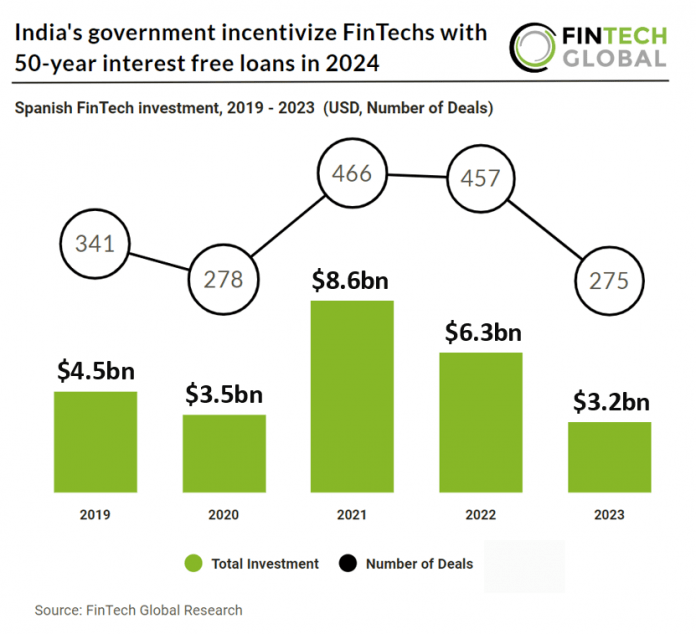

Key Indian FinTech investment stats in 2023:

• Indian FinTech companies raised a combined $3.2bn in 2023, a 49% drop from 2022

• Indian FinTech deal activity totalled at 275 deals in 2023, a 40% drop from the previous year

• Lending Technology was the most active Indian FinTech subsector in 2023 with 58 transactions, a 21% share of total

In 2023, Indian FinTech firms faced a notable decline in their fundraising efforts, collectively securing $3.2bn, which marked a significant 49% decrease compared to the previous year. This downturn was mirrored in the deal activity within the Indian FinTech sector, as the number of deals dwindled to 275, reflecting a substantial 40% drop from 2022.

PhonePe, an Indian payments application, raised the largest amount of funding in India during 2023, raising $850m in total during the year. PhonePe plans to use the funding to enter and scale new businesses such as insurance, wealth management, lending, shopping and account aggregators with the new funding. PhonePe’s most recent update was releasing Share.Market, a stock broking app, which is available as a mobile app or web platform and will enable retail investors and traders to purchase stocks, mutual funds, and ETFs. Established in 2015, PhonePe claims to be India’s largest payments app, catering to both consumers and merchants, serving over 440 million users across the subcontinent. It offers payment services, including bill payments, as well as investments and insurance products.

Lending Technology was the most active Indian FinTech subsector in 2023 with 58 deals, a 21% share of total deals. This was followed by WealthTech with 41 deals, a 15% share of deals and third was RegTech with 39 deals, a 14% share of total deals.

Nirmala Sitharaman’s interim budget for the FinTech sector unveils a promising landscape with a Rs 1 lakh crore ($12bn) fund offering 50-year interest-free loans for tech-driven growth, fostering innovation and potentially intensifying competition in lending. While presenting a stable roadmap for innovation within the financial sector, Budget 2024 brings a mixed bag for FinTech lending and NBFC sectors, with promising initiatives like the DBT scheme and tech-savvy growth funds which contrasts against concerns about fiscal deficit and tighter credit conditions. Key takeaways include a push towards digital transactions for government schemes, amounting to benefits over Rs 2.7 lakh crore ($32.6bn), which could empower technology players offering innovative payment solutions and disrupting traditional banking channels. Additionally, the focus on budgets for skill development, financial inclusion, and youth empowerment promises a more productive workforce, echoing the government’s commitment to initiatives like PM Mudra Yojana and overall financial inclusion efforts.