Ushur, a leader in AI-powered Customer Experience Automation (CXA), has introduced a new self-service solution tailored for financial institutions to automate Know Your Customer (KYC) and paperless enrolment processes.

With KYC regulations mandating continuous verification of customer records, including phone numbers and addresses, traditional outreach methods like letters and emails often yield low response rates, posing compliance risks for businesses.

Additionally, the transition from paper-based to digital processes in financial institutions has made securing customer consent through conventional means a costly challenge.

Ushur’s innovative solution addresses these issues by facilitating seamless customer detail capture and consent, offering proactive digital experiences at scale.

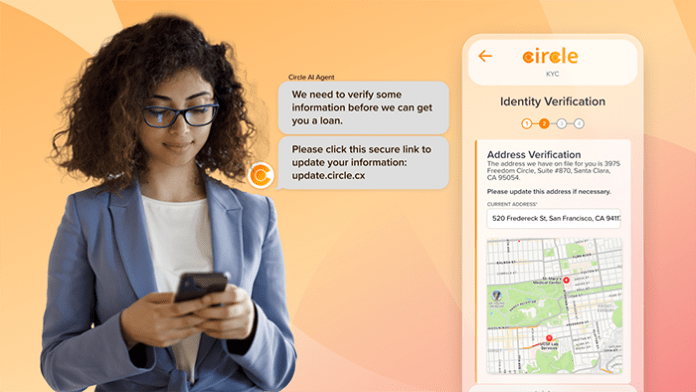

Business users can now initiate self-service journeys that efficiently guide customers through address verification and paperless opt-ins via their preferred communication channels such as text, email, and mobile apps.

This approach reduces manual data entry, enhances customer engagement, and ensures the secure transmission of Personally Identifiable Information (PII).

Yvonne Daugherty, Global Head of Industries at Ushur, stated, “By automating Know Your Customer (KYC) and paperless enrolment processes, we enable clients to capture critical information and support Go Green efforts through innovative communication channels. Our AI-powered platform combines ease of use with enterprise-class security, empowering large, highly-regulated enterprises to swiftly meet AI and digital innovation goals while overcoming costly operational inefficiencies.”

It is these operational inefficiencies that are plaguing many companies which are trying to bolster the customer experience in this increasingly digitalised era. Ushur was designed to change this.

Led by its visionary co-founder and CEO, Simha Sadasiva, the customer experience automation company has been built t0 offer an AI-powered customer experience automation platform that is designed to automate the end-to-end customer journey.

Its offering enables companies to implement hyper-personalised, self-serve customer engagement across the customer journey.

For example, an insurer could leverage the technology to automate claim forms, policy administration, customer outreach, billing, underwriting and more.

The platform also generates a supreme about of value to clients. It achieves this by bolstering the customer experience, which is measured through the net promoter score (NPS).

By leveraging these scores, Ushur can assess whether it is really providing value to its clients. For example, Ushur’s automated survey software can help clients improve their NPS by 40% and reduce process time by 32%, on average, highlighting the real value in its technology. The ability to clearly see value, as well as bolster efficiency, means clients can focus on scaling their operations and seek more opportunities for growth.

While the headlines are remarkable, Ushur’s strengths are so much deeper than that, as Sadasiva explained in an exclusive interview with FinTech Global, “Ushur, is a very broad platform with deep capabilities of front-office, middle-office and back-office capabilities. That’s very unique in the industry. We bring a no-code approach to assembling experience automation. Instead of needing to write software, we allow business users to assemble these modular, you just drag and drop components like Lego pieces to create the solution to any issue that creates friction in the experience.”

To read the full interview with Sadasiva, which exlores how how Ushur is levelling-up customer experience processes, click here.

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global