ThoughtLab conducted a global survey from September to November 2023, engaging 2,000 investors from diverse backgrounds in terms of wealth, age, gender, and location. The participants were from four regions: Asia Pacific, Europe, the Middle East, and North America. The majority of respondents were either mass affluent or high net worth individuals, with Gen X being the largest age group represented, followed by Baby Boomers.

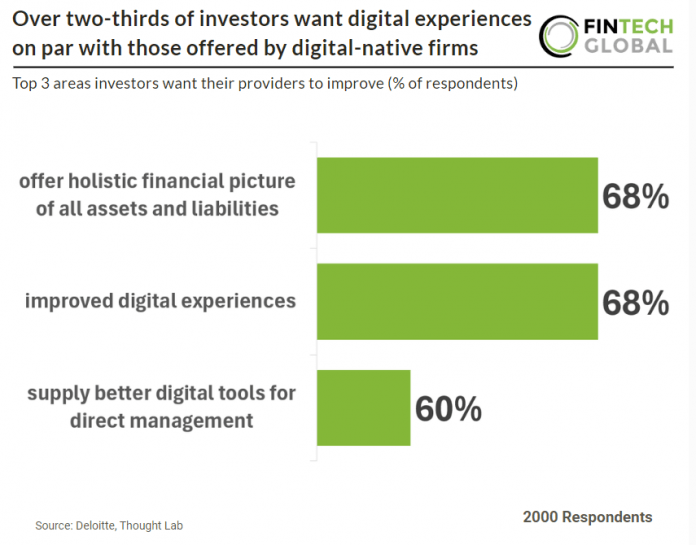

Client demands are reshaping the investment industry, driven by investor expectations for digital experiences comparable to those provided by digital-native companies. More than two-thirds of investors are now seeking digital interactions on par with leading tech firms, with 51% open to investing through major retail or technology brands if possible. Additionally, a significant portion of investors desire a more comprehensive service approach from their providers. Sixty percent are calling for enhanced digital tools that allow them to manage their investments independently, without relying on financial advisors. This trend is likely to intensify with the rise of the next generation of investors, who are accustomed to the digital excellence of e-commerce platforms. For 58% of Gen Y and Z investors, superior digital applications, tools, and platforms are essential criteria when selecting an investment firm.

Jean-Francois Lagasse Global Wealth Management Leader, Deloitte Switzerland said “The most important disruptor in the industry today is the client. Investors and families have higher financial awareness, literacy, and access to information than at any other point in our history. Their attitudes, expectations, and behaviours are compelling wealth managers to innovate across products, services, and experiences.“