Diesta, the London-based InsurTech startup, has successfully closed a seed funding round, raising $1.9m.

This fresh capital infusion comes from a consortium of high-profile international venture capitalists, including Restive, SixThirty, Antler, SystemaNova, and Westerly Ventures. These investors are renowned for their focus on fostering financial technology innovation globally, with a particular emphasis on FinTech and InsurTech enterprises.

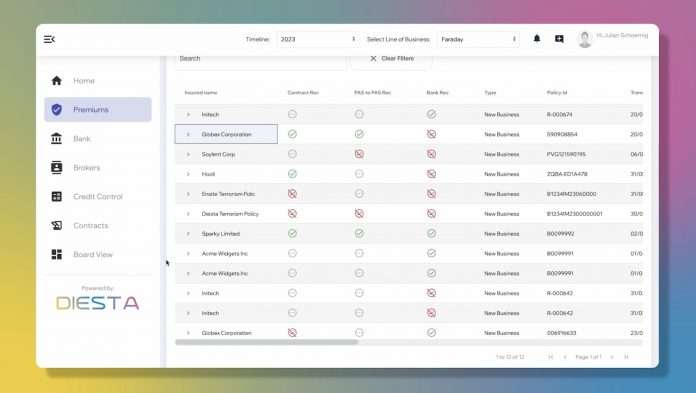

At its core, Diesta is pioneering a premium payments platform set to overhaul the insurance industry’s financial operations. The industry is currently beleaguered by a costly inefficiency, wasting an estimated $32bn annually in the allocation of premium payments along the distribution chain. Diesta’s platform promises a centralised engine that aims to cut these costs by a staggering 75%, heralding significant savings for insurance and broking companies alike. The solution has already garnered endorsements from sector heavyweights such as Mapfre and Generali.

The newly raised funds are earmarked for the enhancement of product development and the scalability of Diesta’s platform. The strategic goal is to secure a substantial share of the UK premiums market by integrating brokers, MGAs, insurers, and possibly reinsurers into their system.

In the backdrop of a challenging tech landscape, InsurTech startups like Diesta have shown tenacity, continuing to attract investment. Industry analyses reflect a burgeoning $7trn opportunity, with an accentuated focus on operational efficiency within the sector.

Diesta’s Co-Founder Julian Schoemig shared, “With Diesta, we are addressing a problem which I experienced first hand and thousands of insurance entities continue to face on a daily basis. This is an example of a legacy industry practice that is costing insurance companies millions every year. Our platform provides a solution which directly addresses this challenge, while setting the foundation for a transformative shift in insurance industries in Europe and around the world.”

Expressing confidence in Diesta, Ryan Falvey, Partner at Restive, said, “We were thrilled to lead Diesta’s early financing. We know how challenging payment reconciliation is in the global insurance industry and were extremely impressed by the expertise, dedication and technological sophistication of the team. Restive invests early in innovative businesses that have the potential to transform financial services so we are proud to work with Julian and the team to scale this business.”

The founding members of Diesta, Julian Schoemig and Christopher Davis, met during an Antler residency in London, melding a vast array of expertise from the insurance, banking, and tech startup realms. Schoemig, a German engineer, boasts a formidable resume with experience at Munich Re across various geographies, while Davis, a South African IT security and database expert, brings a track record of scaling and exiting two IT firms, along with experience at Discovery Bank.

Reflecting on the investment, Ollie Purdue, Partner at Antler, remarked, “The success of British fintech startups has become the stuff of legend in tech ecosystems around the world and I have every confidence that insurtech will be the next chapter of that growth story. Diesta is at the forefront of a new generation of insurtech talent emerging in London and they have the potential to become one of the most important players in this space. We are delighted to have supported Diesta from day zero of their growth journey and have every confidence in the future growth of this team.”

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global