Despite the sizable total, the week was dominated by smaller deals. In fact, $733m was raised by two deals and only seven of this week’s FinTech funding rounds were larger than $10m.

This was a similar scenario to last week, where two big deals propped the sector up to secure over a total of $1bn.

In this week’s FinTech deals, marketplace lending accounted for the three biggest deals of the week. These were a $400m forward flow agreement raised by Lendbuzz, a $333m funding secured by DMI Finance, and a $76m raised by Arch Lending.

Axio was the only other marketplace lending company to close an investment round this week, with it raised $20m from the Amazon Smbhav Venture Fund.

While marketplace lending housed the biggest deals, it wasn’t the subsector with the most deals. This was a three-way tie between WealthTech, PayTech and infrastructure and enterprise software, which each recorded five deals.

The five WelathTechs were Siepe, Lettuce Financial, Your Money Line, TransBank and Vanilla. The five PayTech companies were Resal, Skyfire, Waza, Kem and Mesh, while the five infrastructure and enterprise software businesses were PostEx, DiMuto, Workpay, When and Thera.

Finishing off the sectors, there were three CyberTechs (Holonym Foundation, Nucleus Security and Cyberbit), one InsurTech (YouSet) and one RegTech (Chaos Labs).

Continuing the trend, the US was home to the lion share of the FinTechs that raised funds. Of the 24 deals, 15 of these were companies based in the US. These were: Lendbuzz, Arch Lending, Chaos Labs, Siepe, Lettuce Financial, Skyfire, Waza, Holonym Foundation, When, Your Money Line, Thera, Nucleus Security, Vanilla, Cyberbit and Mesh.

India was the only other country to see more than one FinTech deal. The Indian FinTech companies are DMI Finance, Axio and TransBank.

Other countries represented this week were Saudi Arabia (Resal), Pakistan (PostEx), Singapore (DiMuto), Kenya (Workpay), Canada (YouSet) and Kuwaiti (Kem).

In a recent research piece from FinTech Global, it found that Singapore dominated Asian top 10 deals in H1 2024 with two deals in the top three. However, the biggest deal of the period was raised by India-based Svatantra.

Asia is experiencing a slowing FinTech sector, like most regions around the world. In the first half of the year, the Asian FinTech sector recorded 514 transactions, representing a decline of nearly 47% from the 969 deals completed during the same period in 2023. It is also a 36% drop from the 808 funding rounds in H2 2023.

In terms of investment volume, total FinTech funding in H1 2024 amounted to $7.4bn, a steep drop of 70% from the $24.4bn raised in H1 2023 and a 48% drop from the $14.3bn raised in H2 2023.

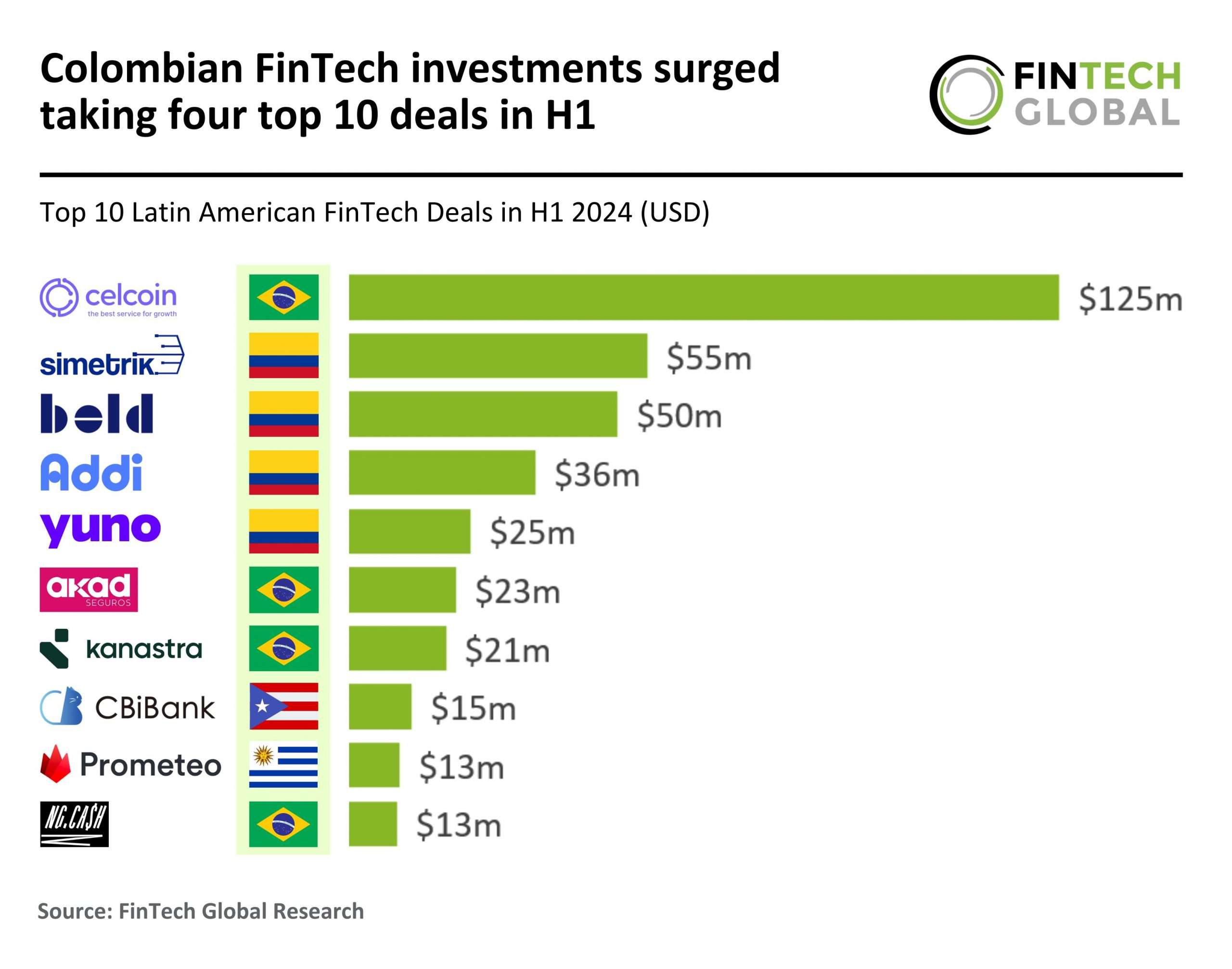

While this is a common trend around the world, recent research from FinTech Global found that Latin American FinTech sector has had some positive stats in 2024. While the number of transactions for H1 2024 was down by 58% compared to H1 2023 (79 and 189, respectively), investment volume went up. FinTech funding in H1 2024 amounted to $1.2bn, representing a 20% increase from the $1.0bn raised in H1 2023. However, this is still a 29% decline from H2 2023. In terms of the deal activity, Brazil and Colombia led the region.

Here are the 24 FinTech funding rounds that were covered on FinTech Global this week.

Lendbuzz secures $400m in forward flow agreement with Viola Credit to expand auto finance reach

Lendbuzz, an AI-based FinTech company from Boston, MA, announced a significant financial milestone with a new $400m forward flow program secured with Viola Credit, a global alternative asset manager.

This latest arrangement cements the ongoing partnership between the two firms, which has seen over $1bn in financing and asset purchase transactions since 2018.

The $400m in fresh capital will aid Lendbuzz in scaling its operations and extending its proprietary AI-based auto finance platform, which leverages alternative data and machine-learning algorithms to evaluate the creditworthiness of consumers. These consumers often find themselves underserved by traditional banking systems. The forward flow program will also help Lendbuzz to enhance its reach and serve an increasing number of borrowers seeking vehicle finance.

Lendbuzz aims to use this funding to continue redefining the auto financing landscape. By providing accessible credit solutions, the company supports underserved demographics, primarily through a modern, digital lending experience. The initiative underscores Lendbuzz’s commitment to innovation in consumer credit by utilizing AI and advanced analytics to assess loan applications.

DMI Finance secures $333m from MUFG to propel growth in Indian digital lending

MUFG Bank has ramped up its investment in DMI Finance, an Indian digital lender, with a hefty sum of $333m.

According to Finextra, this latest investment thrusts the valuation of DMI Finance to about $3bn. This funding marks a continuing commitment from the Japanese financial behemoth, following a substantial $400m investment just over a year ago.

Based in India, DMI Finance leverages cutting-edge technology to provide point-of-sale (POS) loans. Collaborating with major global and local brands such as Samsung, Google Pay, and Airtel, DMI effectively addresses the needs of millions by facilitating quick and accessible financing solutions.

This strategic funding is earmarked to significantly enhance DMI Finance’s balance sheet and amplify its operational scale. This expansion is vital for the company’s mission to extend its reach within India’s vast underbanked population, a key market that DMI continues to serve effectively. To date, the firm boasts a robust customer base exceeding 15 million users.

MUFG’s investment spree extends beyond DMI, as it has also infused capital into other Asian Pacific FinTech ventures targeting similar underbanked segments. Noteworthy investments include stakes in Thai super-app Ascend Money, Singapore’s Grab, Indonesia’s Akulaku, and Mynt, a prominent player in the Philippines’ mobile payment and credit sector.

Arch Lending announces $75m fundraise to expand lending solutions

Arch Lending, based in New York, has announced a substantial $75m fundraise.

The company has successfully raised $75m through a combination of a $5m equity seed round and a $70m loan financing facility.

The equity round saw co-leadership by Morgan Creek Digital and Castle Island Ventures, with contributions from Galaxy Ventures, BitGo Ventures, and more.

Arch Lending specialises in offering crypto-backed loans, serving both individual and institutional clients. The company is celebrated for its top-tier customer service, superior product offerings, and a commitment to security and trust.

These loans are backed by robust cryptocurrencies such as Bitcoin, Ethereum, and Solana, ensuring a solid foundation for its financial services.

Onchain risk leader Chaos Labs lands $55m from Haun Ventures

Chaos Labs, a pioneer in onchain risk management, recently announced a significant milestone with a $55m Series A funding round, led by Haun Ventures.

This infusion of capital, targeting the enhancement of onchain economic security, has also garnered the support of notable new investors including F-Prime Capital, Slow Ventures, Spartan Capital, and others. This round sees the continuation of support from established backers like Lightspeed Venture Partners, Galaxy Ventures, Wintermute Ventures, PayPal Ventures, General Catalyst, Bessemer Venture Partners, and Coinbase Ventures.

Additionally, prominent strategic angel investors like Kevin Weil (OpenAI CPO), Michael Shaulov (Fireblocks CEO), Anatoly Yakovenko (Solana CEO), Francesco Agosti (Phantom CTO), and Anton Katz (Talos CEO) have also participated.

Chaos Labs is poised to use this new funding to accelerate the development of new products and scale its sophisticated risk management platform, which currently includes advanced observability tooling, cutting-edge risk oracles, and real-time parameter recommendations.

The investment marks the first Series A leadership for Diogo Mónica, General Partner at Haun Ventures.

In the past year, Chaos Labs has significantly expanded its customer base, now serving over 20 protocols including Aave, GMX, and Jupiter. These protocols depend on Chaos Labs to secure, monitor, and enhance their platforms, with the company’s technology safeguarding an impressive $860bn in cumulative trading volume and managing $25bn in loans and $35m in incentives.

Siepe secures $30m Series B funding to enhance private credit data management

Siepe, a pivotal player in the FinTech sector, recently announced a substantial $30m Series B funding boost, led by strategic investor WestCap.

This funding round marks a significant milestone for the company, positioning it for further expansion amidst the burgeoning private credit and CLO markets.

WestCap, a prominent operating and investing firm with a robust $6bn in assets under management, is at the forefront of this financial injection. The collaboration between Siepe and WestCap is set to empower the former’s ambitious multi-product roadmap, notably enhancing its AI and Machine Learning capabilities to streamline operations and improve data accuracy across the financial ecosystem.

At its core, Siepe provides innovative software and services tailored for private credit and CLO managers. Since its inception in 2012, the company has been committed to transforming investment management practices. Its solutions offer comprehensive data management, enabling seamless integration and real-time insights that support critical decision-making processes across various business stages.

The newly acquired funds are earmarked for broadening Siepe’s product offerings and fortifying its strategic partnerships. These enhancements aim to address the escalating demands and complexities within the private credit domain, ensuring superior service delivery and operational efficiency.

Beyond product development, Siepe has outlined plans for leveraging this investment to refine their client services and expand their market footprint. The company’s recent activities underscore its growth trajectory, having added significant deals and expanded its asset administration significantly in the first half of 2024.

Digital lender Axio boosts operations with $20m investment from Amazon’s fund

Axio, formerly known as Capital Float, has announced a significant boost in funding, securing $20m from the Amazon Smbhav Venture Fund.

The newly acquired funds are earmarked for scaling operations significantly, according to a report from Inc42.

Axio plans to broaden the use cases for its checkout finance solutions and introduce a range of new credit products designed to meet diverse consumer needs.

As a digital consumer finance company, Axio specializes in “pay later” options and personal finance management. Established in 2013 by Gaurav Hinduja and Sashank Rishyasringa, the platform is known for offering personalized credit solutions, ranging from INR 30K ($357) to INR 4 Lakh ($4,700), and has successfully served over 15 million customers, with more than nine million benefiting from its credit services.

Lettuce Financial secures $15m in Series A to bolster solopreneur support

Lettuce Financial, a pioneering FinTech company specialising in automated accounting and tax solutions for solopreneurs, has successfully closed a $15m Series A funding round.

This significant financial injection was led by Zeev Ventures, a prominent investor in innovative technology startups.

This funding round is set to propel Lettuce Financial into its next growth phase, with plans to accelerate product development and innovation. The capital will also enhance the company’s ability to forge key partnerships across the industry.

At its core, Lettuce Financial provides critical financial tools designed to optimise business taxes for solopreneurs—a rapidly growing segment of the workforce. With products like LettuceHead AI, a unique AI-chat bot, the company offers tailored advice on tax and accounting questions, directly addressing the needs of its users.

The new funding will be used to expand Lettuce’s capabilities and reach.

Resal secures $9m in Series A funding to expand digital rewards in Saudi Arabia

Resal, the prominent Saudi Arabia-based e-gifting platform, has successfully raised $9m in a Series A funding round.

The investment was supported by a consortium of investors including Derayah Ventures Fund, Al-Wafrah AlThanya Investment Company, Venture Souq FinTech Fund, ADDiriyah Asset Management, Nomad Holdings, Bugshan Investment Group, along with several family offices and angel investors, according to a report from Wamda.

Founded in 2016 by Fouad Alfarhan and Hatem Kameli, Resal specialises in digital solutions that connect merchants, companies, and individuals. The platform enables the efficient management and exchange of loyalty points, prepaid cards, and vouchers from diverse sources such as banks, telecom companies, and airlines.

The freshly acquired funds are earmarked to drive Resal’s growth within Saudi Arabia. The company plans to target new sectors, launch innovative technological products for alternative payment solutions, loyalty programs, and rewards, and expand its network of partners and infrastructure across various sectors.

Skyfire launches global AI payment network with $8.5m boost

Skyfire Systems, the innovator behind the first payment network for AI agents, has recently announced a substantial funding round.

This platform enables transactions without human intervention, integrating secure wallet access and verifiable agent identities, tailored for a burgeoning AI market.

The company has successfully raised $8.5m in a round led by prominent investors including Neuberger Berman, Brevan Howard Digital, and Intersection Growth Partners, among others. This funding round also saw participation from tech-focused venture firms like DRW, Inception Capital, and Arrington Capital, along with industry giants such as Ripple and Gemini.

Skyfire’s platform is the first of its kind, designed to facilitate fully autonomous transactions across various AI agents, large language models (LLMs), data platforms, and service providers. By offering an open payment protocol, Skyfire aims to eliminate the need for traditional payment methods such as credit cards, fostering a direct economy between AI agents and services.

The capital infusion will be utilized to enhance the platform’s capabilities, including the expansion of its payment protocol and the integration of more advanced features such as automated budgets and control systems. These innovations are intended to provide AI agents with the autonomy to execute transactions within set financial limits, promoting a secure and efficient economic environment.

Additional aspects of Skyfire’s development include the establishment of verification services to ensure the reliability of transactions and the creation of funding on-ramps that facilitate the use of stablecoins for instant AI transactions.

Waza secures $8m for B2B payments innovation in emerging markets

Waza, a B2B emerging markets payment platform, has successfully closed an $8m funding round comprising both equity and debt.

According to Finextra, this significant financial boost includes a $3m seed equity round from a consortium of institutional and strategic investors, namely Y Combinator, Byld Ventures, Norrsken Africa, Heirloom VC, Plug and Play Tech Center, and Olive Tree Capital. Additionally, Timon Capital has provided $5m in debt funding.

The company specialises in simplifying global payments and liquidity for businesses within emerging markets. By facilitating seamless transactions, Waza is aimed at empowering African businesses, traders, and large organisations to efficiently manage and remit payments to their global suppliers.

The recently acquired funds are earmarked for a variety of strategic initiatives. Primarily, the investment will fuel the pilot of trade financing solutions tailored for the firm’s large enterprise clients, tapping into an additional market potential of $371m across Africa.

Founded by Maxwell Obi and Emmanuel Igbodudu, Waza emerged from stealth mode after 18 months of development, commencing operations in January 2023 as part of YCombinator’s Winter ’23 cohort. With a registered MSB status in the US and a VASP license, Waza operates in Ghana and Nigeria.

The platform has rapidly scaled, serving hundreds of businesses and processing over $700m in annualised payment volume. It facilitates business payments across six continents, boasting a growth rate of 20% per month. Impressively, Waza reached profitability by the fourth quarter of 2023, a status it has maintained into 2024.

Pakistan’s PostEx raises $7.3m in pre-Series A led by Conjunction Capital

PostEx, one of Pakistan’s top FinTech companies, has successfully closed a US$7.3m pre-Series A funding round.

The investment was spearheaded by Conjunction Capital, a global venture capital firm with a technology focus. Participating in this round were new investors including Dash Ventures and Sanabil500, alongside existing investors VSQ, FJ Labs, and Zayn VC.

PostEx operates at the intersection of FinTech and logistics, providing innovative financial solutions integrated with logistics services. The company offers immediate capital access, overcoming traditional financing barriers, while its embedded logistics solutions enhance the efficiency of ecommerce deliveries, addressing cash flow challenges for its clients.

The newly acquired funds are earmarked for strengthening PostEx’s market leadership in Pakistan and supporting its ambitious expansion plans into the Gulf Cooperation Council (GCC) countries. This expansion is expected to open new markets and customer bases to PostEx’s services.

Amid a favorable market environment, PostEx is disrupting traditional finance and logistics industries within Pakistan. The nation’s ecommerce sector, though only accounting for 1-2% of total retail transactions, presents significant growth opportunities compared to the global average of approximately 15%.

In the last 18 months, PostEx has achieved numerous financial and operational milestones, including reaching an Annual Recurring Revenue of $21m and attaining profitability. The company, now processing over four million transactions monthly, has maintained its market leadership for the past two years, showing remarkable growth since its inception less than three years ago.

DiMuto secures $5.9m in Series A to expand AgriFood digital solutions globally

DiMuto, a pioneering AgriFood trade solutions company based in Singapore, has announced the successful closure of its Series A funding round, amassing a significant US$5.9m.

This financial injection was led by The Yield Lab Asia Pacific, with notable contributions from SiS Cloud Global Tech Fund 8, Gold Sceptre Limited, and Dave Chen.

The round also saw continued support from previous backers such as SEEDS Capital, SGInnovate, and PT Great Giant Pineapple, who had participated in DiMuto’s initial US$2.35m funding round in 2021.

Operating at the nexus of technology and global food supply chains, DiMuto integrates cutting-edge solutions like AI, blockchain, and IoT to drive digital transformation. This latest capital infusion is set to propel the company’s expansion into critical markets, particularly in Latin America and the United States, while accelerating enhancements to its robust digital ecosystem.

DiMuto is not just another tech company; it is transforming the AgriFood industry through its innovative tri-layer digital solutions. Its Trade Management Platform ensures quality assurance and data visibility by digitizing every carton of AgriFood products. The platform’s traceable Marketplace fosters transparency and trust by connecting verified buyers and suppliers, while its Financial Services offer vital post-shipment trade financing, promoting the growth and business efficiency of AgriFood companies.

The company plans to use the new funds to broaden its Marketplace offerings and venture into greenhouse-based agriculture and climate-adaptive varietal development. These initiatives aim to boost year-round supply resilience and expand DiMuto’s private label, SoLuna Fresh, which has been marketing traceable fresh produce from Latin America to Asian markets, focusing on tropical and berries categories.

Holonym Foundation secures $5.5m seed funding to enhance digital identity security

Holonym Foundation, an innovator in digital identity security for the decentralized web, has successfully closed a $5.5m seed funding round.

According to FinSMEs, the investment drive was spearheaded by Finality Capital and Paper Ventures, supported by Arrington Capital, Draper Dragon, Lightshift, Zero Knowledge Ventures, Zero DAO, among others.

Holonym Foundation is dedicated to crafting cutting-edge security solutions for the decentralized web. The organisation’s focus is on revolutionising how digital identities are managed through their proprietary technology called Human Keys. This innovative approach aims to enhance privacy and security in zero-trust environments, which are becoming increasingly crucial as digital interactions evolve.

The freshly acquired $5.5m will be directed towards scaling the company’s operations and advancing its development projects. This funding will enable Holonym Foundation to accelerate the deployment of its technologies, such as the Mishti Network, Silk, and Zeronym, which together create a comprehensive framework for users to generate, manage, and prove their digital identities securely and privately.

The additional information highlights the organisation’s vision and the strategic direction set by its co-founders, Nanak Nihal Singh Khalsa and Shady El Damaty. Their leadership is pivotal in steering the foundation towards its goal of redefining digital identity security on the decentralized web.

Workpay secures $5m to enhance HR and payroll solutions across Africa

Workpay, a Kenyan HR and payroll startup, has recently secured $5m in Series A funding.

The round was led by pan-African venture capital firm Norrsken22, with notable new participation from Visa and Plug n Play, alongside re-investment from existing backers such as Y Combinator, Saviu Ventures, Axian, Verod-Kepple Africa Ventures, and Acadian Ventures, according to a report from TechCrunch.

Specializing in cloud-based HR, payroll, and benefits solutions, Workpay serves businesses with employees across Africa. The startup caters to local businesses with 20-100 employees in a single jurisdiction and larger enterprises with up to 1,000 cross-border employees, ensuring compliance across various markets.

The newly acquired funds will be used by Workpay to broaden its financial services, enhance performance management tools with AI, and continue expanding its workforce.

Co-founder and CEO Paul Kimani emphasized the shift towards offering a more comprehensive full-stack HR service, driven by customer feedback and the evolving needs of the market.

Historically, Workpay has shown robust growth, adding nearly 500 businesses to its platform over the past 16 months, now serving over 1,000 customers across 20 African countries. Despite challenges, such as delaying expansion into Francophone Africa, the company’s revenue grew by 1.5x in the first half of 2024 and is projected to double by year-end.

Employee support platform When secures $4.6m in seed funding

When, a Chicago-based company specialising in AI-powered offboarding solutions, has successfully raised $4.6m in its latest seed funding round.

The funding round was led by B Capital, a global investment firm, and saw participation from several investors, including TTV Capital, Joyance Partners, Alumni Ventures, Network Ventures, and Enfield Capital Partners, according to The SaaS News.

This new capital brings When’s total funds raised to $7m, following a previous $2.4m round.

When’s offboarding platform is designed to assist employees after they leave their jobs, providing essential post-employment support.

The platform helps users maintain access to healthcare by offering affordable alternatives to COBRA. Additionally, it includes services such as 401(k) rollovers, career coaching, résumé building, and a specialised healthcare severance solution called the When Benefit.

The company plans to use the new funding to further expand its AI-driven platform. This will involve adding new services to its post-employment marketplace and growing its customer base.

B Capital is a multi-stage global investment firm founded in 2015, with a focus on early and growth-stage companies across various sectors, including enterprise, FinTech, healthcare, and opportunistic investments.

Your Money Line’s new $4.5m investment fuels AI financial coaching

Your Money Line, a prominent player in the field of employee financial wellness, has successfully raised $4.5m in a Series A investment round.

The funding, led by Allos Ventures with contributions from First Trust Capital Partners, CareSource, and Elevate Ventures, marks a significant step forward for the company.

The investment will be used to further develop Your Money Line’s unique financial wellness solution, aimed at bolstering financial stability and confidence amongst users.

At the heart of Your Money Line’s service is a combination of AI-driven financial tools and personal coaching. The company collaborates with various organisations including businesses, schools, and hospitals, providing their employees with free access to financial coaching. This innovative service blends advanced technology with human expertise to offer tailored financial advice and support.

The new funds will enhance the platform’s capabilities, making financial advice more accessible and effective.

Peter Dunn, the founder and CEO of Your Money Line, noted the importance of the investment in addressing financial instability, a major concern for American workers and their employers. Dunn, known as Pete the Planner, has been a vocal advocate for financial health, drawing on his extensive experience as a financial planner and media personality.

The investment has also led to new board appointments. David Kerr, Managing Director at Allos Ventures, and Mark Kroeger, Senior Vice President at First Trust Capital Partners, will both join Your Money Line’s board, bringing valuable insights and experience to the table.

Your Money Line has already made a notable impact, evidenced by thousands of employees improving their financial situations and garnering high praise from users. One such testimonial from a hospital employee highlighted a significant credit score improvement and newfound financial knowledge thanks to the platform.

Thera secures $4m seed funding to enhance payroll and payments platform

Thera, a notable player in the payroll and payments sector, has successfully closed a $4m seed funding round.

This financial injection saw contributions from notable firms such as Y Combinator, 10x Founders, Amino Capital, Zillionize, and Bayhouse Capital, alongside prominent angels like Oliver Jung, Chris Bakke, Andrew Yeung, Akash Magoon, and Bobby Matson.

Operating at the intersection of technology and finance, Thera offers a comprehensive suite of financial tools under one umbrella, including payroll, treasury, and accounts payable/accounts receivable (AP/AR) services.

The fresh capital will be utilized to accelerate Thera’s growth, focusing on further platform development and team expansion in New York City.

The goal is to address and simplify the complexities of managing global payments, positioning Thera as a leader in bundled financial services, akin to what Wise has achieved in the remittance sector.

In addition to its primary services, Thera processes substantial payroll volumes annually, catering to numerous fast-growing US companies like Oceans, Landed, 1840 & Company, and Zendrop. The company’s strategy revolves around bundling essential financial services to meet the increasing demands of small and medium-sized businesses (SMBs) for integrated solutions.

Thera’s founding story dates back to 2022 when Akhil Reddy, an ex-Amazon engineer who designed systems for Amazon Prime, established the company. Since its inception and subsequent inclusion in the prestigious Y Combinator program, Thera has been at the forefront of simplifying financial operations for companies worldwide.

TransBnk secures $4m in Series A for transaction banking innovation

TransBnk, a burgeoning transaction banking platform, has successfully garnered $4m in its latest Series A funding.

According to IBS Intelligence, the investment round was spearheaded by 8i Ventures, a venture capital firm with a focus on early-stage investments in India, and Accion Venture Lab, which supports FinTech startups aiming to broaden financial access globally. Additional support came from GMO Venture Partners, Ratio Ventures, and Force Ventures, supplemented by various family offices, institutional, and angel investors.

TransBnk operates as a pivotal backbone for both traditional and contemporary BFSI entities, allowing them to develop new applications across different business areas such as lending, payments, and customer onboarding. By offering an API-driven enhancement to the current infrastructure, TransBnk enables the delivery of financial services that are scalable, robust, and compliant with existing regulations.

The funds from this round are earmarked for expanding TransBnk’s network of banking partners and furthering its reach into the Middle East and Southeast Asia. The company aims to capitalize on its first-mover advantage in these regions to secure a significant market share. Additionally, there are plans to fortify its technological base and further develop its product offerings.

Since its initial seed funding last year, TransBnk has experienced a tenfold increase in revenue, demonstrating significant growth and potential in the transaction banking sector. The company is now poised to disrupt the substantial unsecured lending market in India, tapping into the estimated $200bn in potential with innovative transaction banking solutions.

YouSet secures $3.5m in seed funding to transform insurance shopping in Canada

YouSet, a Canadian startup aimed at simplifying the insurance procurement process, has successfully closed an oversubscribed seed funding round, amassing $3.5m.

The round saw participation from both previous and new strategic investors. Returning investors from the company’s $2.1m pre-seed round in 2022 include notable figures such as Don Fox, former Executive VP at Intact, and Neil Mitchell, former Managing Director at Marsh. They were joined by new faces like Jim Texier, former Head of Big Data at AXA, and Phil Gibson, former Senior VP at Aviva.

Founded in 2017, YouSet has been dedicated to making insurance shopping quicker and more cost-effective. By leveraging its technology, users can compare rates from top insurers in less than four minutes, typically saving nearly 30% on their premiums. Adding to its innovative approach, YouSet has now launched a new feature that allows customers to bundle home and auto policies from different insurers, potentially unlocking an additional 15% in savings.

The fresh capital injection will be instrumental in furthering YouSet’s growth strategy. This includes expanding its reach through a network of over 50 distribution partners and scaling its team from 20 to accommodate its rapid user base expansion, which currently stands at over 250,000 Canadians.

Kuwaiti FinTech Kem secures $3m from Tether to boost digital payments

Kem, a Kuwaiti FinTech rapidly emerging as a leader in P2P payments, has recently raised $3m from Tether, a player in the digital asset sector.

According to FinTech Finance, this investment marks a significant milestone in the development of digital financial services within the Gulf region.

The funds will be used to foster the regional adoption of USD₮, a digital currency aiming to streamline access to digital financial systems. This collaboration aligns with Tether’s mission to enhance financial accessibility and dovetails with Kem’s innovative real-time payment solutions.

Kem is distinguished by its focus on providing real-time payment services that are crucial for economic stability and growth in the Gulf. The platform stands out as a facilitator of efficient, decentralized financial services, which are particularly valuable in regions experiencing economic volatility, such as hyperinflation and fluctuating currencies.

The investment will be directed towards expanding Kem’s capabilities and reach within the Middle East. This initiative not only signals Kuwait’s openness to foreign investment but also indicates a broader regional trend towards embracing digital economic frameworks, as seen in the GCC’s increasing Foreign Direct Investment (FDI) flows from neighbors like the UAE and Saudi Arabia.

Kem’s association with Tether extends beyond financial transactions; it is part of a strategic effort to develop a decentralized ecosystem that democratizes access to essential financial services. This partnership is seen as a pivotal move at a time when Tether’s market activities, including a record-breaking 24-hour trading volume that surpassed major cryptocurrencies, highlight its growing influence.

Nucleus Security bags funding to enhance federal cyber solutions

Vanilla secures funding to expand cutting-edge Estate Advisory Platform

Cyberbit secures major investment to fuel global cybersecurity initiatives

Mesh secures monumental investment from QuantumLight, tripling its pre-Series A valuation

Mesh, the innovative crypto infrastructure provider known for seamless payments and deposits, today announced a significant new investment by QuantumLight.

QuantumLight, a pioneering venture capital firm founded by Nik Storonsky, the visionary behind the global financial superapp Revolut, has chosen to invest in Mesh, valuing the company at three times its Series A pre-money valuation.

The investment by QuantumLight follows a period of explosive growth for Mesh since the beginning of 2024. The company, founded in 2020 by a team of cybersecurity and crypto experts, addresses the crypto industry’s fragmentation issue by offering a connected and embedded experience for exchanges, wallets, and payment providers. Mesh’s robust platform has been adopted by major players like MetaMask, MoonPay, and Fireblocks, enabling users to effortlessly connect, deposit, and pay with their crypto accounts across hundreds of platforms.

QuantumLight distinguishes itself by using a proprietary AI model, Aleph, to analyze billions of data points for making precise investment decisions, a method that stands out from traditional qualitative approaches used by other venture capital firms.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global