Each week the US records the most FinTech deals, often accounting for more than half of deals recorded on any given week. However, with the Thanksgiving break, the US was notably quiet with just one deal closed.

Without the US, it meant it was a very small week for FinTech. There were just 14 deals closed and a total of $103.5m was raised. To compare to the previous week, there were 24 reported funding rounds, collecting a total of $762m. Even more shocking is how strong November started, with the first week seeing $1.3bn raised across 27 deals. One thing both of these week’s had in common was a strong performance from the US in terms of deal activity.

Back to this week’s funding rounds, the UK took the top spot for deals and funding. It housed five deals and accounted for $50.6m of the total capital invested during the week. UK-based marketplace lending company TRIVER housed the biggest deal, attracting $25.2m to support its short-term working capital loans.

The other UK-based companies securing funds this week were PayTech Crezco, WealthTech DoorFeed, RegTech Smarter Contracts and WealthTech WealthOS.

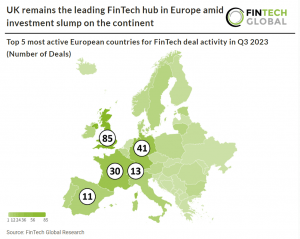

The UK has been the main FinTech hub in Europe and a recent report from FinTech Global found this is still the case. During Q3 2023, there were 233 FinTech deals across Europe, a 56% drop year-on-year. Similarly, the amount of capital invested has declined. A total of $1.24bn was invested during the quarter, which is a 72% reduction from the same period in 2022.

During Q3, the UK was home to over a third of all deals, accounting for 85 funding rounds. It was followed by Germany, which recorded 41 deals, and France, which housed 30 deals.

Spain was the only other country to record more than one deal this week, one of these was marketplace lending company ID Finance, which closed the second largest investment of the week. The other Spanish FinTech this week was marketplace lending startup Fence.

The other countries represented this week were India (PayTech company Kiwi), Nigeria (PayTech startup FrontEdge), France (infrastructure and enterprise software developer HappyPal), Israel (CyberTech startup Lasso Security), Italy (RegTech company Aptus.AI), Canada (PayTech startup Peloton Technologies) and US (PayTech service provider AppBrilliance). Notably, AppBrilliance did not disclose the size of the funding round.

In terms of sectors, it proved a popular week for PayTech. Of the 14 deals to close, five of these were within the PayTech space. This was followed by marketplace lending with three deals, WealthTech and RegTech with two, and CyberTech and infrastructure and enterprise software with one.

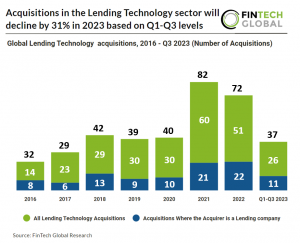

A recent report from FinTech Global noted that the number of acquisitions within the lending technology sector is looking to decline by 2023, based on the first three quarters. Lending Technology acquisitions are expected to reach 49 deals in 2023 based on the first the quarters of 2023, a 31% reduction from 2022 levels. Lending companies accounted for 30% of Lending Technology acquisitions in Q1-Q3 2023, no change from 2022 figures.

As people look to take advantage of the Black Friday sales, an interesting study from Creditspring claimed that 16 million people in the UK are still oblivious to the fact that using ‘Buy Now Pay Later’ (BNPL) services can lead to significant debt.

Without further ado, here are the 14 FinTech funding rounds we covered this week.

TRIVER secures £20m ($25.2m) from Avellinia Capital to revolutionise UK SME financing

TRIVER, a SME working capital provider, has successfully raised a significant £20m in a new funding round.

This substantial sum was sourced from the Luxembourg-based Avellinia Capital, according to a report from IBS Intelligence. The deal, involving a £20m debt facility, is poised to enable TRIVER to offer over £200m of funding annually.

TRIVER leverages innovative open banking data and AI to meet the short-term working capital needs of small businesses. The company stands out by instantly and automatically underwriting the risk associated with small business borrowing. This efficient approach allows TRIVER to provide advances on a business’s client invoices around the clock, offering a faster and more accessible alternative compared to traditional high street banks.

Jerome Le Luel, Founder & CEO of TRIVER, commented on the company’s philosophy and operational strategy. “The vast majority of SMEs we interact with are willing to grant us access to their bank data via Open Banking. They are familiar with this tool because it is commonly used with their accounting software. They see the benefit of a simpler process than manually providing bank statements and other data. Nor do they have to make personal guarantees when applying to us.”

TRIVER’s future goals include significantly reducing the time taken to open a new facility and advance an invoice, aiming for less than 10 minutes and 1 minute respectively. This ambition highlights a stark contrast to the traditional banking process, which can take up to four weeks for facility opening and 24 hours for invoice advancement.

ID Finance secures landmark €12m ($13.1m) credit line to boost Spain’s consumer lending

ID Finance, a prominent FinTech company, has achieved a significant milestone by securing a €12m credit line from a listed bank.

The financing agreement is set to bolster ID Finance’s consumer lending operations in Spain, where it has already established a strong presence with over two million unique registered users. This move is expected to solidify ID Finance’s standing as the top alternative lending brand in the Spanish market.

ID Finance’s journey to this point has been marked by impressive financial achievements. The company reported a revenue of €132m for the first nine months of the year, underpinned by a record high in credit originations which reached €282m. The Spanish consumer lending segment has played a crucial role in the group’s overall success, contributing €7.3m in net profit in the first nine months of 2023. Notably, credit issuance in Spain was a significant portion of this, amounting to €191m.

Reflecting on this landmark deal, ID Finance co-founder Boris Batin expressed his enthusiasm. “This is our first financing agreement with a renowned banking institution, which is not just a testament to ID Finance robust financial standing but also a beacon of trust and confidence in our business model. As ID Finance continues to navigate the dynamic fintech landscape, this partnership is poised to unlock a new path for growth and innovation, further cementing our position as a market leader.”

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global

FinTech innovator Kiwi garners $13m in latest investment

Virtual credit card platform Kiwi, a Mumbai-based startup, has successfully completed a Series A funding round on $13m.

The round was spearheaded by Omidyar Network India and saw contributions from earlier investors Nexus Venture Partners and Stellaris Venture Partners, according to a report from entrackr.. This marks Kiwi’s second major funding event in 2023, following a $6m maiden funding round led by Nexus and Stellaris in May.

Kiwi specialises in providing innovative financial solutions, primarily through its virtual credit card platform. The company was founded by Siddharth Mehta, Mohit Bedi, and Anup Agarwal.

Although Kiwi has not publicly disclosed its valuation, entrackr cites sources close to the matter that suggests it had a post-Series A valuation between $70-80m.

The firm has ambitious plans for the fresh capital. Kiwi intends to introduce new products over the next year, including no-cost equated monthly instalments (EMI) on UPI and a credit line on UPI, sanctioned by the National Payments Corporation of India (NPCI). The company has already forged a partnership with Axis Bank and is looking to collaborate with two more major banks within the next six months.

UK FinTech firm Crezco lands $12m for B2B payment solution

Crezco, a UK-based FinTech company, stands at the forefront of revolutionising B2B (business-to-business) invoice and bill payments.

By harnessing the power of open banking, Crezco aims to make B2B transactions as seamless and convenient as consumer-oriented card payments. This innovative approach has not only garnered attention but also substantial financial backing.

Recently, Crezco has triumphantly secured $12m in a Series A funding round. This significant investment was led by MMC Ventures and 13books capital, both of which are well-known for their keen interest in FinTech ventures. This infusion of capital marks a pivotal moment in Crezco’s growth trajectory.

At its core, Crezco is dedicated to simplifying the B2B payment process. The company leverages an advanced account-to-account (A2A) payments API, fundamentally altering how businesses manage their transactions. Crezco’s collaboration with Xero, a global small business platform, is a testament to their technological prowess. By integrating Crezco’s technology, Xero will soon offer on-platform bill payments in the UK, a first for any major small business cloud accounting software in the region.

The implementation of this solution promises to streamline bill management and payment processes for small businesses. By staying within Xero’s platform, these businesses can handle their financial transactions with unprecedented ease and security. Crezco’s use of open banking technology is key in achieving this convenience, representing a significant shift from traditional payment methods to more efficient, digital solutions.

Amidst the backdrop of economic uncertainties, Crezco’s innovative approach offers a ray of hope. According to a recent report by Xero, about half of the UK’s small businesses are concerned about their financial future. Crezco’s technology, integrated within Xero’s new bill payments feature, could play a crucial role in helping these businesses gain a clearer insight into their cash flows.

The firm sets itself apart in the open banking landscape by focusing on the B2B sector, prioritising user experience over cost savings alone. Ralph Rogge, Founder and CEO at Crezco, emphasises this strategy, stating, “A2A payments allow Crezco’s partners to move the point of payment from the bank to their platform. This is not just a domestic transfer solution. We connect real-time payments everywhere, and it’s one of the most obvious examples of embedded payments.”

Nigerian startup FrontEdge bags $10m for trade finance growth

Nigerian trade finance startup FrontEdge, a company focused on facilitating cross-border trades for African SMEs, has raised a substantial $10m in a mix of debt and equity funding.

FrontEdge intends to utilise the $10m to expand its reach and deepen its impact across the African continent, according to a report from Disrupt Africa. By doing so, the company aims to facilitate the growth of African cross-border trade, providing SME exporters and importers with the necessary capital and expertise to achieve scale.

The funding round was led by TLG Capital and included participation from Flexport.

At its core, FrontEdge is dedicated to empowering exporters and importers in emerging markets. Founded in 2021 by Harvard MBA graduate Moni Alli, the startup offers a blend of working capital solutions and advanced software tools. These services are tailored to meet the unique needs of SMEs engaged in cross-border trade, aiming to enhance their competitiveness on the international stage.

FrontEdge founder Moni Alli commented on the company’s mission, stating, “SMEs are the cornerstone of our economies and the export market presents a significant opportunity for small and medium sized African businesses. However, from Lagos to Mombasa, business owners are constrained by an inability to finance their exports as well as a lack of support at every stage of the export process. FrontEdge was founded to address both challenges through a seamless technology platform tailored to cross-border traders.”

TLG’s Johnnie Puxley shared his enthusiasm for the partnership, saying, “TLG is proud to support FrontEdge in its mission to help African SMEs prosper, serving as a crucial conduit to provide access to capital for Africa exporters and financial empowerment. FrontEdge is strategically placed to tackle an important problem that must be solved for African traders to effectively engage in global trade and we believe that the leadership will execute on the vision.”

HappyPal secures €7m ($7.6m) in Series A funding to revolutionise employee benefits

HappyPal, a pioneering FinTech company, has recently announced a significant milestone in its journey. This mobile-first solution is changing the landscape of employee benefits, offering a digital and personalised approach to access benefits for the entire workforce.

The company has successfully raised €7m in a Series A funding round. This impressive financial boost was led by Educapital, with continued support from existing investor Anthemis. This funding represents a significant endorsement of HappyPal’s innovative approach to employee benefits.

At its core, HappyPal is revolutionising the way employee benefits are managed and accessed. Launched in 2019, the company targets the uneven access to employee benefits, particularly for deskless workers who make up a substantial portion of the global workforce. HappyPal’s mobile-first strategy ensures that benefits are accessible to all, regardless of their location or tech-savviness.

The funds raised will be utilised to further enhance HappyPal’s technology and expand its reach. The company aims to bridge the gap in employee benefits access, focusing on the financial well-being of workers. This investment will help HappyPal in its mission to provide seamless, digital access to culture and entertainment for employees, thereby improving their engagement and job satisfaction.

Additional information from the press release highlights HappyPal’s significant traction in the market. The company has already garnered a user base of over 200,000 employees across 1,000 SMBs and large enterprises. Notable clients include RATP, Toyota, Doctolib, and Meta. HappyPal’s user-centric approach, coupled with strong customer support, has led to impressive usage statistics, such as a rise from 27% to 87% in one of France’s largest ERCs.

DoorFeed secures €7m ($7.6m) in seed extension for innovative real estate investment platform

DoorFeed, a pioneering company in the real estate investment sector, recently secured a significant €7m in a seed extension funding round.

The round was led by Motive Ventures, according to a report from TechCrunch. Notably, Stride VC and Seedcamp also participated in this funding round, marking a substantial milestone for the company.

Founded by James Kirimy, an early Uber UK employee, DoorFeed has made its mark by offering a unique platform for managing large-scale real estate investments.

DoorFeed is essentially a comprehensive data platform that facilitates the assembly and management of large-scale portfolios of apartments and houses for investment funds. It stands out by enabling investors to identify properties with poor energy performance and then renovate them. This not only improves the properties but also potentially unlocks ESG credits from governments, as the company claims.

Additionally, DoorFeed had previously raised €3.5m in a seed round led by Stride and Seedcamp in 2021, and a €1.5m debt financing from BPI France in 2022.

Lasso Security bags $6m in seed funding to advance LLM cybersecurity

Lasso Security has emerged from stealth mode and announced a significant milestone in its growth journey of $6m.

According to Help Net Security, the investment was led by Entrée Capital, and featured the participation of Samsung Next, marking a strong vote of confidence in Lasso Security’s innovative approach to cybersecurity.

Lasso Security has carved out a unique niche in the burgeoning field of cybersecurity, especially in relation to Large Language Models (LLMs) and Generative AI. The company is setting new standards in the industry by safeguarding every touchpoint involving these advanced technologies. This approach ensures comprehensive protection for businesses leveraging these rapidly evolving digital innovations.

The newly acquired funds are earmarked for strategic growth initiatives. Lasso Security plans to expand its team and further enhance its cybersecurity offerings. This investment will enable the firm to scale its operations and continue its mission of providing top-tier security solutions.

At the core of Lasso Security’s mission is a commitment to equipping pioneers in the Gen AI and LLM space with state-of-the-art security solutions. The company is addressing a range of sophisticated and evolving cybersecurity threats. These include challenges such as model theft, malicious code generation, prompt injection, and data poisoning, among others. Lasso Security also offers essential oversight in areas like sensitive data disclosure and provides real-time guidance on the safe use of LLM-based workplace tools.

Blockchain-based data privacy innovator Smarter Contracts bags £2.65m ($3.3m) funding

Smarter Contracts, a leading innovator in the blockchain-based data privacy sector, secured £2.65m in equity funding.

The UK-based tech company secured the funding through one of their existing private investors. This investment comes on the heels of an earlier announcement, less than five months ago, about Smarter Contracts receiving over $1m in equity investment. The continuous financial support is a testament to the confidence investors have in the team, their market traction, and the quality of their products and services.

With this new injection of funds, Smarter Contracts aims to significantly bolster its development and design capabilities. The primary focus will be on enhancing the product features of Pulse®, catering to the increasing demands of their growing customer base and pipeline. Key initiatives include extending the functionality of the smart contract underpinning the Pulse® protocol and integrating Pulse® with generative AI. This latter project is in collaboration with Elder Research, a respected AI and Data Science company, which took a minority stake in Smarter Contracts back in February 2021.

Pulse® is hailed as a “proof-of-permissions protocol,” addressing a critical need in today’s data-driven world. Organisations often struggle with managing how their customer data, both on-chain and off-chain, is shared and used by various stakeholders. Pulse® offers a solution by providing a real-time view of the data permissions an organisation holds, ensuring compliant data sharing and usage, thus fostering trust and enabling more relevant product and service offerings through compliant personalisation and analytics.

Smarter Contracts’ Founder and CEO, Wayne Lloyd, expressed his pride and gratitude for the investment, stating, “I’m extremely proud that we’re able to announce this investment into Smarter Contracts. My team deserves all the accolades given how much hard work and commitment they have put into building a world-class product that solves real problems in relation to data and data privacy.

“The problems we saw in 2019 have manifested as we expected and the future we saw back then has arrived. I’m delighted we’re arriving at this point with the right product, the right team, favourable regulatory conditions that support the need for a solution like Pulse® and the funding we need to scale. It marks a very exciting moment in the company’s history, and I would like to take this opportunity to thank our investors for believing in the team and the vision we have”

RegTech innovator Aptus.AI raises €3m ($3.2m) to revolutionise legal document handling

Aptus.AI, a pioneering RegTech startup based in Pisa, has successfully closed a pre-Series A funding round, securing €3m.

The round was led by Programma 103 by VC P101 Sgr. Fin+Tech, an accelerator from CDP Venture Capital, also played a significant role, contributing to the round and reaffirming its support from a previous investment.

Aptus.AI is redefining the way large organizations, particularly banks and insurance companies, engage with legal documents. The startup’s innovative approach transforms these documents into interactive, machine-readable formats, thereby streamlining compliance and risk management processes. This technology not only enhances operational efficiency but also turns compliance into a strategic business advantage.

The €3m injection will be instrumental in furthering Aptus.AI’s mission. Its flagship product is Daitomic – a groundbreaking platform that revolutionizes the accessibility and usability of legal documents. Daitomic enables users to seamlessly navigate regulatory landscapes, compare legal texts across different versions, and simulate potential regulatory impacts.

Aptus.AI’s journey began with the creation of their transformative technology, developed by co-founders Andrea Tesei and Lorenzo De Mattei. The company’s successful pilot application, launched in late 2021, garnered immediate attention for its innovative approach to compliance management. Following this, a seed round in 2022 allowed Aptus.AI to expand its solution, catering to the complex needs of major financial institutions.

Barclays leads WealthOS to secure £2m ($2.5m) seed funding

WealthOS, a cloud-native and API-driven core WealthTech firm has secured £2m in institutional seed funding round led by Barclays.

The initial closing of this seed funding round amassed £2m, with an additional £2m anticipated in an imminent second closing.

Barclays Bank, along with other significant investors such as Singapore-based VC fund nVentures, Chris Adelsbach from Outrun Ventures and Techstars, and John Donohoe, CEO of Carne, actively participated in this funding round. Notably, existing investors like Mike O’Brien and John Herlihy also continued their support for WealthOS.

WealthOS specialises in delivering technology for various critical functions in wealth management, including compliant client onboarding, portfolio management, trading, settlement, reconciliation, and more.

The company’s approach, leveraging cloud-native technology and CI/CD methodologies, aims to significantly reduce infrastructure and running costs for organisations while offering scalable and secure solutions.

Recently, the company introduced the UK’s first cloud-native, API-driven self-invested personal pension (SIPP) drawdown technology, aimed at offering fully digital retirement propositions to clients of DC pension providers.

Peloton Technologies boosts SME payment services with $2m investment

Peloton Technologies, a pioneering Canadian FinTech company, has successfully completed its late seed funding round, raising a notable $2m.

The $2m investment, garnered from a collective of private investors with expertise in various fields including payments, banking, and risk management, marks a crucial phase in Peloton’s development. The diverse background of the investors provides not only capital but also valuable industry insight and support.

At its core, Peloton Technologies is dedicated to transforming the payments landscape for Small and Medium Sized Enterprises (SMEs) in Canada. Established in 2011, the company has been at the forefront of simplifying complex payment workflows that SMEs often encounter. Peloton’s platform is renowned for accommodating a broad spectrum of payment needs, setting a new standard in the market.

The newly acquired funds are earmarked for strategies that will accelerate Peloton’s growth trajectory. Specifically, the capital will be instrumental in driving the company’s acquisition strategy, which includes the integration of Independent Sales Organizations (ISOs) into their operations. This expansion is aimed at enhancing Peloton’s client base and sales capabilities, thereby facilitating the delivery of their innovative payment solutions.

Peloton Technologies Executive Chair of the Board, John MacKinlay said, “We’re thrilled with the response from the Private Investor community. We have a world-class group of investors with deep background in payments, banking, risk management, compliance, accounting, IT architecture, and securities law.

“This capital is instrumental to our acquisition strategy and a catalyst to our organic growth initiatives. It’s a precursor to a larger capital raise planned for Q1/Q2 of 2024.”

Spanish startup Fence attracts €1.8m ($1.9m) for transforming debt operations with blockchain

Madrid-based FinTech company, Fence, has raised €1.8 million in its pre-seed financing round.

The round was led by Semantic.vc and saw participation from various venture capital firms including Crane Earth, Actyus, and a group of prominent business angels, according to a report from EU-Startups.

The funding round was oversubscribed, receiving four million commitments. This strong investor interest underscores the potential of Fence and its innovative approach in the FinTech sector.

The new capital will be strategically utilised for further development and technology enhancements. Additionally, it will support the expansion of Fence’s operations across Europe, catering to banks, private debt funds, and other FinTechs. To support its ambitious global expansion plans, the company aims to double its Madrid-based team by the end of the year.

Founded in 2023 by Juan Montero, Ignacio Rosario, and Gonzalo Bandeira, Fence has rapidly established itself as a key player in transforming debt management. Its technological prowess was recently showcased in facilitating a significant financing agreement of up to €20m between BBVA Spark and Payflow.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global