Key FinTech investment stats in Africa during Q3 2023:

• African FinTech deal activity reached 51 transactions in Q3 2023, a 28% drop YoY

• African FinTech investment reached $38m in Q3, a 89% decline from the same quarter in 2022.

• Nigeria remained the most active FinTech country in Africa with 12 deals

Africa’s FinTech sector has seen a drop in both investment and deal activity during Q3 2023 although the number of deals has dropped significantly less than the global average. In Q3 2023, the number of African FinTech deals dwindled to 51, marking a significant 28% YoY decline. This being said the global average for FinTech deals dropped 48% over the same period. In Q3 2023, African FinTech funding amounted to $38 million, representing an 89% decrease compared to the levels seen in Q3 2022.

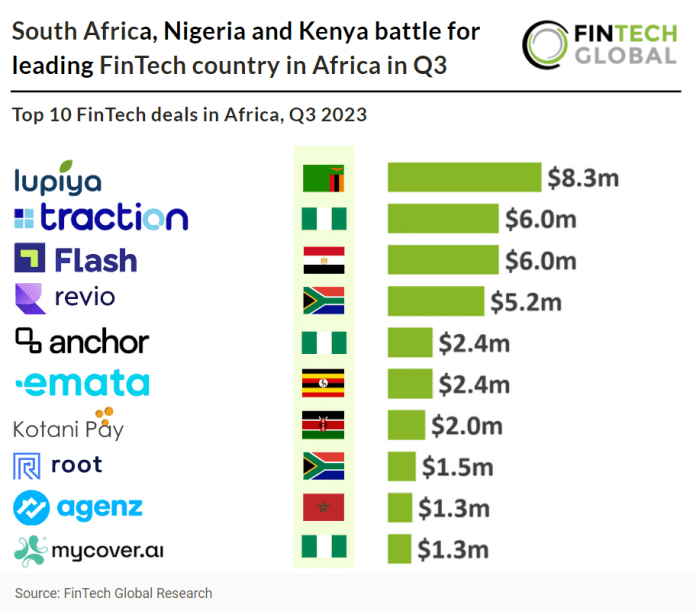

Lupiya, a marketplace for micro-loans, had the largest Fintech deal in Africa during Q3 2023 after raising $8.3m in their latest Series A funding round, led by Alitheia IDF. This was also notably Zambia’s only FinTech deal during Q3 2023. The capital raised by Lupiya will be employed to bolster its technological infrastructure, broaden its suite of financial offerings, and extend its operations, thereby enabling the FinTech startup to cater to a wider customer demographic. Speaking on the funds raised, Co-Founder and CEO of Lupiya Evelyn Chilomo Kaingu said, “This Series A investment marks a significant milestone in our journey to continue serving our customers and the opportunity to further provide holistic financial solutions. The team at Lupiya has worked hard and is excited about the new phase of our growth. With the support of Alitheia IDF, INOKS Capital, Mastercard, and Kfw DEG, we are better poised to scale our operations and deepen our footprint not just in Zambia but also in the broader Southern and East African region.”

Nigeria remained the most active FinTech country in Africa with 12 deals, a 23.5% share of deals. This was closely followed by South Africa with 11 deals, a 21.6% share of deals and Kenya also closely followed this with 10 deals, a 19.6% share of total deals.