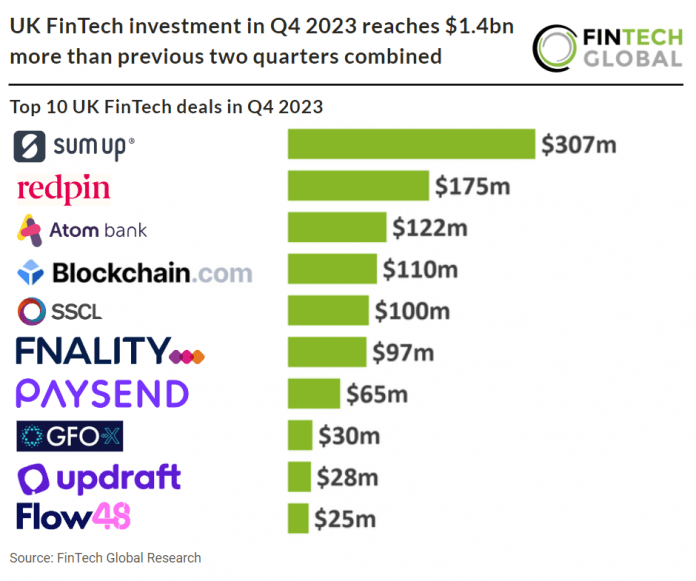

Key UK FinTech investment stats in Q4 2023:

• UK FinTech deal activity totalled at 72 deals a 56% reduction from Q4 2022

• UK FinTech companies raised a combined $1.4bn in Q4 2023, a 9% increase YoY

• WealthTech was the most active Fintech subsector in Q4 2023 with 19 deals, a 26% share of total deals

The UK’s FinTech sector has seen a remarkable recovery in terms of investment during Q4 2023 with the total surpassing the previous two quarters combined. In Q4 2023, UK FinTech deal activity amounted to 72 deals, representing a 56% decline compared to Q4 2022. UK FinTech companies collectively secured $1.4bn in funding during Q4 2023, marking a solid 9% YoY increase. It is also notable that there were five deals that surpassed $100m.

Sumup, a point of sale technology provider, had the largest UK FinTech deal during Q4 2023, after raising $307m in their latest Venture round, led by Sixth Street. The funding will be used to broaden its global presence and enhance its array of financial products and services for its four million small business customers. The recent infusion of growth funding comes on the heels of SumUp securing a $100 million credit facility from Victory Park Capital in August. This initial funding injection was intended to support the launch of a cash advance product aimed at merchants in the UK and Europe. The latest funding round comprises a blend of equity and debt, although SumUp has not disclosed the specific breakdown. Notably, the company’s valuation remains at €8 billion, as it was in June 2022. This financing round arrives following a year marked by significant progress for SumUp. The company has achieved positive EBITDA since the fourth quarter of 2022 and reported impressive year-over-year revenue growth exceeding 30%.

WealthTech was the most active FinTech subsector in Q4 2023 with 17 deals, a 26% share of total deals. This was followed by RegTech which had 13 deals, a 18% share of deals and Lending Technology was third with 11 deals.

The UK’s Treasury has plans to introduce legislation in early 2024 for Buy-Now Pay-Later (BNPL) after a consultation concluded in April 2023 . The proposed regulations involve removing the exemption for interest-free agreements repayable in 12 or fewer instalments within 12 months when the lender is a third party, while introducing new exemptions for insurance contract financing, social landlords providing finance to tenants, and employee loan arrangements. There will be no exemption for BNPL products under £50, but a “business use” exemption will apply. Meanwhile, the FCA is taking action to address concerns in the growing BNPL sector, recently using its powers against potentially unfair terms in unregulated BNPL contracts issued by PayPal and QVC, emphasizing the importance of consumer protection, especially for frequent BNPL users facing financial difficulties.