In a report published March 2024, Alveo polled 200 financial institutions about their current usage of data and AI. The respondents were split over the US, the UK and the DACH region (consisting of Germany, Austria and Switzerland). The sample was composed of asset owners, asset managers and banks but also contained brokers, hedge funds and central banks.

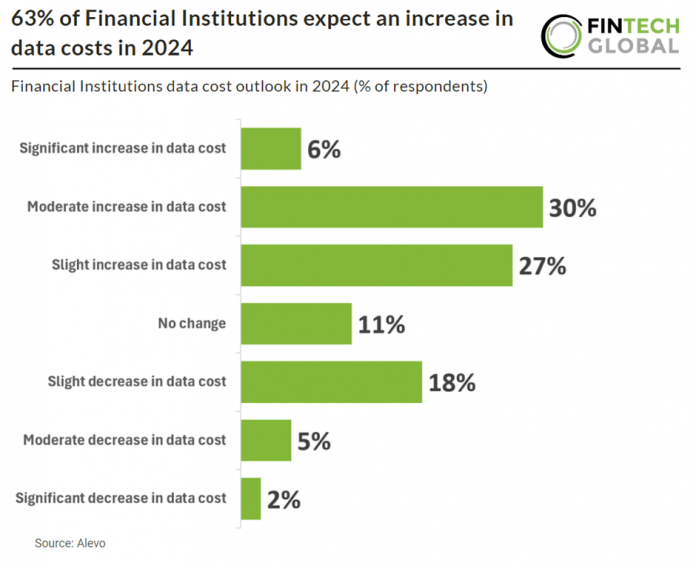

There is an increased value placed on high-quality data with almost two thirds of financial institutions expecting an increase in data costs. This development comes as AI I being implemented across financial institutions’ operations and a growing need for high quality data. This is also sparking innovation in the data supply chain, presenting numerous opportunities for specialized data service providers, analytics tools, and data quality management solutions. These providers are becoming key enablers for firms striving to harness superior AI-driven insights and maintain a competitive edge. By ensuring the data that powers these technologies is of the highest standard, these providers play a pivotal role in maximizing the returns on AI investments for these firms.