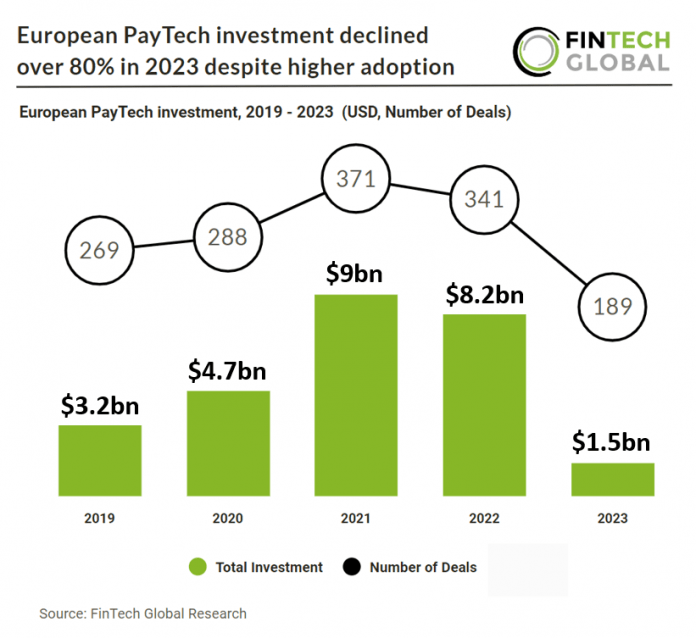

Key European PayTech investment stats in 2023:

• European PayTech companies raised a combined $1.5bn in 2023, a 81% drop from 2022

• European PayTech deal activity totalled at 189 transactions in 2023, a 45% decline from 2022

• The UK dominated European PayTech deal activity with a 40% share of total deals

In 2023, European PayTech companies faced a significant decline as companies raised a collective $1.5bn, representing a 81% drop from the previous year’s figures. The overall deal activity in the European PayTech sector also witnessed a substantial downturn, with only 189 deals completed in 2023, marking a 45% decrease from the levels seen in 2022.

Sumup, a point of sale technology provider, had the largest European PayTech deal during 2023, after raising $307m in their latest Venture round, led by Sixth Street. The funding will be used to broaden its global presence and enhance its array of financial products and services for its four million small business customers. The recent infusion of growth funding comes on the heels of SumUp securing a $100m credit facility from Victory Park Capital in August. This initial funding injection was intended to support the launch of a cash advance product aimed at merchants in the UK and Europe. The latest funding round comprises a blend of equity and debt, although SumUp has not disclosed the specific breakdown. Notably, the company’s valuation remains at €8bn, as it was in June 2022. This financing round arrives following a year marked by significant progress for SumUp. The company has achieved positive EBITDA since the fourth quarter of 2022 and reported impressive year-over-year revenue growth exceeding 30%.

The UK was the most active PayTech country in Europe during 2023 with 75 funding rounds, a 40% share of all deals. Germany was second with 19 transactions, a 10% share of total deals and France was third with 17 deals, a 9% share.

By 2024, the total transaction value in European digital payments is expected to reach $2,194bn, with an anticipated annual growth rate (CAGR 2024-2028) of 8.81%. By 2028, the market is projected to have a total transaction value of $3,076 bn, reflecting the evolving landscape of digital payment adoption within Europe.

Cross-border payments have come under the spotlight recently due to their critical role in global commerce. In the European Union, regulators have been driving the push for instant euro payments, aiming to streamline transactions and stimulate cross-border economic growth. This initiative aligns with the G20 Roadmap’s global efforts to enhance cross-border payment systems and promote greater interoperability. The COVID-19 pandemic has accelerated the digitalization of payments, with over half of organizations worldwide reporting increased use of Automated Clearing Houses (ACH), digital wallets, Real-Time Payments (RTP), and virtual cards, displacing traditional methods like checks and cash. Both public and private payment systems and regulators are recognizing the efficiency and security benefits of these digital platforms, further fueling this transformative trend.