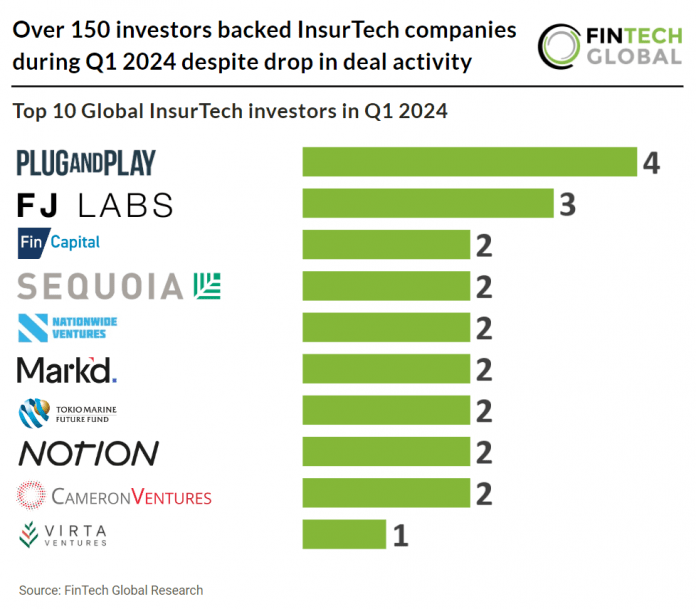

The Global InsurTech sector recorded 75 funding rounds with over 150 investors participating in the first three months 2024. The USA was the most active InsurTech country in Q1 2024 with 41 transactions, a 55% share of total deals. A recent survey conducted by Mercer found that nearly four in ten (39%) insurers view increasing their private markets allocations as a key opportunity in 2024. This shows that the downturn in investments is tightly linked to the general investment landscape rather than lack of innovation by InsurTechs.

Plug and Play, an early stage VC, was the most active InsurTech Investor, globally in Q1 2024, participating in four investment rounds. Plug and Play’s investment strategy in the InsurTech sector, as part of their broader venture capital efforts, is characterized by a highly active, stage-agnostic approach. They focus primarily on pre-seed and seed-stage investments, typically ranging from $100,000 to $150,000 per deal. Examples of their investments in Q1 2024 are Ansel Health, a health insurance platform intended for employers to enhance their employee benefits and Buddy, an insurance gateway for software companies.