Key FinTech investment stats in India, Q3 2023:

• Indian FinTech deal activity reached 43 transactions in Q3 2023, a 63% decrease YoY

• Indian FinTech companies raised a combined investment of $654m in Q3 2023, a 39% drop from Q3 2022

• Lending Technology was the most active FinTech subsector in India during Q3 2023 with 10 deals, a 23% share of all investments

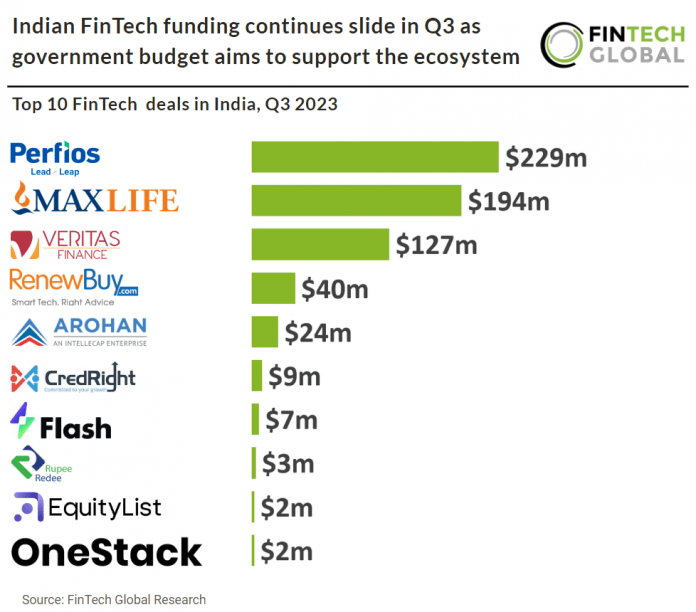

India’s FinTech sector has, like many other countries in 2023, seen a significant drop in both deal activity and investment although India has three deals over $100m in 2023. This is notable as Europe as a whole saw no deals over $100m announced in Q3 2023. In Q3 2023, the number of Indian FinTech deals dropped significantly by 63% compared to the same period last year, totalling 43 deals. During Q3 2023, Indian FinTech firms secured a collective investment of $654, marking a 39% decline when compared to their Q3 2022 funding figures.

Perfios, which offers credit decisions, analytics, and onboarding automation services, had the largest FinTech deal in India during Q3 2023, after raising $229m in their latest Series D funding round, led by Kedaara Capital. With the funding, which includes both primary fundraising and a secondary sale, Perfios intends to extend its global footprint by establishing a presence in North America and Europe, in addition to its current markets in the Middle East and Southeast Asia. Furthermore, the company has strategic plans to allocate resources towards enhancing its technology stack and elevating its decision analytics SaaS offerings, with the aim of improving the overall customer experience and “reduce complexities”. Sabyasachi Goswami, CEO of Perfios, says: “This investment will help us in strengthening the digital transformational journey of our partners, thereby powering financial inclusion and providing access to financial services to billions across the globe.”

In the 2023-2024 financial budget, the Indian Government allocated INR 1,500 crores for FinTech and banks. Earlier, they had announced an incentive of INR 2,600 crore to promote Unified Payments Interface transactions (UPI) for FinTech startups and banks. Additionally, measures were introduced to encourage investments in tech, FinTech, and startups in India, along with tax-related relaxations such as extending timelines for funds relocation to IFSC GIFT City until March 31, 2025. Furthermore, the IFSCA introduced an incentive scheme to facilitate market access for domestic and foreign FinTechs to IFSCs in India and overseas markets.

Lending Technology was the most active FinTech subsector in India during Q3 2023 with 10 deals, a 23% share of deals. Blockchain & Digital assets and RegTech were the joint second most active subsectors in India with eight deals each, a 18.6% share of deals.