats in 2023:

• Japanese FinTech investment totalled at $212m in 2023, a 52% drop from 2022

• Japanese FinTech deal activity reached totalled at 39 deals in 2023, a 21% increase YoY

• The average FinTech deal size in 2023 was $5.4m, a 55% drop YoY

In 2023, Japanese FinTech investment saw a significant decline, dropping to $212m, marking a substantial 52% decrease compared to the previous year, 2022. However, despite this decrease in investment, the Japanese FinTech sector exhibited resilience in terms of deal activity, with a total of 39 deals recorded for the year. In 2023, the average FinTech deal size witnessed a significant decline, plummeting by 55% compared to the previous year, reaching just $5.4m.

Funds, an online marketplace for lending funds, had the largest Japanese FinTech deal in in 2023 after raising $26.7m in their latest Series D funding round, led by Anri. Currently, Funds’ registered user base has reached 73,000, surpassing 280 public funds, and the cumulative amount raised has exceeded 30 billion yen. In terms of fundraising accomplishments, Money Forward Co., Ltd. has successfully launched the “Money Forward Fund ME Fund #1” and fully achieved its target of soliciting 1 billion yen through an application-based approach. Among the growth-oriented startups aiming to become publicly traded companies, Gojo & Company Co., Ltd., operating in the microfinance sector, has raised a cumulative total of 1.3bn yen as of the end of February 2023, providing direct debt to fulfil the capital requirements for their growth.

The fourth meeting of the EU-Japan Joint Financial Regulatory Forum occurred in Brussels on October 23 and 24, 2023. Discussions centred on the impact of the current financial and economic landscape, including rising interest rates and geopolitical developments such as Russia’s aggression against Ukraine, on the global financial systems of the EU and Japan. Participants also addressed regulatory and supervisory matters, spanning sustainable and digital finance, banking, insurance sectors, and potential closer cooperation in international forums. The forum was chaired by Ms. Alexandra JOUR-SCHRÖDER from the European Commission and Mr. MIYOSHI Toshiyuki from Japan’s Financial Services Agency (FSA). Key discussions included trends in global and regional financial services, sustainable finance developments, digital finance, Basel III reforms, crisis management and deposit insurance frameworks, insurance standards, asset management, and LIBOR replacements. Participants pledged to continue engaging on these topics and others of mutual interest leading up to the next Forum meeting scheduled for Tokyo in 2024.