Key African FinTech investment stats in Q1 2024:

• African FinTech deal activity reached 40 transactions in Q1 2024, a 40% drop YoY

• African FinTech companies raised a combined $43m in funding during the first three months of 2024, a 88% reduction compared to the same period last year

• Nigeria was the most active African FinTech country in Q1 2024 with 15 deals, a 38% share of all transactions

In the first quarter of 2024, African FinTech saw a significant decline in deal activity, dropping by 40% compared to the previous year. This slowdown was mirrored in fundraising efforts, with companies collectively raising just $43 million, marking an 88% reduction from the same period in 2023.

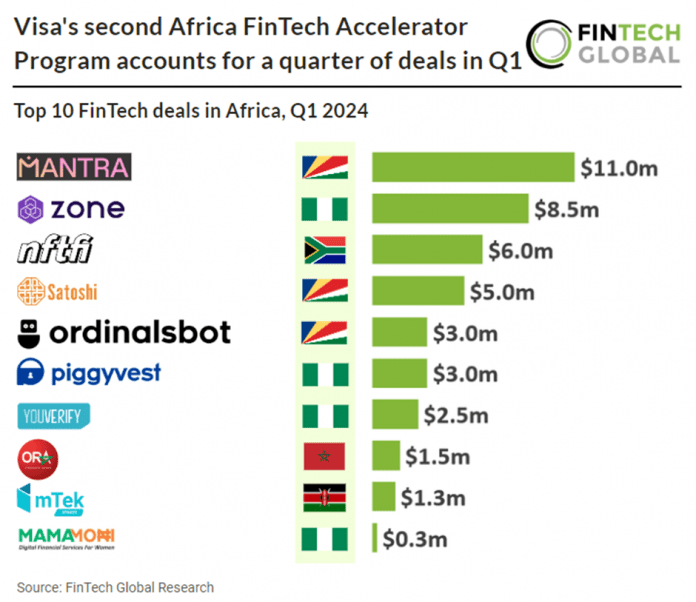

Mantra, a RWA Layer 1 Blockchain for regulatory compliance, had the largest African FinTech deal in Q1 2024 after raising $11m in their Series A funding round, led by Shorooq Partners. Mantra is in the final stages of securing licensures from Dubai’s crypto regulator VARA, founder John Patrick Mullin told CoinDesk. These approvals will be essential in MANTRA’s plans to build and host a suite of compliance-minded tools for issuing and trading RWAs. Plenty of companies in crypto and beyond are betting RWAs will become a multi-billion dollar business by the end of the decade. Much of the trading in “traditional” asset classes that are broadly popular with investors (real estate, stocks, maybe even art) will have to move onto blockchains for this to happen.

Nigeria was the most active African FinTech country in Q1 2024 with 15 deals, a 38% share of deals. Kenya was second with seven deals, a 18% share and Ghana and the Seychelles were joint third with three deals each, a 7% share of deals.

In July, Visa’s Africa FinTech Accelerator program launched, following Visa’s commitment to invest $1 billion in Africa’s digital transformation and its dedication to fostering economic advancement and inclusive growth in the region. The accelerator aims to facilitate the growth of startups through a three-month intensive learning program focused on business expansion and mentorship. Upon completion, Visa will continue to support selected startups through capital investment and aid in their commercial launch by providing access to Visa technology and resources. The cohort includes startups from various African countries, such as Nigeria, Kenya, Ghana, Morocco, South Africa, Egypt, Uganda, Zambia, and Tunisia, each offering innovative solutions ranging from digital recordkeeping tools to on-demand wage access platforms. Alfred F. Kelly Jr., Visa’s executive chairman, emphasized Africa’s vibrant fintech ecosystem, noting Visa’s longstanding commitment to investing in the continent and supporting its innovative startups to foster scalable growth.