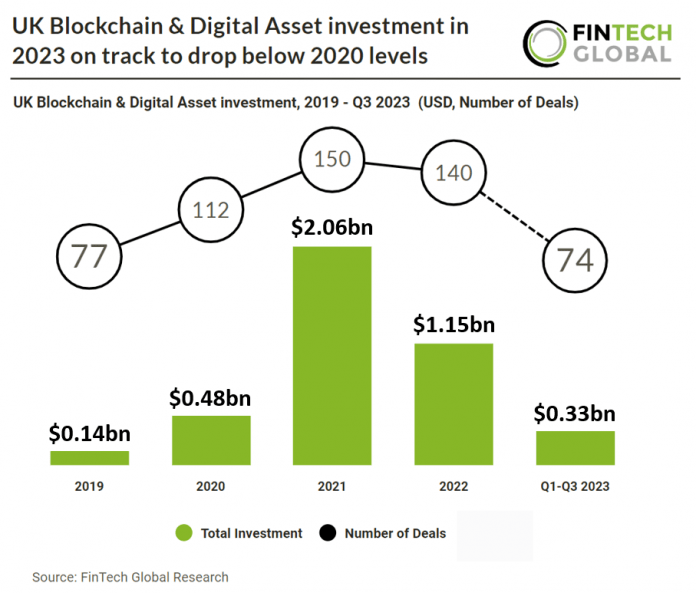

Key UK Blockchain & Digital Asset investment stats in Q1-Q3 2023:

• UK Blockchain & Digital Asset deal activity is on track to reach 97 transactions in 2023, a 31% drop from 2022

• UK Blockchain & Digital Asset investment totalled at $270m in Q1-Q3 2023, a 73% reduction from the same period in 2022

• UK Blockchain & Digital Asset is on track to reach $360m in 2023, a 35% drop from 2020’s levels

In the first three quarters of 2023, UK Blockchain & Digital Asset deal activity and investment fell considerably, signalling a continued drop for the sector. Deal activity in the UK’s blockchain and digital asset sector is projected to hit 97 deals in 2023, marking a 31% decline compared to the previous year. Investment in the UK’s blockchain and digital asset industry reached $270m in the first three quarters of 2023, reflecting a significant 73% decrease compared to the same period in 2022. The total investment in the UK’s blockchain and digital asset space is expected to reach $360m in 2023, indicating a 35% decrease from the levels seen in 2020.

Gensyn, a machine learning compute protocol, had the largest UK Blockchain & Digital Asset deal after it secured a $43m in their Series A funding round, led by venture capital giant a16z. The company plans to utilize the funds to expand its team, complete the development, and subsequently launch its product. Co-founded by Harry Grieve, and Ben Fielding, Gensyn is advancing a Machine Learning Compute Protocol that unites all of the world’s compute into a global supercluster, accessible by anyone at any time. As a P2P network, any device in the world can connect to Gensyn. This includes underutilised devices like consumer GPUs, custom ASICs, and SoC devices which are capable of training neural networks. The protocol aims to disintermediate cloud oligopolists through a pay-as-you-go decentralised ML system, verified by cryptography, to lower the cost of compute.

In October 2023 the UK made plans to introduce regulations for the digital currency sector, requiring authorization for market participants offering services to consumers. This move follows concerns raised after the FTX digital exchange collapse and is in line with rules set by the European Union in June. The regulations will focus on digital assets like Bitcoin and the underlying blockchain technology, with an emphasis on consumer protection, and firms dealing with UK retail consumers will need authorization. The specific start date for these regulations has not been provided. “The government’s position is that firms dealing directly with UK retail consumers should be required to be authorised irrespective of where they are located,” the ministry said.