A survey conducted by Finastra has shed light on the changes and investment trends in the financial services industry, despite prevailing economic constraints.

According to FinTech Finance, the survey canvassed opinions from 956 professionals across various global financial institutions, including banks in France, Germany, Hong Kong, Singapore, Saudi Arabia, the UAE, UK, US, and Vietnam, between August and September 2023.

The findings reveal a significant level of enthusiasm among decision-makers in financial institutions about the rapid technological and cultural changes within the industry. An overwhelming 87% of respondents expressed excitement about the current pace of change, with 83% optimistic about the opportunities it presents for their institutions, and 81% for the wider financial services sector.

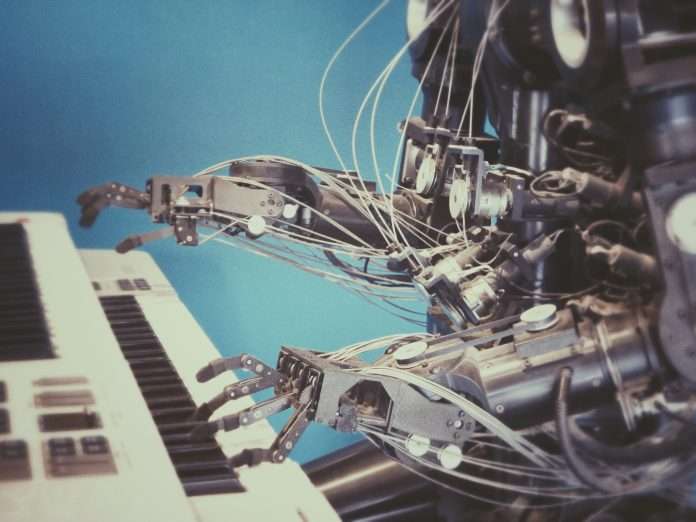

A key highlight of the survey is the growing focus on artificial intelligence (AI), particularly generative AI. Compared to 2022, there’s been a notable increase in AI deployment and capability enhancements, with 37% of respondents indicating their institutions improved or deployed AI technology in the last year.

Generative AI stands out, with 83% of decision-makers showing interest and 26% having already incorporated it in some form. This technology is primarily seen as a tool for meeting the rising demand for personalised customer services and for specific tasks like ESG criteria classification and data analysis for KYC and AML compliance.

The survey also points to an increased uptake of Banking as a Service (BaaS). Nearly half of the institutions surveyed (48%) have either deployed BaaS or enhanced their capabilities in this domain over the past year, marking a significant rise from the 35% in 2022. The most common applications include buy now pay later schemes, embedded lending, and cross-border payments.

Despite the current economic climate putting a damper on tech investments, with 78% acknowledging this impact, there remains an optimistic outlook. A majority (69%) expect their investments to fully resume by the first half of 2024. Additionally, the survey underscores a strong belief among financial institutions in Open Finance’s positive impact, with 85% acknowledging its collaborative influence on the industry.

Furthermore, the survey highlights a steadfast commitment among financial institutions to their communities, even amidst economic challenges. A significant 86% of decision-makers affirm that the financial services and banking sector’s role extends beyond mere finance, emphasizing a duty to support the communities they serve.

Finastra CEO Simon Paris said, “Despite the challenging economic climate, it’s clear from our research that investment in AI, BaaS, and embedded finance remain key priorities for financial services organizations over the next 12 months, particularly as they seek to further enhance and personalize the customer experience. We share the industry’s ongoing commitment to ESG initiatives, to collaboration around Open Finance, and excitement in using advanced technologies like AI to help deliver on the opportunities ahead.”

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global