It was a slow week for FinTech deals, with just 13 deals completed and a total of $176m raised.

This was a relatively slow week for the sector compared to last week which saw $332m raised across 21 deals.

Without the US, this week’s FinTech deals activity would have been nearly nonexistent. The country was responsible for eight FinTech deals, including five of the biggest funding rounds. In total, US-based FinTech companies pulled in $138m.

The US-based companies to secure funds this week were SpyCloud, HYPR, Indico Data, Understory, Sixfold, Authentic Insurance, Liminal and Prósperos.

A handful of European countries also recorded deals this week. These were Germany (re:cap), France (Continuity), the UK (WealthOS) and Switzerland (Kaspar&). Only one country outside of the US and Europe recorded a deal this week, with India recording one deal (Vegapay).

In terms of sectors, InsurTech reigned supreme, recording four deals. These companies were Understory, Sixfold, Authentic Insurance and Continuity.

Following just behind InsurTech was WealthTech, which recorded three deals (WealthOS, Prósperos and Kaspar&.) There were also two CyberTech deals this week, SpyCloud and HYPR, which both raised $35m – the biggest deals of the week.

Other sectors represented this week were PayTech (VegaPay), RegTech (Liminal), marketplace lending (re:cap), and data & analytics (Indico Data).

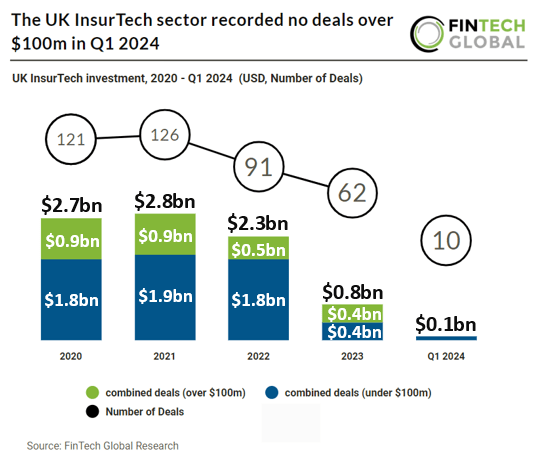

While InsurTech led this deals this week, the sector has not had the strongest start to the year. A recent study from FinTech Global found that just $93m was raised by UK-based InsurTech companies during Q1 2024 – this is a 74% drop from Q1 2023. Deal activity is also down YOY, with just 10 deals completed in Q1 2024, which is down by 58% from 2023.

Here are this week’s 13 FinTech funding rounds covered by FinTech Global this week.

Cybersecurity startup SpyCloud secures $35m to combat account takeovers

Cyber startup SpyCloud has announced a successful funding round, raising $35m to further enhance its capabilities in account takeover prevention.

According to Silicon ANGLE, the $35m investment was led by CIBC Innovation Banking, the investment arm of the Canadian Imperial Bank of Commerce, aimed at bolstering SpyCloud’s offerings against cyber threats.

Founded in 2016, SpyCloud specialises in detecting leaked employee login credentials and protecting consumer accounts through its platform. The company proactively disrupts attackers’ ability to profit from stolen information by gathering data from breaches, malware-infected devices, and dark web sources, transforming these into actionable insights.

SpyCloud intends to use the new funding to continue innovating its automated solutions, enhancing protection against ransomware, consumer fraud losses, and cybercrime investigations. The platform is equipped to detect if employee passwords linked to internal supply chain applications are on the dark web, find other types of leaked login credentials, and identify compromised cookies, which hackers can exploit for session jacking.

The company’s solutions integrate with a variety of services, including Active Directory, Okta Inc., Tines Inc., Splunk Inc., Microsoft Sentinel, Palo Alto Networks Cortex XSOAR, and other identity response and orchestration tools.

SpyCloud has shown significant growth and serves half of the Fortune 10 companies, including notable clients like Canva Pty Ltd., Intuit Mailchimp, LendingTree LLC, Atlassian Corp. PLC, Uber Technologies Inc., Zscaler Inc., and Samsonite International S.A.

Passwordless company HYPR secures $35m Series C funding round

HYPR, the passwordless company, has announced the successful raising of $35m in a Series C financing round.

The company, known for its innovative approach to eliminating passwords, has now doubled its total funding to over $70m.

The latest investment round was led by Advent International through its dedicated global technology fund, Advent Tech. Advent has a strong background in cyber technology investments, with notable contributions to companies like Wiz and Cyware. Joining Advent are HYPR’s existing investors, including RRE Ventures, .406 Ventures, Boldstart, Top Tier Capital, MESH, Alumni Ventures Group, Allen & Co, Samsung NEXT, and Mastercard.

HYPR specialises in True Passwordless MFA™ technology, which merges the convenience of a smartphone with the security of a smart card. This technology is designed to help businesses remove passwords entirely, thereby reducing cybersecurity risks, IT support costs, and improving user experience. The company’s approach focuses on enhancing the user experience while providing robust security measures against phishing, fraud, and user friction.

The newly acquired funds will be used to accelerate HYPR’s go-to-market strategy and expand its global support organisation. This effort aims to help businesses worldwide eliminate the need for passwords, a major cybersecurity vulnerability. The pandemic-induced shift to remote work has highlighted the security risks and costs associated with password-based authentication, further validating HYPR’s mission.

AI leader Indico Data raises $19m, partners with Guidewire

Indico Data, the industry’s leading solution for automating critical intake workflows across the policy lifecycle, has announced the successful closure of a $19m funding round.

The round included a strategic investment from Guidewire, a premier platform for Property and Casualty (P&C) insurers.

The $19m investment was led by .406 Ventures and joined by Guidewire, along with existing investors Sandbox Industries, Osage Venture Partners, and Jump Capital.

Indico Data, known for its first-to-market “hybrid” Discriminative and Generative AI platform, aims to use the new funding to enhance its technology, extend its global reach, and bolster customer success initiatives. The company’s AI technology enables enterprises to make better decisions with improved data, driving operational efficiency and revenue growth.

In conjunction with this investment, Indico Data is set to launch its Ready for Guidewire validated accelerator. This integration will connect Indico Data’s intelligent intake solution with Guidewire PolicyCenter, addressing the critical challenges underwriters face in managing unstructured data in broker submissions. Traditionally, underwriters spend countless hours manually extracting and inputting data from submission emails and documents into PolicyCenter, a process prone to errors. The integration will automate this process, ensuring immediate access to vital data and expediting the quote process, enhancing decision-making, and growing underwriting premiums.

Indico Data CEO Tom Wilde said, “We are thrilled to announce the successful closure of our latest funding round, which includes a strategic investment from Guidewire.

Understory bags $15m in Series A for renewable energy sector

Understory, a provider of insurance solutions against severe weather losses, has secured $15m in a Series A funding round.

This investment will aid in the development of a new product aimed at the renewable energy sector, according to InsurTech Insights.

The funding round was led by undisclosed investors, signifying strong confidence in Understory’s innovative approach to weather risk mitigation.

The capital injection will be used to launch a product specifically designed for the renewable energy industry.

The technology aims to help solar farms reduce hail repair costs by 50% by predicting weather events up to 45 minutes in advance. This allows operators to take preemptive measures to minimise damage, such as stowing or moving solar panels.

Founded in 2014 by Alex Kubicek and Brian Down, Understory initially focused on deploying a network of ground-level weather stations to improve real-time weather tracking and forecasting.

The company’s cutting-edge weather stations, known as Dots, measure wind, rain, hail, temperature, pressure, and humidity 125,000 times per second.

This technology provides detailed ground-level weather data, which has enabled the company to expand its network globally and build comprehensive catastrophe models. Leveraging this data, Understory has developed its own parametric insurance offerings.

Sixfold raises $15m to enhance AI-driven underwriting technology

Sixfold, the company empowering underwriters with a generative AI solution for end-to-end risk analysis, has announced a successful $15m Series A funding round.

This significant investment round was led by Salesforce Ventures, with contributions from Scale Venture Partners and previous investors Bessemer Venture Partners and Crystal Venture Partners.

The funds will be utilised to further build Sixfold’s team of AI/ML engineers, enhance product capabilities, and accelerate research and development efforts.

This tranche will help Sixfold expand its operations beyond North America, targeting the UK and European Union markets. The company aims to bolster its international presence while continuing to innovate and refine its AI-driven underwriting solutions.

Over the past year, Sixfold has gained traction with a diverse customer base that includes commercial P&C, Specialty, and Life insurers like AXIS Capital, Zurich Insurance Group, Generali Global Corporate & Commercial, and Mosaic Insurance.

The company has also formed partnerships with firms such as EXL and joined the Guidewire Insurtech Vanguard.

Sixfold’s achievements include selection for the Lloyd’s Lab Accelerator program, which fosters global innovation in the insurance and reinsurance marketplace.

The program offers collaboration opportunities with Lloyd’s mentors, aiding Sixfold’s expansion into new markets.

Additionally, Sixfold was named a winner in the Zurich Innovation Championship 2024, an annual program sponsored by Zurich Insurance Group. This accolade positions Sixfold to participate in a four-month accelerator program aimed at developing new commercial underwriting solutions.

FinTech firm re:cap secures $14.6m Series A funding led by Entrée Capital

Financing and data insights company, re:cap, has announced the completion of its Series A funding round, raising $14.6m.

The round was led by Entrée Capital, with participation from existing investors Felix Capital and Project A.

Founded in Berlin in 2021, re:cap provides alternative debt financing and data insights to tech and services businesses in Germany and the Netherlands. The company also operates re:cap Institutional, a decision-making platform for institutional investors.

The newly raised funds will be used to expand re:cap’s alternative debt financing business and marketplace, and to scale its proprietary software platform. This includes the general release of re:cap Institutional, a data-driven platform for investors, and Cash Insights, a cash flow management software for businesses.

The first customers of re:cap Institutional include asset managers Avellinia Capital and Channel Capital, who use the platform for real-time cash flow monitoring and data automation.

Julian S. Schickel, Partner at Avellinia Capital, said, “re:cap’s platform allows us to identify potential constraints at our portfolio companies, which ultimately helps us to be better partners and investors. We have been impressed by the initial product and continuous improvements. The team has been exceptionally responsive and customer-focused.”

New York-based InsurTech Authentic Insurance secures $11m in Series A funding

Authentic Insurance, a New York-based InsurTech startup, has successfully raised $11m in a Series A funding round.

This investment round was led by First Mark Capital, with additional participation from Slow Ventures, Altai Ventures, MGV, Upper90, and Commerce Ventures, according to InsurTech Insights.

The fresh capital will be used by Authentic to expand its team and introduce new offerings to its product suite, such as workers’ compensation and health insurance products. This move aims to broaden the scope of coverage and benefits available to its clients.

Founded in 2022, Authentic Insurance enables SaaS platforms, associations, and other communities to establish their own captive insurance programs tailored for small business coverage. With a single line of code, partners can introduce their own insurance products. Authentic handles all aspects of underwriting, claims management, and oversees capital markets and reinsurance, earning a fee for these services.

The company primarily serves businesses generating less than $5m in annual revenue.

Since launching its product last September, Authentic Insurance has gained over ten customers, including notable names like Mindbody, Restaurant365, and theCut.

These clients collectively serve approximately one million small businesses. Authentic has already sold over 100 policies through its partners and anticipates selling more than 1,000 by the end of the summer.

French InsurTech Continuity raises €10m ($10.8m) to boost AI-driven risk assessment

Continuity, a pioneer in leveraging artificial intelligence and external data for professional and commercial P&C insurers, has announced a €10m Series A funding round.

This financing round was led by 115K, with additional support from historical investors Elaia and Bpifrance through their Digital Venture fund. This follows an initial capital injection of €5m in 2021.

The fresh funding is a testament to the robustness of Continuity’s model and will enable the company to further invest in its technology, solidifying its position as a market-leading solution for insurers.

The Parisian firm, established in 2019, offers innovative SaaS solutions that utilise external data and AI to improve risk selection and ongoing monitoring. The company’s technology analyses insurance contracts and new subscription requests to identify risk factors, providing the best recommendations based on the insured company’s actual situation.

Continuity’s mission addresses a significant issue in the insurance industry: accurate risk assessment. With 10 to 15% of professional and business P&C insurance contracts not matching the insured’s actual conditions due to subscription errors or changes during the contract’s term, Continuity’s solutions provide a 360-degree, real-time view of risks.

This allows insurers to better support their clients and offer coverage that fits their needs.

Continuity’s tools are currently utilised by over 500 underwriters, monitoring one million contracts and representing €2bn in premiums. Esteemed partners such as AXA, Crédit Agricole, Entoria, Groupama, IME, Sada Assurances, Wakam, and Hiscox rely on Continuity to enhance risk assessment during underwriting and optimise long-term risk monitoring.

With the new funds, Continuity plans to continue developing its technology and AI to tackle new challenges for insurers, particularly in the large risks segment.

This includes hiring around 15 new team members to strengthen their current team of over 30 talents and expanding their presence across Europe.

Vegapay raises $5.5m to boost card management platform and lending tech

Gurgaon-based fintech startup, Vegapay, has successfully raised $5.5m in seed funding, according to FinSMEs.

The funding round was led by Elevation Capital, with additional investment from Eximius Ventures.

Vegapay, founded in 2022 by Gaurav Mittal, Himanshu Agrawal, Puneet Sharma, and Abhinav Garg, specialises in providing a lending tech stack and a card management platform.

Their solutions enable banks, NBFCs, and fintechs to launch flexible card and credit-based products swiftly. Vegapay’s technology supports a variety of card programs, including credit, debit, prepaid, and forex cards, along with innovative credit-on-UPI-based solutions. They also offer Loan Origination Systems (LOS), Co-lended Loan Management Systems (Co-LMS), and Loan Collection Systems (LCS), focusing on speed, scale, and innovation.

The newly secured funds will be used to expand their team by hiring developers, designers, and engineers. This will help enhance their product suite, with a particular focus on product development and regulatory compliance updates.

RegTech leader Liminal raises $5m in seed round led by Fin Capital

Liminal, a leader in horizontal GenAI data security, has announced the successful raising of more than $5m in an oversubscribed seed funding round.

The investment round was led by Fin Capital, with additional participation from High Alpha, Matchstick Ventures, Craft Ventures Scout Fund, and veteran regulated industry executives.

This new influx of capital will enable Liminal to swiftly enhance its ability to help customers securely deploy and utilise generative AI. The rapid proliferation of generative AI in the past 18 months, with over 12,000 generative AI-enabled applications released in the past year, has presented regulated organisations with significant data security and privacy challenges.

Liminal’s platform is model-agnostic and horizontal, providing secure workflow tools that allow regulated organisations to benefit from the productivity enhancements of generative AI while maintaining regulatory compliance and protecting sensitive data such as intellectual property, employee information, and customer data. The platform ensures secure interactions with generative AI, offering a seamless experience for end users and comprehensive oversight for security teams.

The company intends to use the new funding to accelerate the adoption of generative AI in regulated industries by enhancing its robust data protection and secure workflow tooling capabilities. This strategic investment will support Liminal’s mission to enable organisations to confidently leverage generative AI technologies while addressing the associated security and compliance concerns.

WealthOS closes £4m ($5m) seed round with Barclays and Main Set as key investors

WealthOS, the cloud-native wealth management infrastructure platform provider, has announced the successful closure of its seed round, raising £4m.

The funding round was led by Barclays Bank, with additional investment from Main Set, part of international investment firm Capricorn Capital Partners UK.

The investment includes £2m raised in the final closing, adding to the £2m already invested by Barclays and other leading FinTech investors such as Chris Adelsbach, Mike O’Brien, John Donohoe, and John Herlihy in late 2023.

WealthOS specialises in developing advanced wealth management solutions that allow organisations to offer omni-channel wealth management products to clients quickly and cost-effectively. The company will use the new funding to further develop its platform, increase distribution, and scale the organisation to support its strong client pipeline.

WealthOS plans to leverage the investment to enhance its technological capabilities and expand its market reach, ensuring it can meet the growing demand for digital wealth management solutions.

This funding news follows WealthOS’s release of the UK’s first and only cloud-native and API retail pensions (SIPP) technology. Additionally, WealthOS has been chosen by Quai Digital as its new strategic technology partner. Quai Digital, a prominent provider of B2B wealth management white-label outsourcing services, will leverage WealthOS’s composable software to integrate with its proprietary platform. This partnership aims to foster growth by delivering scalable, feature-rich digital financial capabilities to Quai Digital’s clients.

Financial platform Prósperos raises $3m to transform Latino banking

Prósperos, a tech company focused on delivering a powerful financial platform for the Spanish-speaking Western hemisphere, has raised $3m.

The funding round saw participation from FEBE Ventures, BAT VC, Tekton Ventures, Courtyard Ventures, and several technology executives.

Founded in 2023 by Vinay Pai and Salvador Chavez, Prósperos aims to empower millions of Latinos by providing an innovative financial platform. This platform enables users to manage their finances while supporting their families both in the USA and Latin America.

The Prósperos platform offers two bank accounts and two cards—one for the account holder in the USA and one for their family in Mexico, with plans to expand to Central and South America soon. In 2023, remittances to Latin America reached nearly $160bn, generating more than $4bn in fees and taking days to process. Prósperos aims to eliminate these inefficiencies, enabling instant fund transfers to family members in Latin America.

With the new funding, Prósperos plans to enhance and expand its platform, offering a faster, more affordable solution for financial transactions. The company is already seeing strong demand and intends to roll out its services in the coming weeks.

The company’s leadership team includes Chief Technology Officer Sangam Singh, Chief Data Scientist Eitan Anzenberg, and Chief Compliance Officer Netsai Massetti, who have all worked together previously and helped take their former FinTech company public in 2019.

Swiss FinTech Kaspar& secures CHF 2.5m ($2.7m) seed funding, partners with Avaloq

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global